Business confidence shattered as east coast lockdowns cost $1bn a week

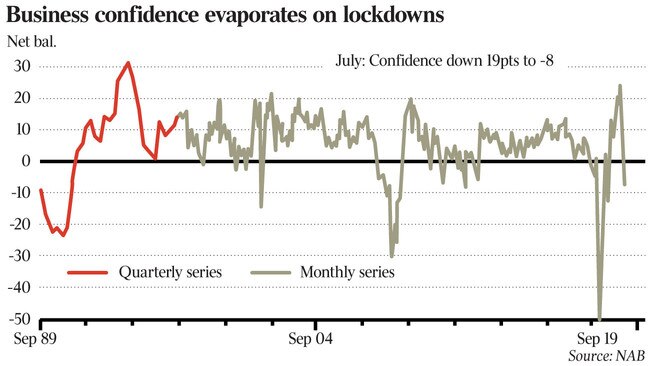

Business confidence has suffered its second biggest fall since the GFC as a spate of Covid-19 lockdowns have materially increased uncertainty about the outlook.

Business confidence has suffered its second biggest hit since the GFC, and its third largest fall ever, as a spate of Covid-19 lockdowns across the nation’s east coast, costing at least $1bn a week, have materially increased uncertainty about the outlook.

After hitting record highs in April and May due to unprecedented fiscal and monetary policy stimulus and Australia’s early success in suppressing the Covid-19 pandemic, falls from those peaks accelerated last month largely due to the lockdown of Greater Sydney.

Business confidence suffered a “very sharp” 19 point fall to minus 8 points – its second biggest fall since the GFC almost 14 years ago, according to the NAB Monthly Business Survey for July. NAB’s measure of business conditions dived 15 points to 11.

The last time the business survey deteriorated so sharply was during the first wave of the pandemic.

But the absolute number remains vastly better than early 2020, when business confidence and conditions hit record lows.

While NSW did much of the damage, due to its sheer size and the severity of the lockdown, conditions worsened in all mainland states, with South Australia also seeing a very large fall.

Conditions softened in all industries except mining, thanks to buoyant commodity prices.

Forward-looking indicators also softened, with forward orders now back in negative territory and capacity utilisation falling back to around average levels, suggesting there will be little improvement in conditions in the near term, according to NAB.

“Overall, the survey shows that the strength in the business sector seen in early to mid 2021 has faded on the back of fresh disruptions in the economy but it has not yet deteriorated to the lows seen in early 2020,” NAB senior economist, Gareth Spence said.

“With the survey showing a very strong momentum in the lead-up to the recent lockdowns, the hope is that once restrictions are eased, the economy will rebound relatively quickly, consistent with the experience through the pandemic to date, and resume a strong growth trajectory – and a return to strong capex and employment plans.”

The weekly ANZ-Roy Morgan Australian Consumer Confidence Index fell 3.1 per cent to a 10-month low of 98.6 per cent as fresh lockdowns were announced in parts of Queensland and Victoria.

As a result, confidence dropped by 7.5 per cent in Brisbane and 1.6 per cent in Melbourne, while Sydney and the rest of NSW rose to 3.7 per cent and 2.1 per cent respectively, as the vaccination rate picked up and some restrictions on construction work were eased.

“Sentiment is still above the level reached during Victoria’s long second lockdown, but it is now in pessimistic territory for the first time since early November last year,” ANZ head of Australian economics David Plank said.

“Our research suggests we can’t be sure the low in confidence in the current cycle has been reached until Covid case numbers start to trend lower.”

UBS Australia chief economist George Tharenou warned that the third wave of Covid-19 in Australia had “materially” increased economic uncertainty.

Official economic forecasts released by the Reserve Bank last week – including a material upgrade of the bank’s 2022 economic growth forecast to 5 per cent year on year versus 4 per cent forecast in May – may prove “very optimistic” in light of such a significant shutdown of NSW.

Mr Tharenou saw a “material risk the RBA’s forecasts are disappointed”.

If lockdowns continue to be extended, the RBA may decide to delay its plan to “taper” purchases of government bonds from the current pace of $5bn a week to $4bn early next month, he said.

In his view, the RBA is “more the outlier to consensus” and the economy is more likely to track the “downside scenario” outlined by the RBA in its economic forecasts, which run through 2023.

“It is possible some NSW restrictions are eased earlier – as hinted by Premier Gladys Berejiklian – but it would require a material change in the “reaction function”, Mr Tharenou said.

“If NSW eases restrictions after achieving a 50 per cent vaccination rate, will they actually stick to it if cases and ICU admissions rise further? We can’t know for sure.”

The national cabinet is currently targeting “near-zero community infections” as a precondition for ending lockdowns – at least until full vaccination rates of about 70 per cent of adults is achieved.

But while vaccinations have lifted sharply recently to about 200,000 per day, due to supply constraints, the “magic number” for reopening “can’t be reached” before October.

Mr Tharenou also saw a “longer tail of restrictions compared with after previous lockdowns” causing a relatively slower rebound in mobility and economic activity.

He has predicted a 2.5 per cent quarter-on-quarter contraction in national economic growth in the September quarter, assuming Greater Sydney remains in lockdown through September and only brief lockdowns elsewhere.

The NSW lockdowns are now costing at least $1bn plus a week, with a “cumulative hit” to national GDP expected to total about $25bn.

On the upside, fiscal support is now $1bn-$1.5bn per week, but it can’t all be spent in the third quarter.

Rather, it will support a bounce of activity in fourth quarter – assuming lockdowns end – but that will be “constrained by a long tail of restrictions until vaccination thresholds are met”.

But modelling by Oxford Economics predicted it would take until at least the middle of the December quarter before the government’s 80 per cent vaccination target for people over 16 years of age could be met. This week, the vaccination level reached 22 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout