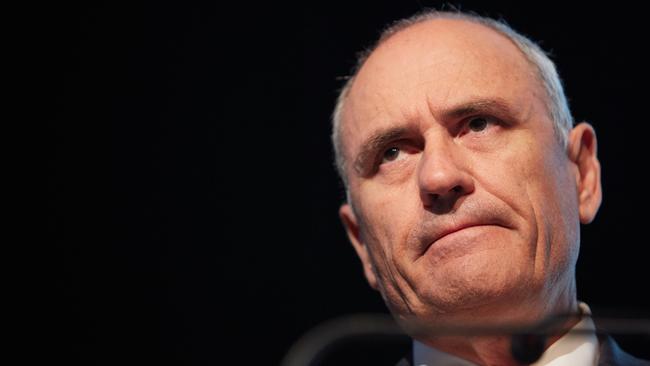

Contrarian Ken Henry’s coronavirus snapback tip right on the money

Ken Henry’s contrarian prediction of an economic snapback from the coronavirus now looks like it will be realised.

A contrarian prediction by Ken Henry in March that the economy would snap back to robust growth after a deep COVID-19 hibernation is now looking like it will be realised.

Dr Henry, the former federal Treasury secretary who was the architect of the nation’s response to the 2008 global financial crisis, said on March 27 as lockdown restrictions were implemented across the country that economic shocks always gave way to healthy recoveries. Nine months later, amid a rash of upgraded forecasts and unexpectedly buoyant economic data, Australia was “bouncing back as hoped”.

“It was really grim back in March — we didn’t know how bad things would get, or if health measures would keep people safe, but now it’s a case of so far so good,” the ex-National Australia Bank chairman said.

“We’ve handled the pandemic pretty much better than anywhere else in the world, and that’s because history tells us that Australian governments listen to the experts in times of economic crisis.

“Globally, it’s been the biggest failing, so the government should be commended — if it hadn’t done so, we’d be in a much worse position.”

Dr Henry’s commentary came as the value of deferred loans to households and businesses fell 31 per cent from $87.6bn to $60.3bn in November.

Monthly data from the Australian Prudential Regulation Authority showed that household credit on deferral fell 27 per cent to $49.5bn, with SME loans down 47 per cent to $7.6bn.

The rollout of COVID-19 vaccines and the end of a hard lockdown in Victoria has lifted business sentiment, which in turn has improved the quality of lending portfolios.

But Dr Henry cautioned against any premature declaration of victory, at least until the middle of the year when the full impact of the pandemic on employment would become clear.

While there had been a significant increase in public debt, it would be manageable over time, although reform measures to drive a sustainable lift in productivity and economic performance were now even more important.

The aspiration, he said, should be to match the 4.5 per cent average annual growth rate in the second half of the 1990s, in the aftermath of the early 90s recession.

“We should be looking at something closer to 4 per cent rather than 3 per cent,” said Dr Henry, who became chairman of Wildlife Recovery Australia early last month.

The controversial call on a snapback recovery was made as the sharemarket was levelling out from a meltdown, with the ASX 200 tumbling 32 per cent from a record 7162.5 points on February 20 to 4842.4 on March 28.

At the time, Dr Henry dismissed the equities volatility as the outcome of “traders doing their jobs”, saying it was an unreliable guide to future economic performance.

The panic, however, was not confined to traders. In the final week of March, the International Monetary Fund forecast that $US9 trillion would be stripped from global GDP in 2020 and 2021, more than the combined economies of Germany and Japan.

While the Australian economy was tipped to shrink by 6.7 per cent in 2020, the outlook began to change after governments, regulators and banks worked in concert to contain the fallout.

By early November, an extraordinary $257bn, or 13 per cent of GDP, had been provided in direct economic support, more than double the economic stimulus of 6 per cent of GDP in the GFC.

Added to that, there were about $260bn in home and business loans on deferral at the May peak, and various programs were put in place by the Reserve Bank to ensure liquidity was adequate, bank funding costs remained low and markets overall were stable.

The torrent of money could not prevent the nation sliding into recession, with a record-breaking 7 per cent GDP contraction in the June quarter.

September-quarter growth of 3.3 per cent — the strongest quarterly expansion in 44 years — marked the beginning of the snapback, heralding a flood of revised economic forecasts.

In November, the RBA upgraded its December-year GDP forecast from a 6 per cent contraction to a 4 per cent one, with unemployment to peak at 8 per cent instead of 10 per cent.

Dr Henry said in every crisis since the 1990s recession, the economy had demonstrated “more resilience and flexibility than people seem to give us credit for”.

“When people do lose their jobs, they get much more support here than in many other places, and the support is deliberately designed to keep people job-ready,” he said. “It’s probably time that we stopped looking to the US as a role model for labour market flexibility.”

The key to a strong and sustainable recovery was always confidence, both for consumers and businesses. “On this occasion, governments have done as much as could be reasonably expected to build the confidence that they were on top of things,” Dr Henry said.

“The JobKeeper program was highly innovative, and it was also very expensive in a fiscal sense.

“But it sent a signal that the government was prepared to do whatever it took to get the economy to bounce back as soon as possible.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout