In a bilateral sense, Australia’s ties with China have continued to worsen with an array of tariff and non-tariff trade measures aimed at Australian exports.

The opening of China’s third import expo in Shanghai — once a proud showcase for Australian goods — this week has proved another sign of Australia’s poor relations with its biggest trading partner, with no visits from Trade Minister Birmingham or Australian chief executives.

The wine industry, which until recently was trumpeting its success in China, is now bracing for new tariffs on its Chinese exports, a business once worth $1.2bn.

This week has made it clear that the Coalition’s years of continuing to upset Beijing with its outspoken views will have economic consequences, with talk of pressure within China on buyers of wine, wool and grain not to buy Australian and announcements about increased inspections of forestry products for “pests”.

Australia’s $500m annual wheat export trade to China is now bracing for trade sanctions, following on from the end of Australia’s barley export trade to China, once worth as much as $1.4bn a year, after tariffs of 80 per cent were imposed in May.

Delays on processing of lobster shipments, once a thriving trade largely from Western Australia, are all adding up to an increasingly worrying picture.

While China is having bitter disputes with several other countries (including the US, Canada and Sweden), Beijing now seems to be determined to teach Australia a lesson and to do so in a way that will provide a warning for other countries reassessing their public views on the world’s second-largest economy.

But more profoundly for those assessing the implications of long-term regime changes in China is this week’s pulling of the float of Jack Ma’s online financial company Ant Group, 48 hours before it was due to go ahead on the exchanges in Shanghai and Hong Kong.

Some had estimated that the float of the world’s largest fintech company would have raised as much as $55bn, the largest ever IPO.

The move is a blow to Alibaba founder Ma — once the poster boy for Chinese entrepreneurship.

While Ant is supposedly in negotiations with regulators, the last-minute intervention by Chinese authorities highlights that Beijing is becoming a riskier place to do business.

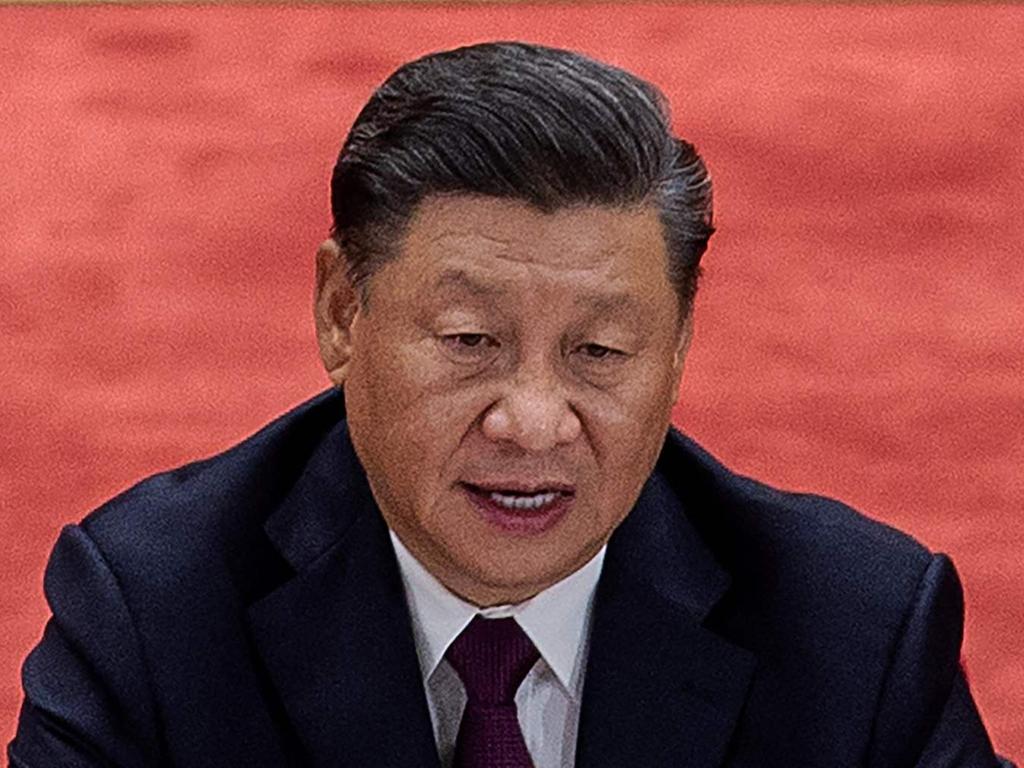

Despite moves to internationalise many of its markets, China has taken a far more interventionist view of the world under Xi Jinping since he became President eight years ago.

What started out looking like a crackdown on corruption has become a widespread crackdown on any form of political criticism both internally and externally.

Xi has headed up a seachange at the top of China refocusing on shoring up the power of the Communist Party through all forms of society.

Pulling the Ant float confirmed what has been apparent but not quite appreciated — that the risks of doing business for foreign investors in China are going up.

That may be a separate thing from the risks of exporting to China, but from Australia’s point of view it may be one and the same.

There is no doubt Chinese buyers of a range of goods — from iron ore to wool, wheat, coal, wine, beef and dairy products, to tourism and education — still hold Australian goods in high esteem and want to buy them.

But political tensions are corroding trade ties.

The changing political position from Beijing — more hardline, more austere and more pro-government intervention — is flowing through into business.

Two years ago, when Ma announced his plans to step down from his day-to-day involvement in Alibaba, the company he founded in his home town of Hangzhou in 1999 that went on to become a world leader in e-commerce, there was speculation that the changing political landscape had played a part in his decision.

Beijing now insists that businesses in China have active representatives of the Communist Party at senior levels.

The departure of Australian journalists from China recently, plus the crackdown on dissent in Hong Kong, are signs of a political regime in Beijing that is becoming less tolerant of criticism and less concerned about what the rest of the world thinks about it.

In an economic sense, China has come through the coronavirus pandemic much better placed than almost any other country.

But in a broader sense, China is refashioning itself in a way that has to be taken seriously, with a leader determined to put China first.

Xi may not have the arrogant rhetoric of Donald Trump, but his new “dual circulation” approach is aimed at boosting China’s reliance on domestic consumption.

This comes on top of his existing Made in China 2025 policy, which if anything is being stepped up, for China to become more self sufficient and market-leading in key areas such as 5G, electric vehicles, robotics and artificial intelligence.

At the same time, it is also carving out a strategy of boosting ties with those countries that have signed up to Xi’s Belt and Road Initiative, while internally it is pushing the revival of government-owned businesses.

How all those forces play out in practice over the long term remains to be seen.

China’s Belt and Road Initiative has strategic advantages by diversifying sources of supply and expanding its political allies, but it is also a financial drain.

Western capitalists would also argue that a more government-controlled economy dampens growth, stifles initiative and reduces efficiency.

Much has been said about the need for Australia to diversify away from an export reliance on China. It looks as if that will happen despite the very real goodwill on a business-to-business and people-to-people basis between Australia and China.

While most of the world’s attention has been gripped by the close-run US election, this week has been a milestone week in news from China.