Business boom lifts confidence and hopes for wages

The best business conditions in a generation are boosting confidence and paving the way for much-anticipated wage rises.

The best business conditions in a generation are boosting confidence and paving the way for much-anticipated wage rises, according to a closely watched survey that foreshadows more good news for the Turnbull government.

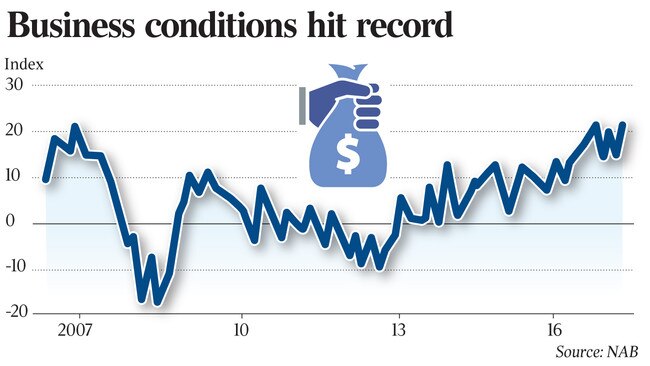

As the battle to legislate company tax cuts looks set to intensify after tonight’s federal budget, National Australia Bank’s business conditions index has revealed an extraordinary improvement in trading conditions across all sectors of the economy except retail and manufacturing.

The index, based on a survey of 400 firms, unexpectedly jumped six points to 21 in April, the highest level since the mid-1990s, a purple patch matched only by that in late 2007 on the eve of the GFC, in the last year of the Howard government. “The record high in the April survey simply reinforces what has been evident since the middle of last year, that business activity in Australia is robust,” said NAB chief economist Alan Oster.

“Profits are very strong but businesses aren’t taking those profits and investing like they normally do. They are paying down debt. I see the business survey as indicative as why the government appears to be rolling in corporate tax revenue.”

The federal budget, unveiled at 7.30pm tonight, is expected to include significant upward revisions in company tax collections, enough to bring the return to surplus forward a year.

The government dumped its planned increase in the Medicare levy last week, standing by its controversial plan to cut company tax to 25 per cent from 30 per cent for all companies.

“The strength in business conditions and leading indicators suggest economic growth will strengthen and that, overtime, we should see strong jobs growth and falls in the unemployment rate,” Mr Oster said. “Falling unemployment should eventually translate into upwards pressure on private sector wages.”

The survey was consistent with a renewed spurt of job creation.

“The survey cautions against reading too much into the recent softening in official jobs growth,” the survey says, referring to the unemployment rate settling at about 5.5 per cent following regular falls.

The survey followed signs stagnant wage growth had troughed. Enterprise agreements registered in the December quarter showed average wage increases of 2.5 per cent a year, up from a record low of 2.2 per cent the previous quarter.

The government came under fire after last year’s budget for including optimistic forecasts, including pencilling in an acceleration of wage growth to 3.5 per cent by 2021. Private sector wages rose 1.9 per cent last year.

ANZ economist Felicity Emmett cautioned it was “still early days”, but “the improvement in EBA wage gains is important given that it is essentially a leading indicator of actual wage growth”.

Mr Oster added: “Of some concern is that retail conditions turned negative for the first time this year.”

Separately, the number of job advertisements fell for the third consecutive month, to about 176,000, but they remain 8 per cent higher than a year ago, in keeping with strong jobs growth.

Local blue-chip stocks briefly hit a three-month high yesterday; the benchmark S&P/ASX 200 index finished 0.4 per cent higher at 6084.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout