Bushfire cloud hangs over Australians’ spending: JPMorgan

Bushfires could make Australians uneasy about spending or socialising as others struggle, retail analysts warn.

Images of a burnt Australian landscape, destroyed homes and evacuated towns could depress consumer spending, especially on discretionary goods, as people become uncomfortable to spend money or celebrate social occasions as others in the country are struggling, JPMorgan warns.

Smoke-filled skies above cities are also threatening to dampen consumption, as the impact and consequences of the bushfires drive some consumers to divert their spending from discretionary to non-discretionary shopping and, in general, cause a retail downturn.

A fresh retail report from JPMorgan argues that the Australian bushfires could weigh heavily on consumer sentiment, while for the wine and food sectors, destroyed crops and arable land could feed into higher food prices.

“Consumer discretionary retailers Wesfarmers, Harvey Norman, JB Hi-Fi, Super Retail and Myer and beverage companies Coca-Cola Amatil and Treasury Wine Estates, negatively impacted initially by subdued consumer sentiment and a reallocation of spending away from these companies,’’ JPMorgan analyst Shaun Cousins said in a note to clients.

“During periods of national disaster, consumer sentiment can be negatively impacted as consumers are unwilling to spend when others are struggling. This can see a reallocation of funds otherwise to be spent on discretionary items, eating out ... either donated, not spent or at least trading down.”

Poor air quality as smoke from the bushfires floats into major population centres is also a negative factor for spending, he added.

“For beverage companies this could see less demand as socialising occurs less - with smoke deterring outdoor socialising in some parts of Australia - and could be more subdued.

“In time, this negative is likely to pass, but could see negative comments from consumer discretionary retailers and beverages companies regarding the start to trading in 2020.”

The JPMorgan figures come as new credit card spending data from ANZ shows shopping during the crucial Christmas spending period was “particularly weak”, suggesting November’s retail sales surge may have come at the cost of a soft December.

Shoppers spent 5.6 per cent less between December 16 and Boxing Day than during the same period in 2018, the bank’s data show. That compares with year-on-year growth of 6.3 per cent in 2018, and 3.3 per cent in 2017.

“Christmas 2019 looks to have been particularly weak,” ANZ economist Adelaide Timbrell said.

The bank’s analysis comes days after Australian Bureau of Statistics figures showed an encouraging 0.9 per cent jump in retail sales in November – the strongest month of growth in two years.

The ABS noted that the US-style Black Friday sales event late in November helped turbocharge spending.

Analysts, however, fretted that households simply pulled forward spending from December, and that the weak consumption trend of 2019 would quickly reassert itself.

Still, JP Morgan’s Mr Cousins said work to rebuild destroyed infrastructure and homes could help hardware businesses, while a nationwide lift in government spending is also a long-term positive for the retail sector.

“In the medium term, rebuild efforts are likely to be positive for consumer discretionary retailers, with Bunnings, and Metcash-owned Mitre 10, most directly impacted,” he said.

“More broadly, efforts by the federal government to contribute to the rebuild effort, and possibly stimulate what is a somewhat subdued consumer, could see fiscal policy become more expansionary.”

Mr Cousins also argued consumers should brace for higher food prices as the fires have burned farms and destroyed crops, Other industries such as meat and dairy face supply constraints both from the prolonged drought and the bushfires.

“The location of fires in agricultural areas is likely to see fruit and veg and meat prices rises due to shortage and this will impact prices in other categories, such as alternative proteins.

“JPMorgan’s economics team noted in November the drought was a rough 0.2 per cent drag on GDP and a 0.4 per cent increase to CPI. So far consumers have been able to absorb rising food inflation in fresh and now dry grocery, with volumes being somewhat resilient, although tobacco inflation has seen some trading down and a shift to illicit tobacco.”

Last week, listed dairy processor Bega Cheese confirmed it expects to lose 1.9 million litres of milk due to the bushfires. The expected loss of milk accounts for less than 0.2 per cent of Bega’s one billion litres of supply.

The expected food inflation will lift sales for the supermarkets.

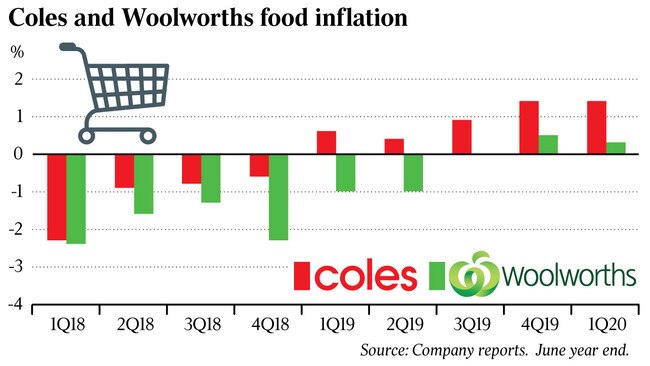

“Looking to 2020, we suggest food inflation will contribute to like-for-like sales growth for Coles, Metcash and Woolworths,’’ Mr Cousins said.

There would be limited impact to aggregate crush volumes for the wine sector and value, yet there was likely to be added upward pressure to grape prices.

“Initial press reports indicate that a third to half of the wine production in the Adelaide Hills (SA) has been destroyed. Adelaide Hills comprises roughly 1 per cent of total Australian wine crush and wine value … suggesting a modest national impact although likely to add upward pressure on grape prices.”

-with Patrick Commins

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout