Coronavirus: Consumers more savvy about thrift

Consumers are poised to embrace ‘value shopping’ en masse in 2021, based on research that finds newly cautious households have had vastly different experiences during the pandemic.

Consumers are poised to embrace “value shopping” en masse in 2021, based on research that finds newly cautious households have had vastly different experiences during the pandemic, with a third “minimally affected” while almost a fifth have had to completely upend their life plans.

Consulting house McKinsey found 33 per cent of consumers, dominated by generation X and millennials, had been “stable and secure” throughout 2020 based on its latest confidential survey of about 800 consumers.

“This group was affluent before the onset of COVID-19 and little has changed during the crisis. There’s been minimal change in income, saving and spending,” the analysis found.

Meanwhile, just under 20 per cent of consumers, in contrast to claims “we’re all in this together”, were classed as “pause and pivot”, having felt a “major impact on their finances due to job or income loss”.

“Sixty per cent have experienced a drop in income, and 37 per cent were expecting a further decline,” the study found.

The middle two segments, were dominated by baby boomers concerned about their health but cautiously optimistic about the future.

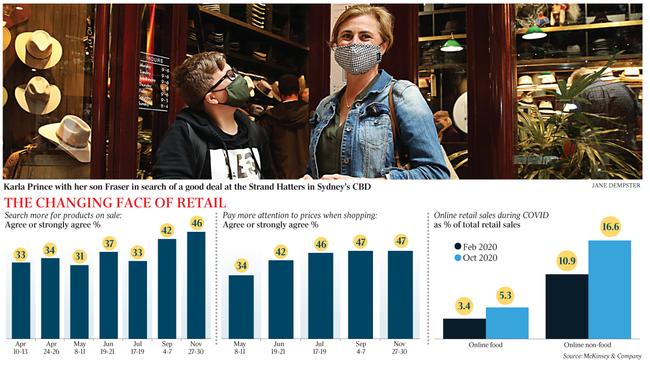

Across all four segments, the survey also found a “high net intent to pull back on spending” in 2021, including a dramatic jump in the share of consumers who said they were “paying more attention to prices” from 34 per cent in May to almost half.

“As government stimulus comes off, the savvier consumer focused on quality for price is poised to continue,” McKinsey said.

From Monday, JobKeeper dropped back from $1200 to $1000 a fortnight for full-time workers and from $750 to $650 a fortnight for part-time workers.

The program is scheduled to end entirely on March 28.

“Whether researching more, waiting for specials or generally cutting back, this more mindful approach to shopping is new to many consumers,” the study concluded.

“Being frugal doesn’t mean ignoring emotional needs that go beyond price. Many Australians we have met highlight how they are focused on and continue to support their local businesses and increasingly choosing Australian brands that have a focus on sustainability,” it added.

Retail sales in October rose 1.4 per cent compared to the previous month and were more than 7 per cent higher than the same month in 2019, according to the ABS’s latest survey, as consumers make up for spending that was constrained during the middle of the year because of coronavirus restrictions.

The survey found a near 100 per cent increase in the share of total sales made online between February and October, raising questions about to what extent online shopping would remain the norm as restrictions ease.

For Karla Prince, who celebrated the end of the lower northern beaches lockdown by taking her son Fraser shopping for an Akubra at Strand Hatters in Sydney CBD, the lure of a bricks and mortar store was irresistible.

She said the pair were “over the moon” to get out of the house.

“It’s such a relief to finish lockdown,” said Ms Prince, a Manly resident. “My brother-in-law is in quarantine after returning from Hong Kong so we are going to drop off his hat.”

According to the McKinsey study, “as lockdowns have been removed and vaccines will be given out, we should expect in-person shopping to have some bounce back as Australians head out to look for offline bargains.

“Despite the underlying economic optimism, as stimulus comes off and more conscious spending habits become the norm, our expectation is that we will continue to see segments being more cautious in how they spend their money.”