Australia’s recovery roaring ahead, says NAB’s Ross McEwan

Ross McEwan has a front-row seat to the recovery in motion across Australia and it’s business leading the way.

Ross McEwan has a front-row seat to the recovery in motion across Australia and it’s business leading the way.

The National Australia Bank chief executive can see all the signs. Business confidence is well above the long-run average, business investment is lifting and jobs are being created.

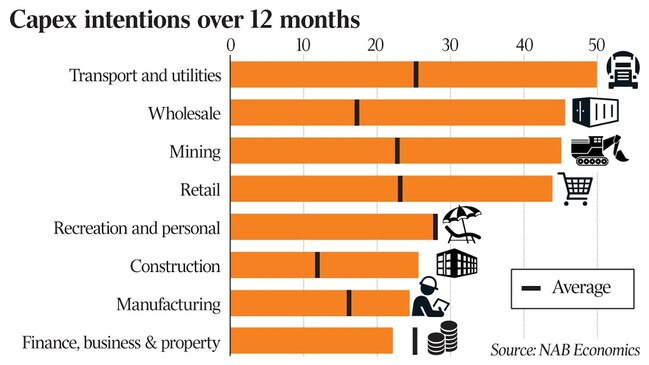

He says NAB’s business customers are telling his bankers that expectations for spending on capital — be it machinery, equipment, trucks or sheds — across a wide range of industries is well above average.

“It is very clear that businesses are starting to invest again and they are seeing lots of opportunity,” McEwan tells The Australian.

“In 2020 many of them had to restructure themselves.

“They took the opportunity of tidying their own businesses up, but in 2021 it’s very clear that they are looking to invest,” says McEwan, whose the bank is the biggest lender to small and mid-sized businesses in Australia.

The latest data from NAB Economics finds business capital expenditure plans shifted from minus-8 in the second quarter of 2020 to 31 in the fourth quarter (where 0 indicates no capital expenditure plans).

Moreover, capex expectations for the next 12 months are above average in almost all industries.

“You are seeing the agricultural sector doing incredibly well at the moment.

“The weather conditions certainly help there,” McEwan says. “Manufacturing is starting to pick up because many global supply chains have been interrupted and they are finding alternative sources onshore in Australia.”

His comments follow official figures released last week that show the Australian economy has recorded its strongest six months of growth in recorded history, with GDP in the December quarter beating expectations to lift by 3.1 per cent.

The optimism from the big four banker is backed up by NAB Economics research showing a rebound in business activity and capacity utilisation (output achieved compared to maximum production output) almost back to pre-COVID times.

In manufacturing, capacity utilisation sits at over 80 per cent compared to a long-running average in the high 70s.

This is a good signal for growth because the data indicates there is pressure on businesses to expand their operations.

The bank also found capacity utilisation in the retail sector in the mid-80s compared to its average in the low-80s as consumers move their spending away from overseas travel into retail.

Businesses responded well to the government support programs, especially the instant asset write-off program.

“Business borrowing for machinery and equipment is well up to 8 to 9 per cent, which is a big lift,” McEwan says.

Growth in equipment financing credit has risen 5 per cent in retail and 11.6 per cent in agriculture.

McEwan also notices rural communities starting to boom with a positive flow into construction as people move an hour or two out of the cities.

And the bank’s business confidence index also shows a net 10 per cent of firms that are confident, jumping five points in January and compared to the long-run average of 6 per cent.

Crucial to the January jump in business confidence to 10 points on the NAB Economics index is the government stimulus and McEwan singles out JobKeeper and the infrastructure support with HomeBuilder and the first-home buyer schemes.

However, he says the government is right to curb the stimulus at the end of this month.

“JobKeeper has done its job,” he says.

“The unemployment levels are down to the sixes: 6.4 per cent. By the end of this year, we think it is going to be 5.9 per cent and by the end of next year, back down to around 5.4 per cent.”

McEwan says the bank is starting to see job creation among employers he speaks to in the market. “One of their biggest issues is finding people to work in their businesses,” he says.

The NAB chief says most lending growth will be generated by businesses themselves. “We are back in the recovery zone: invest, grow, employ and that is certainly starting to happen across many industries,” he says.

“I was out with a couple of businesses over the last week. Many of them have pivoted away from what was their core business into other areas. They are looking for people to employ to help them develop their businesses.”

Earlier this month, NAB chair Phil Chronican urged business leaders to seize the day following Australia’s successful handling of the pandemic and invest and retool their companies for growth. But McEwan stresses that his chairman also had a message of caution.

“We saw this in the third lockdown for Melbourne and I think we’re going to see more and more small sharp lockdowns that will just dent people’s confidence as it goes through.

“Big businesses like ourselves, were just getting some of our colleagues back into the office space which then feeds in the cafes and restaurants in Melbourne.

“Then you close down for five days or you are wearing masks, so people say I’d rather spend that time at home. This will be a wee bit bumpy, but the definite trajectory is positive for the next few years in Australia.”

Ross McEwan favours an extension of the instant asset write-off in the May budget for SMEs to get supply chains moving and some continued support for the building industry. “It will get people back into jobs very quickly.”

When asked about an increase in competition for business banking, including a new push by Commonwealth Bank and fintech disrupters like Judo, McEwan says NAB is growing market share in its business bank but he stresses that the growth comes from the success of his customers.

“Competition is great for customers and you will find that the NAB is a very good competitor in our core market. We look forward to that competition because it will be great for customers.

“It all comes back to customers having confidence to invest in their businesses and that is when we can be helpful.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout