The Australian taxation system is breaking down in vital areas and it’s not the fault of the Australian Taxation Office, nor its commissioner, Chris Jordan.

In the three years to 2018, overseas profits and other funds lawfully leaving the country doubled to $63bn, and the total looks set to rise a lot further.

Very little tax was paid on at least half of this money, which was generated by the growth areas of the economy: services provided by US owned companies related to internet-based technology.

It is a problem faced by most western countries outside the US, and if not overcome, will destroy confidence in the tax system. Further, if it continues, it will reduce Australia’s revenue base. The non-taxation of these internet based services is a contributor to the fact that, in the words of Alan Kohler, tax as a percentage of household income has increased from 16 to 19 per cent over the past eight years.

READ MORE: The economy’s silent killers | Why we need earlier tax relief | RBA lowers inflation forecasts

Paradoxically it was the former speaker of the US House of Representatives Paul Ryan who came up with a brilliant solution to the problem. I will examine the solution below, but first let’s detail the looming crisis.

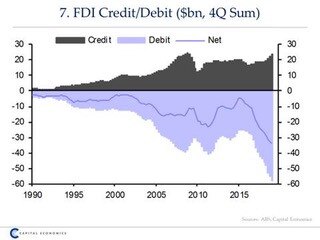

Whether you are a politician of any persuasion, a Treasury or Reserve Bank official, or just a member of the public you will be scared by the graph below, entitled Foreign Direct Investment Credit/ Debit.

As you can see, back three decades ago the returns we received from our overseas investments roughly matched what we were paying out. Even in 2015 we were not far behind breaking even and by 2015 the capital value of Australia’s overseas investments roughly equated with the capital value of the overseas investment in Australia.

But in the next three years suddenly the money going out of the Australian door to overseas destinations skyrocketed, even though the amount of overseas investment did not greatly change.

The net outflow (netting inflow and outflow) has risen from less than $10bn to more than $30bn in a few short years and is accelerating at a dramatic pace. In the three years to 2018 gross outflow almost doubled to $63bn.

Has the mining industry growth caused the exodus? Of the total $63bn outflow, mining has contributed only roughly $10bn and overseas miners pay tax. And given that interest rates are low, debt exodus is not the reason. We all know the problem: the growth areas of the economy that generate the biggest returns are technology-based and those industries are led by companies like (in alphabetical order) Amazon, Apple, Facebook, Google, Netflix, Microsoft and many more.

Most (but not all) ship their “profits” offshore, often to tax havens, and they do it with a skill that makes it totally legal under existing tax rules. Western countries around the world, outside the US, face this problem because the existing tax rules are simply not coping. Paul Ryan’s solution was cash flow taxing but when President Trump took office cash flow taxing was abandoned, probably because Trump was fearful that other countries would adopt it, which would hurt the US.

A local solution

Late last year the University of Melbourne’s Ross Garnaut, former ALP trade minister Craig Emerson, the London School of Economics’ Reuben Finighan, and Industry Super Australia’s Stephen Anthony adapted the Ryan cash flow tax plan for Australia.

I strongly urge Treasurer Josh Frydenberg and Finance minister Mathias Cormann to appoint a group including treasury and non-treasury people to check the sums and closely look at the plan to see whether its obvious merits have pitfalls. We have to do something.

So, let’s detail how cash flow taxing of business might work in Australia using the Garnaut-Emerson-Finighan-Anthony model:

- The cash flow tax would have as its base net cash flows, being taxable revenue less non-financing cash outlays, encompassing operating costs plus capital expenditure. Note that capital expenditure becomes tax deductible.

- As an offset, interest and other financing costs are non-deductible, except for finance organisations like banks. .

- The accounting data for revenue and expenditure would be exactly the same as for corporate income tax, and the petroleum resource rent tax, so that established case law would still apply.

- No deduction would be allowed for imported services, unless the transaction is at arm’s length and relates to current costs of goods and services directly applied to producing the service for which a deduction is claimed. This would deny a deduction for payments for imported intellectual property except to the extent that the service purchased has itself required direct expenditure on goods and services for Australia.

- Foreign owners of intellectual property can earn rent through Australian sales, but payments for it are not deductible against Australian cash flow, except to the extent that they require specific expenditure on adaptation to Australian conditions.

- For Australian investment in research and development, the tax treatment is highly encouraging because there is an immediate deduction of all expenditures.

- Franking credits remain.

- There would be grandfathering provisions in the changeover.

The greatest revenue problem with the cash flow system is that in capital-intensive projects, net cash flows in the early years would be negative and with the grandfathering there might be some adverse taxation revenue implications.

If we assume the non-taxed cash leaving the country is about $30bn we are losing around $10bn in tax. It will soon double to $20bn. Corporate tax revenue is about $100bn. Those figures are very rough, but something must be done and by adopting a version of the Ryan plan the US can hardly complain. And what an exciting society we would create, with high capital investment and research setting us up for the future. And all major political parties can unite on this issue so helping to bring the nation together.