Bill shock as standard of living slumps

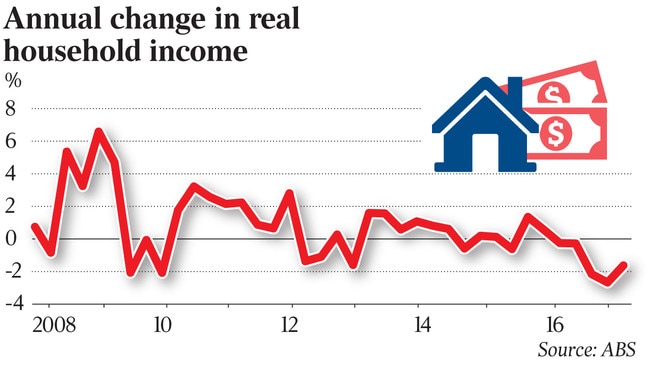

Australians have endured their longest period of falling living standards in more than 25 years.

Australians have endured their longest period of falling living standards in more than a quarter of a century as growth in costs outstripped earnings for the fifth consecutive quarter, leaving households worse off than they were six years ago.

After allowing for inflation, taxes and interest costs, average household incomes dropped 1.6 per cent in the year to September, capping a sustained fall in living standards that has not been seen since the 1990-91 recession.

Economists say more than half the cost increases for households are being driven by electricity, rent, health, new housing and tobacco, while modest wage rises are being partially absorbed by workers being pushed into higher tax brackets.

The Turnbull government is planning to respond to the financial pressure on households in the May budget with the promise of personal income tax cuts.

It is also claiming success in developing a policy to rein in runaway electricity prices.

However, Bill Shorten flagged in his new year message that he saw weak growth in living standards as a political vulnerability of the government, promising that his policies would “help families deal with the cost of living and out of control energy prices”.

After adjusting for living costs, interest and taxes, average earnings in the three months to September were 0.7 per cent lower than in the same period of 2011, which marked the peak of the resources boom.

Over the previous six years from 2005, households had seen an average improvement in their living standards of 17 per cent.

AMP chief economist Shane Oliver said the mid-year budget update delivered before Christmas provided only limited scope for tax cuts.

“To be anything more than ‘sandwich and milkshake’ tax cuts and still maintain a trajectory towards a budget surplus by 2020-21, they would have to be offset by spending savings elsewhere. That is where the politics kicks in and the government has had difficulty getting things through the Senate,” he said.

Dr Oliver said if the government was successful in getting the 0.5 per cent increase in the Medicare Levy through the Senate, it would offset the benefit of any tax cut. The Medicare Levy increase is scheduled to start on July 1 next year and increase personal taxes by $3.6 billion in its first year and $4.3bn in the second.

Although living standards stopped rising after 2011, the decline since the middle of 2016 is new and reflects both the fall in wage growth and an increase in tax payments.

The ABS Wage Price Index shows a 1.9 per cent rise last year, but this is measured before tax and records the average increase for each job. National accounts show that personal income tax collections are rising much faster than pre-tax wages, partly because more wage income is being pushed into higher tax brackets. They show a 4 per cent lift in taxes per capita over the year to September, absorbing 60 per cent of the increase in wage income per person, which rose only 1 per cent.

Much of the very strong employment growth in the past year has been in lower paying jobs in the services sector, which has reduced average incomes overall.

National Australia Bank’s head of research Peter Jolly says pressure has built on household incomes since the peak of the resources boom in 2011 as a result of weak productivity growth and falling prices for Australian export commodities.

He said this partly reflected weakness in the economy overall, with unemployment higher at 5.4 per cent than it should be, but also reflected structural changes in the economy from technology and globalisation, which were increasing competitive pressures on businesses.

The bank’s monthly business survey shows that firms rate wage costs as their third-biggest challenge, following the outlook for their business and pressure on profit margins. “Here we are with wage growth the lowest outside a recession and the third item pressuring business is wages. It shows the competitive pressures on many businesses are very strong and they are pushing back on wage costs.”

Mr Jolly said this showed wage growth was likely to remain weak in the year ahead, although employment growth would generate higher wages in some sectors.

The pressure on families is even greater than shown by the fall in real incomes because the cost of essential services such as electricity, health, education and housing has been rising much faster than discretionary items.

Mr Jolly said over the past five years, 60 per cent of the increase in living costs has been driven by electricity, rent, health, new housing and tobacco. “Households are spending their money on non-discretionary items — the things you can’t avoid — and they’ve been going up much more quickly than discretionary items.”

Mr Jolly believed the worst of the “crunch” on consumers had passed last year. “The international evidence is that wages don’t rise like they used to, but they do still rise, so we will finally see a modest uptick in wages this year,” he said.

Dr Oliver said the government might find some relief with electricity prices likely to drop towards the middle of this year as new renewables plants were commissioned.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout