China downturn could be boon for Australian commodities

A perfect economic storm in China could be a boon for Australian exporters, according to economists.

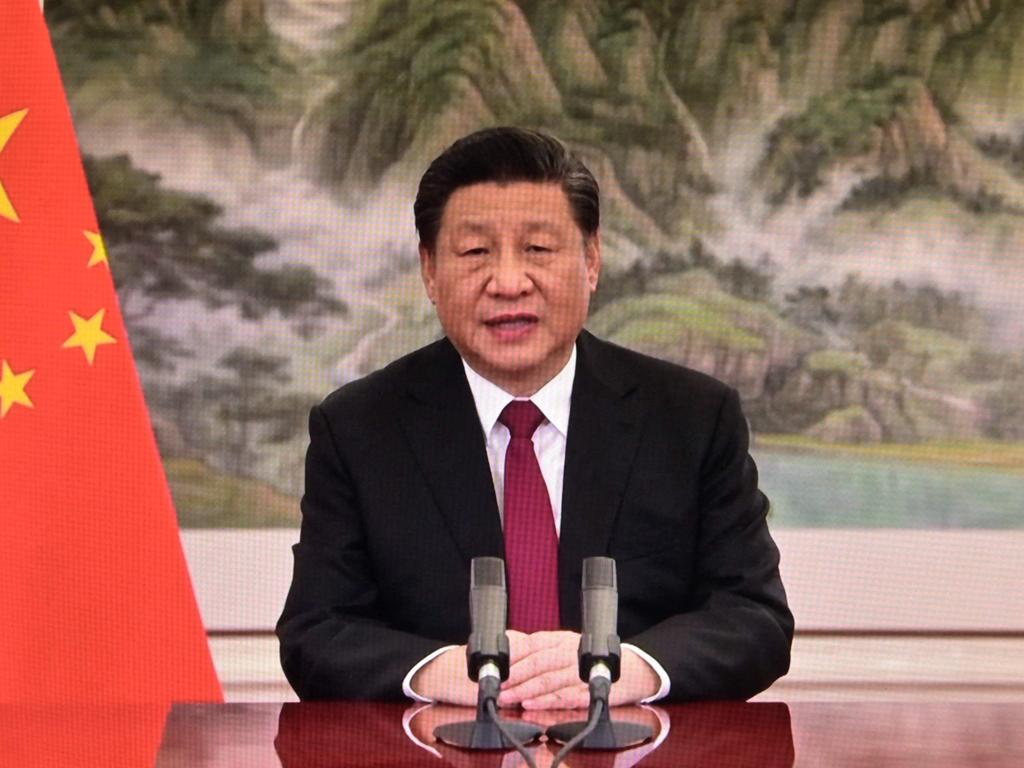

A perfect economic storm in China could be a boon for Australian exporters, according to economists, as Chinese President Xi Jinping warns Western nations to maintain low interest rates or risk “serious negative spillovers”.

Beijing’s commitment to a Covid-zero policy has led to several draconian lockdowns, deflating Chinese consumer spending, while contagion from sinking property developer Evergrande has raised fears about the country’s economic stability.

In response, The People’s Bank of China lowered the interest rate on one-year medium-term lending facility loans to 2.85 per cent – the first cut since April 2020.

With Chinese GDP growth likely to reach a “relatively slow” 5 per cent this year, BIS Oxford Economics chief economist Sarah Hunter said the downturn would likely see a “fairly significant” direct and indirect fiscal stimulus, in addition to already announced monetary policy measures.

A by-product of Beijing’s fiscal intervention could result in a bounce for Australian commodities, Ms Hunter said.

“More fiscal policy coming through and more support for the Chinese domestic economy … that at the very least is good for demand for iron ore when it’s targeted into infrastructure, which is good news for iron ore exporters.”

An uptick in Chinese consumer spending could be “good news” for other Australian exporters, particularly high-end food products and other consumer durables, Ms Hunter said.

Economist Saul Eslake cautioned that Beijing’s fiscal package was unlikely to be “sizeable” but he agreed any fiscal stimulus would likely lead to an increased Chinese demand for Australian iron ore.

He noted the iron ore price seemed to have factored in a likely Chinese stimulus, bouncing back above $US120 a tonne.

In a speech to world leaders at an all-virtual Davos World Economic forum on Tuesday, Mr Xi issued a stark warning to Western nations considering raising interest rates in response to inflationary pressures, saying slamming on the brakes too soon could jeopardise global economic security.

“If major economies slam on the brakes or make major U-turns in their monetary policies, there will be serious negative spillovers. They would present challenges to global and economic financial stability and developing countries would bear the brunt,” he said.

Mr Xi painted a bleak picture of the state of the global economy, noting ongoing disruption to global industrial supply chains, rising commodity prices and tight energy supply. “We must do everything necessary to clear the shadow of the pandemic and boost economic and social recovery and development,” he said.

Mr Eslake pointed to the large quantities of debt held by Chinese companies in US dollars, particularly property developers, along with preventing capital outflows out of China as partial explanations for Mr Xi’s warning.

With developing nations in Latin America, Eastern Europe and to a lesser extent Africa exposed to rising US interest rates, Mr Eslake said the Chinese leader’s speech could be an effort to “curry favour” in the developing world.

Deloitte Access Economics partner Chris Richardson said it was unlikely Australia would see large interest rate rises because inflation was not rising at levels seen in the US and Europe.

He said most commonwealth debt was held in Australian dollars, insulating the government from rate hikes by the US federal reserve.

With 100,000 Russian troops mobilised on the Ukrainian border, Mr Xi in his speech at the Davos forum told world leaders that a confrontation between major powers could have “catastrophic consequences”.

“Our world today is far from the tranquil; rhetoric that stokes hatred and prejudice abound,” he said.

“History has proved time and again that confrontation does not solve problems, it only invites catastrophic consequences.”

Additional reporting: AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout