But with China’s borders opening up and plans for more bilateral exchanges by politicians and business people, the issue is whether it will result in any change of the federal government’s policy on Chinese investment in Australia.

Several approaches by Chinese companies were blocked by the Foreign Investment Review board or the Treasurer under the previous government on grounds including “national interest”, discouraging many other potential investors from China from putting their hands up.

The net result has been a fall in Chinese investment into Australia from $US1.9bn in new deals in 2020 to only $US600m in 2021, according to the latest study by KPMG and the University of Sydney Business School. These figures are well down on the peak of $US16.2bn in 2008 at the height of the mining boom, and the more recent high of $US6.24bn in 2018, just before political tensions started to weigh in.

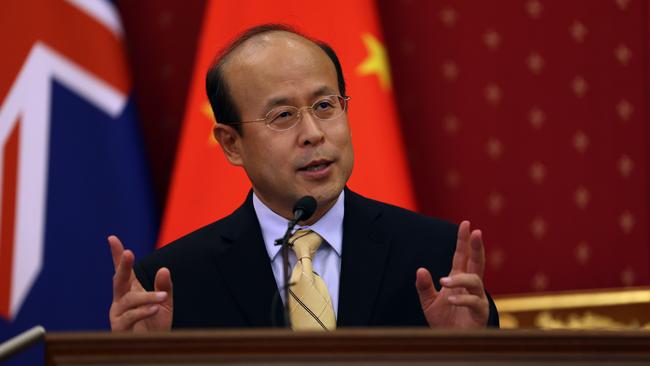

But with the improvement in ties, underlined a week ago in a press conference by China’s ambassador to Canberra, Xiao Qian, the investment community will be watching to see if the broader climate has changed.

While Australia is keen to resume normal trade with China including seeing an end to some $20bn worth of formal and informal trade restrictions including tariffs on wine and barley and restrictions on exports of coal, timber, beef and lobster, Xiao made it clear he would like to see a more constructive approach to co-investments by Chinese companies in Australian projects.

He said there was “strong potential” for China and Australia to collaborate in areas related to green business and climate change. He cited areas such as lithium-based batteries and electric cars as two examples. Australia and China could “explore some new frontiers of co-operation, like green infrastructure”.

Chinese company Tianqi has been a long time investor in one of Australia’s largest lithium mines, Greenbushes, 250km south of Perth, along with local company IGO and the US’s Albemarle, and is also backing a lithium processing plant at Kwinana. While Chinese investment was critical to these two projects, the previous government has blocked moves by other Chinese companies to buy into rare earths companies including ASX-listed Lynas. The federal government has indicated it is looking at its foreign investment policy with regard to the broader area of critical minerals, which includes lithium and rare earths.

Treasurer Jim Chalmers told the critical minerals summit hosted by The Australian and PwC in November the government was “thinking about our longer-term investment requirements, including foreign investment. We welcome and encourage foreign investment in critical minerals. But as investment interest grows, and as the sources of that investment interest grow, we’ll need to be more assertive about encouraging investment that clearly aligns with our national interest in the longer term.”

Exactly what that means remains to be seen.

Recent moves to block Chinese bidding for Australian companies have included the $300m takeover of Probuild by state-owned China State Construction Engineering Corp and a $600m bid by China Mengniu Dairy for Lion Dairy and Drinks.

The Australia China Business Council has cited climate change and green business as an area of future co-operation with China. ACBC president David Olsson said he hoped the next round of Australia-China ministerial meetings could seek more clarification of areas “where investment may be possible”.

Despite political tension between the US and China, he noted, a Chinese battery supplier company was involved in a $US2.4 billion investment in Michigan while another Chinese company, CATL, had invested in a $US2 billion battery factory in South Carolina with BMW.

“Our view is that Chinese investment and access to manufactured goods and technology is not only possible but offers significant potential to accelerate our decarbonisation efforts and the industrial transformation of our economy,” he said.

Baker McKenzie partner, Lawrence Mendes, says his firm has seen a “substantial uptick in interest from Chinese investors looking at Australian M&A opportunities” over the last few months.

“We are not close to pre-2019 levels, but our experience suggests there is a pipeline of Chinese capital looking for a home in Australia,” he said.

Sectors of interest included traditional areas such as mining and real estate as well as new areas such as renewables in particular as well as tech, and some health care assets.

Those interested include a mix of private companies looking to establish operations or buy businesses in Australia and state owned enterprises “looking to invest in businesses of scale”.

KPMG Australia’s head of Asia and International Markets, Doug Ferguson, was cautious about the outlook for any significant new investment from China.

He said the improved diplomatic relations “may lead to more investment confidence from private Chinese companies in 2023 for some sectors including food, mining, renewable energy, commercial property”.

“Chinese entrepreneurs leading companies already here in Australia with assets, experience and access to capital are more likely to lead this next wave,” he said.

But he said investment by Chinese companies offshore into sensitive sectors including FIRB’s broadly defined critical infrastructure and certain tech and data-related services “will most probably remain very quiet”.

The major focus for 2023, he said, would be to rebuild confidence in the trading relationship between Australia and China.

So far there have not been any specific cases – at least in the public arena – to test FIRB’s policies under the Albanese government.

But as China-Australia relations improve, the challenge will be working through opportunities for access to Chinese capital, technology and markets while navigating domestic political sensitivities and, of course, protecting Australia’s “national interest”.

In short, watch this space.

Australia’s improving relationship with China is already showing signs of seeing an easing in trade tensions in areas such as coal, wine, barley and lobsters.