China growth slowest since 1990

China is looking at ways to stimulate its economy after the country recorded its lowest growth rate in almost 30 years.

Chinese policymakers are looking at further measures to stimulate the economy, including tax cuts, higher local government spending, easier monetary policy and a boost to infrastructure spending in the wake of yesterday’s confirmation that the Chinese economy recorded its lowest growth rate in almost 30 years.

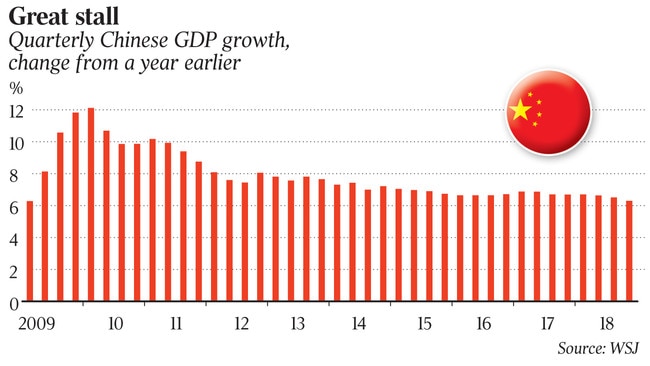

Releasing figures showing China’s economy slowed to 6.6 per cent during 2018 — its lowest annual rate since 1990 — the chief of China’s National Bureau of Statistics, Ning Jizhe, said Chinese policymakers would be taking “targeted measures” to ensure the economy performed “within a reasonable range in 2019”.

Last year’s growth figures were down from the 2017 growth rate of 6.8 per cent, which was the lowest growth rate since the 3.9 per cent recorded in 1990.

Mr Ning blamed a “complicated and severe external environment” for the “downward pressure” on the Chinese economy, with its GDP slowing to 6.4 per cent in the December quarter — the lowest annual quarterly figures since the March quarter of 2009. But he said the Chinese economy was also suffering from “the pains that come up with economic upgrading”.

He said Chinese authorities would respond to the downturn with more tax cuts, increasing the sale of local government bonds to fund more local government spending, a “prudential monetary policy” and a range of measures to increase investment in infrastructure across China.

He gave a list of infrastructure spending projects including better roads, more airports and investment in measures such as water conservation, and predicted that infrastructure spending in 2019 would be higher than in 2018.

Although the economy is slowing, the prospect of targeted infrastructure spending could deliver a boost for Australian exports such as iron ore or coking coal. China is Australia’s biggest trading partner.

Mr Ning’s comments come as Morgan Stanley economists yesterday argued that Chinese authorities would do “whatever it takes” to stop the fall in economic growth this year.

While admitting that “scepticism on China’s growth outlook remains high”, its economists argued that Chinese authorities stepped up their easing measures in December and will introduce further measures this year.

It said these could include increasing the quota for local government bond issuing, a cut in the value added tax, further monetary policy easing, further relaxation of property market measures and other pro-consumption measures designed to stimulate consumer spending on buying cars and household appliances.

“We expect growth still to be weak in the first quarter of 2019, slowing down to 6.1 per cent,” Morgan Stanley said.

“But that should mark the bottom of the growth cycle, as we expect growth to improve from the second quarter onwards, eventually reaching 6.4 per cent in the fourth quarter.”

Morgan Stanley said the Chinese government had been focusing on maintaining fiscal stability over the past two years but “as the downdraft in growth begins to weigh on the labour market, managing the growth cycle has become a top policy priority”. “Policymakers have moved the counter cyclic growth management into full swing (with) a policy response which will be tailored to address the extent of the downward pressures on growth.”

Mr Ning’s comments confirm that Chinese policymakers have now begun to publicly admit that its economy is under downward pressures, now that the official celebration of 40 years of China’s reform and opening up last month is behind them.

The economic growth rates last year fell from 6.8 per cent in the March quarter, to 6.7 per cent in the June quarter, to 6.5 per cent in the September quarter and 6.4 per cent in the December quarter.

While trying to focus the blame on external factors, such as the slowing global economy and increasing protectionism, there is a growing realisation in Beijing that more aggressive stimulatory measures will be needed with many external commentators predicting that China’s real economic growth rate is already headed down towards 5 per cent.

Mr Ning argued that China was still the growth engine of the world economy, contributing some 30 per cent to world economic growth last year, with a growth rate above the top five major economies. He said China had created some 15 million new jobs last year but admitted that “our biggest challenge is to provide employment”.

While China’s official urban unemployment rate is running at 4.9 per cent there have been increasing reports of lay-offs, particularly in the manufacturing areas of Guangdong province in southern China.

Recent reports have employers in manufacturing areas releasing workers early for their annual spring festival, with expectations that not all will return when work resumes in the second week of February.

Mr Ning said China’s trade war with the US was affecting its economic growth but argued that the impact was “manageable”.

The figures show that despite an increase in investment spending in the last four months of 2018, it has been the Chinese consumer who has become the biggest single driver of economic growth in the country.

Final consumption expenditure contributed 76.2 per cent to China’s economic growth during the year — a substantial 18.6 percentage points higher than the year before and 44 percentage points higher than total gross capital formation.

The big jump in the role of consumption in China’s GDP figures may also reflect a slowdown in other areas, particularly the role of the private sector and slow investment in the first half.

“China is the most promising consumer market in the world,” Mr Ning said, particularly the more than 400 million Chinese who were now in the middle-income range.