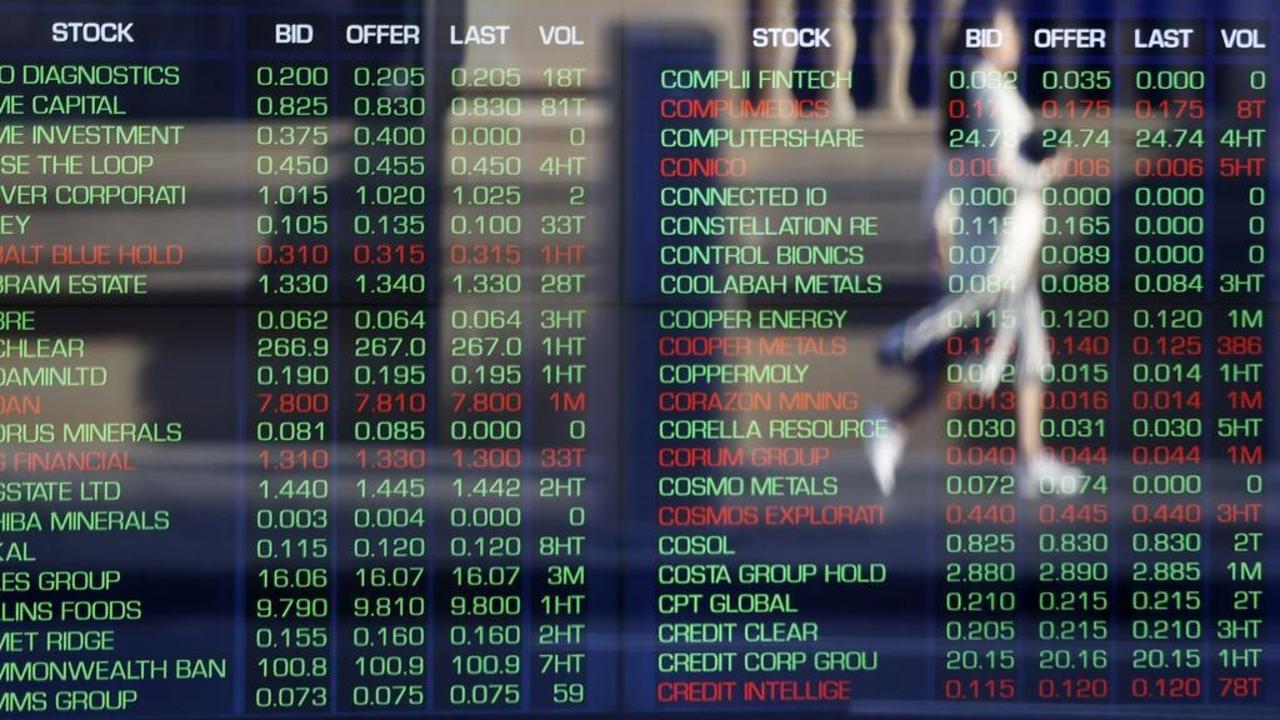

Container price surge is pushing up import costs

The growing cost of freight is lifting costs for Australian retailers and changing the way they think about logistics and inventory management.

Empty shipping containers are piling up at ports around the world — but at the same time, a shortage of containers in China has more than doubled the cost of getting goods from Shanghai to Sydney.

It is all down to the dual impact COVID-19 has had on the economy: unable to travel, consumers are spending more on goods, but stricter health protocols have constrained the ability of ports to load and unload goods.

The increasing cost of freight is lifting input costs for Australia’s import-reliant retailers and changing the way they think about logistics and inventory management.

Sean O’Sullivan, vice-president of investor relations at pallet, crate and specialty container giant Brambles, said the state of shipping had accelerated a growing preference for larger inventories.

“Globally we are seeing higher levels of inventory being held in supply chains, as retailers adapt to increased volatility in demand patterns due to disruptive events such as Brexit and COVID-19, and a move from ‘just in time’ to a ‘just in case’ approach to inventory management,” Mr O’Sullivan said.

Ian Bailey, managing director of Kmart, the largest sole importer of shipping containers into Australia, told analysts this week the retailer was now buying shipping containers on the spot market at rates “substantially higher than pre-agreed rates” and had established an inventory “buffer” in core lines to ensure stock supply.

Conversely, Kogan.com chief executive Ruslan Kogan said on Friday that the over-accumulation of stock, as well as lifting freight costs, had hit the group’s earnings in the March quarter.

Melbourne business identity Claude Lombard, director of party and hospitality goods supplier Lombard the Paper People, said business has roared back to life since the COVID-19 downturn — but the new cost and the time of importing inventory is constraining his ability to invest.

“We’re back to pre-COVID-19 numbers already and we supply the hospitality industry — we were down 30, 40, 50 per cent but it has come back with a vengeance,” Mr Lombard said.

“We are opening a new store in Richmond and our supplier had to physically buy a container in China to load our stock so we could receive it — it was all delayed by seven weeks.

“To ship a container from China to Melbourne used to cost $3000, which was $3 a box. You get about 1000 boxes in a 40-foot container. It’s now $7000. And that’s since Christmas, if not a little before.”

Marika Calfas, CEO of Port Botany and Port Kembla operator NSW Ports, said container availability was affected by COVID-19 changing spending patterns and boosting demand for goods manufactured in places such as China. Meanwhile, the pandemic has constrained the ability of these goods to journey to their destination on time and be unloaded, so empty containers can be returned.

“One of the trends with COVID-19 is, and this is interesting in the sense that it’s global, that with individuals being at home, people have been diverting their available cash to goods as opposed to travel, experiences or events,” Ms Calfas said.

“So these ships (carrying goods) in our case come from Asia, run around the coast of Australia and then go back to Asia. If there is a delay in any one part of that system, it’s going to have a knock-on effect to the rest of that loop.”

Ships would compensate for lost time by minimising their time in port by not taking their full complement of empty containers, constraining the supply of usable containers for export, Ms Calfas added.

“As soon as you start to do that at a port like Port Botany where we handle 2.6 million 10-foot containers a year, they start to build up quite quickly,” she said.

“So the price to ship a 20-foot container from Shanghai to Melbourne, or Shanghai to Sydney, went up from about $1000 and then jumped up to around $2500, which is where it sits today, maybe slightly lower.”

The build-up of empty containers at ports is so acute that earlier this month the world’s longest container ship, the Soroe Maersk, called at Port Botany specifically to pick up empty containers and take them to ports in Asia.

The 346.9m vessel loaded 3756 empty 20-foot containers before journeying on to Port Melbourne to load 4148 more.

Ms Calfas said Australian ports were handling the disruption to shipping well: by way of comparison, dozens of cargo ships regularly build up outside full ports in the US, while in northern Europe shipping container prices have lifted well over 300 per cent.

Mr Lombard said he had maintained a practice of keeping large inventories throughout his 50-year career. What had been changing was where he sourced his products from.

“To me it is a great opportunity to get rid of the Chinese suppliers,” he said. “Because slowly, slowly we are making boxes in Australia, we are making cups in Australia, we are making bags in Australia. A lot of the things we used to buy in China we now buy locally.

“The additional cost is marginal and there are a lot of pluses to buying locally. It’s reliable, you don’t have to wait 12-16 weeks. In the end it is not price, it’s service.

“So this is a good opportunity for Australia to get off our arse and do something positive instead of complaining that we can’t buy from China. That’s good – let’s make our own.”