Climate-change disasters threaten credit ratings: Moody’s

Increasingly frequent natural disasters due to climate change could hurt government credit ratings, Moody’s warns.

Increasingly frequent natural disasters due to climate change could hurt the credit ratings of both the federal government and Australia’s state governments, influential ratings agency Moody’s Investors Service has warned.

While governments have “ample fiscal buffers” to withstand the current bushfire crisis, increasingly frequent and severe natural disasters related to climate change are likely to cause “rising and recurring costs” and “test the government’s capacity to mitigate these costs”, the global credit rating agency says in a report.

It says the more material impact for state and federal governments will be recurring financial costs.

“Over time, increasingly frequent and severe natural disasters related to climate change are likely to result in rising and recurring costs for Australia’s general and local governments, which will test their capacity — currently strong — to mitigate these costs,” Moody’s vice-president and senior credit officer Martin Petch said.

Already the federal government has outlined a $2bn package and announced funds for the leasing of four additional aircraft. Economists from Westpac have estimated the short-term hit to the economy to be as much as $5bn.

In an assessment of the credit impact of Australia’s bushfire crisis, Moody’s notes that the economic impact is “limited” as the fires have mainly hit sparsely populated areas and the cost is likely to be “manageable” at less than 0.1 per cent of GDP. It currently expects the government to offset these recurring costs through higher revenue or other spending costs, “although the rate and magnitude of such costs will become clearer over time and may lead the rating agency to revise its assessment”.

“The 2019-20 bushfire season has been characterised by unprecedented levels of destruction, primarily concentrated in NSW and to a lesser extent Victoria, causing tragic loss of life,” Mr Petch said.

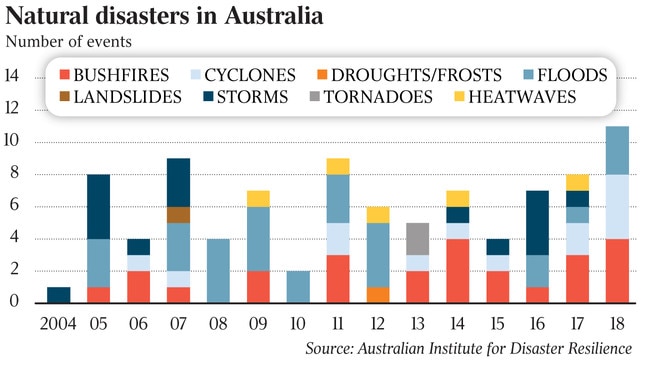

“Climate science, including predictions by the Intergovernmental Panel on Climate Change, indicates that climate change-related natural disasters are likely to increase both in terms of intensity and frequency as air and sea temperatures and sea levels rise globally due to past carbon emissions.”

The Australian bond market looked through the report, with bond prices rising modestly in line with a firmer US Treasury market after weaker than expected US jobs data on Friday.

The 10-year Australian Commonwealth Government bond yield fell 4 basis points to 1.21 per cent. But Moody’s analysis could have longer-term implications for bond pricing.

As with rival S&P Global Ratings, Moody’s has a top level triple-A rating and “stable” outlook for Australia. NSW and Victoria are two of only five comparable states outside the US to hold a triple-A rating.

Mr Petch noted that states and local governments bear primary responsibility for preventing, preparing for and responding to natural disasters, which “significantly boosts their resilience in addressing climate hazards”.

While they can seek reimbursement from the commonwealth for up to 75 per cent of the cost incurred, reimbursements can take several years in some cases, so the impact on states of the timing of the payments is the main credit implication of the bushfires.

“Moody’s does not currently expect this liquidity pressure to be significant as most affected states maintain strong liquidity positions,” Mr Petch said.

The Moody’s report came as S&P said Australian credit ratings could “accommodate” the bushfire impact.

“Strong fiscal outcomes are important because they allow governments to respond to unforeseen events, such as the ongoing bushfires, without weakening their credit profiles,” S&P credit analyst Anthony Walker said.

Mr Walker said the federal Coalition government would remain committed to fiscal discipline and balancing the budget after it addressed bushfire-related matters.

“While the Prime Minister has made recent statements regarding the importance of supporting Australians over delivering a fiscal surplus, we believe the government hasn’t abandoned its strategy of returning the budget to surplus,” he said.

“Although the economic impact of the bushfires remains unknown, the much-vaunted return to surplus of the general government account could be delayed beyond what we had factored in when we revised the outlook on our rating on Australia to stable from negative in September 2018.”

S&P’s Mr Walker added that a “short delay” in balancing the budget because of the fires was “unlikely to cause us to revise our fiscal assessment on Australia”. “Nevertheless, our ratings on Australia could come under downward pressure if political will around prudently managing the budget were to wane,” he said.

Mr Walker said a rush of bushfire donations — expected to run into the hundreds of millions of dollars — would make a real difference to government balance sheets this year.

NSW and Victoria — the two states most affected by Australia’s unprecedented bushfire crisis — will need to lift their expenditure for infrastructure repair as well as social and industry assistance.

That could shave a couple of percentage points off their revenues before reimbursement starts to flow from the federal Disaster Recovery Funding Arrangements. But the budget impact would be “relatively small” and the rush of donations from the private sector would help fire-damaged states recover without straining their finances, the global ratings agency said in a separate report.

“We expect significant insurance recovery, as well as community and business fundraising, to supplement government spending in funding the recovery efforts,” Mr Walker said.

“The funding will allow faster recovery without placing additional burden on government finances.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout