Coronavirus an immediate threat to economy: Peter Costello

The coronavirus outbreak represents an ‘immediate negative’ to the economy, Future Fund chairman Peter Costello says.

The coronavirus outbreak represents an “immediate negative” to the local and global economy that will have a “significant impact” on tourist industries and regions of Australia grappling with the fallout from the bushfire crisis, says former treasurer and Future Fund chairman Peter Costello.

The warning on the sprawling health crisis spreading across the world from the Chinese city of Wuhan came amid concerns raised by Mr Costello that ultra-low local official interest rates risked reigniting a housing price bubble in Sydney and Melbourne after a “welcome correction” in home values over the last year.

He said the Reserve Bank had to be “very careful” it didn’t risk further pumping up house prices by cutting official interest rates, which he said were failing to stimulate the economy.

Mr Costello batted away suggestions climate change presented an immediate serious threat to the Future Fund’s investments.

“As of today, the big short-term risk would be the coronavirus,” Mr Costello said.

“We don’t know how far that will spread. We don’t know what that will do to the tourism industry. We don’t know what that will do to infrastructure assets, such as airports, airlines.

“In the short term there’s obviously going to be an effect on tourism into Australia.

“That will affect airlines, it will affect airports, and it will affect general consumption at a time when many tourist industries have also suffered because of the bushfires.

“It will have a significant impact in addition to that.”

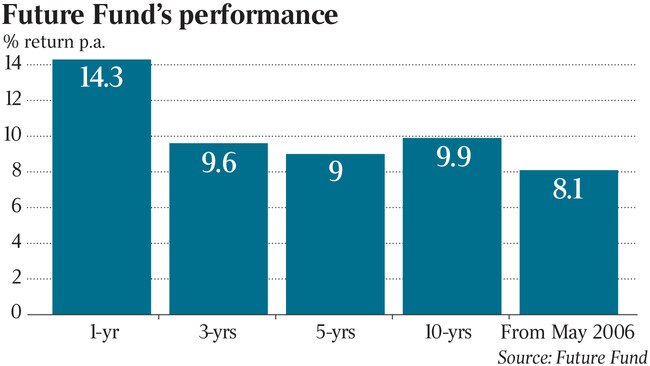

Mr Costello was speaking as Australia’s sovereign wealth fund, the Future Fund, announced it had grown by $21bn over the last year, following a healthy 14.3 per cent annual return, as low interest rates boosted equity markets.

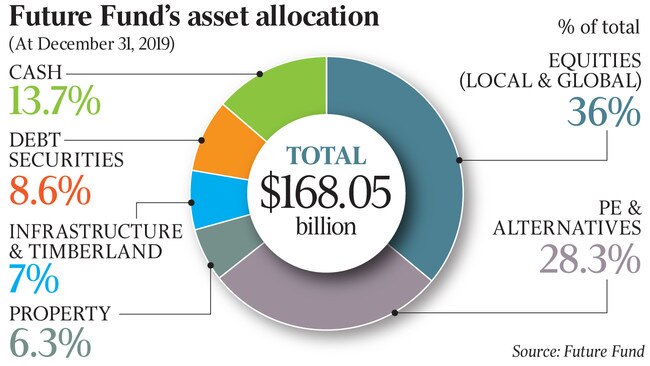

In an update on Tuesday, Mr Costello said the Future Fund at the end of December had grown to $168bn. That was an increase of $107bn over the initial $61bn seed capital handed over to the Future Fund by the Howard government in 2006.

Mr Costello said the biggest risks to the Future Fund’s forward earnings were the coronavirus, monetary policy, climate change and trade tensions.

“The bushfires will have an effect on the Australian economy. That will affect Australian stocks ultimately. But it’s hard to work out in the short term where that will work out,” he said.

But Mr Costello said the coronavirus was an “immediate negative” for the economy.

“It’s too early to say the extent of that because it’s too early to say whether it’s been contained or not,” Mr Costello said. “We don’t know how long it will go. Obviously we hope the measures that have been taken now will contain the virus.”

Mr Costello also said the Future Fund was considering climate change in its investment strategy.

“There’s going to be a switch away from fossil fuels. We take that into account as all investors should. We hold stocks on a passive basis. We wouldn’t go overweight in any of those industries — that’s for sure,” he said.

Future Fund chief executive David Neal said the fund was “carefully positioning the portfolio to navigate the challenging investment environment”.

“We are maintaining an average level of risk in the portfolio, sitting around the middle of the expected range,” Mr Neal said.

“We continue to prioritise portfolio flexibility to ensure we can adjust the portfolio quickly to respond to emerging opportunities and risks.”

Mr Costello said the era of ultra-low interest rates “can’t go on forever” and that the Future Fund was making sure it was not “too over-reliant” on assets where prices had been inflated by low interest rates. “Money is cheaper than any of us have ever experienced in our lifetimes,” he said.

“That is feeding into asset values. Not only stockmarkets but property market as well. Asset markets have been pumped up by cheap money.”

Mr Costello said high debt levels were “quite sustainable on cheap money but you’d have to ask yourself what happens when that era comes to an end. It’s good to be cautionary.”

“At some point monetary policy will go back to more normal levels,” he said.

“We’ve lived through a period of cheap money. The Reserve Bank has been cutting the cash rate in the last year in an effort to stimulate the economy. I think that the effectiveness of monetary policy is coming to an end. Another 25 basis points, another 50 basis points, I don’t think you’ll get much stimulus in the real economy.

“But I do think that you will continue to kick up asset values. I don’t think that’s particularly a good thing. I think we’ve kicked off again the asset price movement in Sydney and Melbourne just after we have a welcome correction. It will end badly if we get asset price movements based on cheap money.

“The Reserve Bank has to be very, very careful.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout