Citi: Easing pressures will bring retail recovery in 2020

The underpinnings of a retail recovery are in place, but there will be a wait before consumers head back to the shops, Citi says.

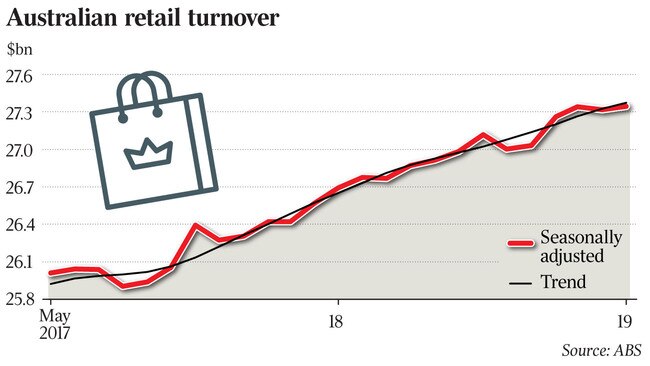

The nation’s $320 billion retail sector is on the cusp of its best sales outlook in four years.

A heady mix of two interest rate cuts, the tax cuts, easing cost of living and a stabilising housing market are combing to provide a favourable backdrop for discretionary retail.

However, it will take time for these positive factors to find their way into consumer confidence, spending budgets and ultimately shopping baskets, with the impetus to boosted spending at the shops arriving in 2020 according to Citi research.

Although some investors could be frightened off by bearish statements and results this reporting season, the sector was at a turning point, Citi analysts said in a note to clients on Wednesday.

Citi analyst Bryan Raymond said the factors that form underpinnings of the recovery will flood households with cash. Citi is tipping that the “household available cash” measure is set to improve in fiscal 2020, increasing from 4 per cent in fiscal 2019 to 4.4 per cent, with upside to 5.1 per cent if the savings rate continues to contract at its current pace.

Citi believes non-food retail will be the main beneficiary.

The outcome of the federal election in May has provided some boost to consumer sentiment, although it was taking time for that to drive money into retail’s cash registers, Mr Raymond believes.

“A favourable Australian federal election outcome has seen an overall improvement in consumer sentiment. However, we are yet to see signs that this has translated into increased sales growth for retailers,” he said in a note to clients.

Data released on Wednesday showed interest rate cuts and the prospect of tax relief failed to buoy consumer sentiment. The Westpac-Melbourne Institute of Consumer Sentiment index fell to hit a two-year low of 96.5 index points in July, down from 100.7 in June.

“The fall in sentiment this month is troubling as it comes against what should have been a supportive backdrop for confidence,” Westpac senior economist Matthew Hassan said.

Initially however there could be a buying opportunity for investors as slightly weaker earnings and bearish management commentary in the upcoming reporting season could see a step back in share prices.

These “near term” risks could prove an opportunity as the outlook for retail in 2020 looks rosy, especially in comparison to 2018 and 2019.

“We expect a favourable backdrop for discretionary retail in fiscal 2020 for the first time since fiscal 2016,’’ Mr Raymond said.

Based on this research he has upgraded a number of retail stocks.

“This is due to the combination of: tax cuts; two RBA rate cuts; falling living cost growth; and a stabilising housing market. We upgrade Flight Centre to Buy; and upgrade JB Hi-Fi, Harvey Norman and Premier Investments to Neutral as we take a more positive stance on discretionary retail stocks.”

But the shadow that has been hanging over retail could provide some buying opportunities ahead of the recover, he said.

“Downside risks remain in the short term reflecting the tough conditions of the past two years. Post-election retail anecdotes have not been positive for May and June, and we see the balance of risks to the downside for earnings and trading updates in reporting season, creating a buying opportunity ahead of a more favourable retail backdrop.”

“While the share market has taken a more positive view on a number of retail stocks, we are cautious about the second half of fiscal 2019. Rate cuts will take time to filter through and the bulk of the data points we have gathered on the consumer are negative about the June 2019 half-year.