Australians look set to splurge on vehicles this year with a big jump in imports, and a surge in EVs

Australia might be playing catch-up on the electric vehicle front but if the latest import figures are any indication there’s growing appetite for next-generation cars.

An almost five-fold increase in electric vehicles shipped to Australia in February has helped push vehicle import figures up by a quarter to close to record levels.

Data released by the Australian Bureau of Statistics on Wednesday shows that electric vehicle imports jumped 485 per cent in February to a record $104m, while hybrid vehicle imports were up 101 per cent to $190m.

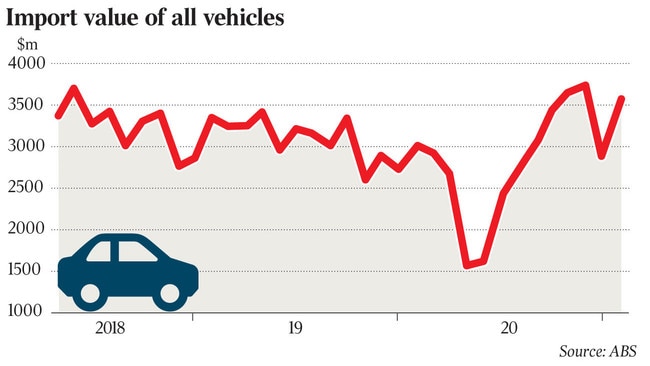

The monthly figures contributed to a 24 per cent - or $705m - increase in vehicle imports in February, pushing the vehicle import value to $3.58bn.

Import values fell as low as $1.58bn in May last year, before bouncing back to a record $3.72bn monthly figure in December.

While January figures are traditionally weaker, falling to $2.88bn, the solid figures for the past few months indicate that an expected return to form for the vehicle sector is well and truly on the cards.

“This is the highest month on record for electric vehicle imports (four times that of February 2020) and the third highest for hybrids,’’ the ABS said in a statement.

“These increases align with media reports of a shift in demand for electric vehicles in early 2021 as a greater range is made available in Australia.’’

While Tesla, which refuses to publish its Australian sales data, has been the market leader in terms of awareness of electric vehicles, there is a broadbased switch to electric propulsion across the car industry.

Toyota - the biggest selling brand in Australia - has announced it will offer electric or hybrid versions of its entire range by 2025.

More broadly, vehicle sales helped boost Australia’s total imports by 2 per cent to $24.01bn, while our total exports increased 2 per cent to $32.1bn.

“Road vehicle imports rebounded to their fifth highest value on record following the first monthly decline in January since May 2020,’’ the ABS said.

“The increase was driven predominantly by internal combustion vehicles across three main categories, new passenger vehicles, off-road vehicles for transporting goods and diesel vehicles.’’

New vehicle sales fell in Australia in the 2020 calendar year, with the Federal Chamber of Automotive Industries reporting that 916,968 vehicles were sold across the period, down 13.7 per cent on 2019.

A sales report released earlier this month however indicated a recovery was under way, with 83,977 vehicles sold in February, up 5.1 per cent on the same month last year, which was unaffected by COVID lockdowns.

FCAI chief executive Tony Weber said at the time the result showed confidence was continuing to grow in the market.

“During the past four months we have seen an increase of 10.6 per cent in new vehicles and this has been reflected with strong growth in NSW, Queensland, Western Australia, South Australia and the Northern Territory in February 2021,’’ he said.

“The sales reduction in Victoria can be attributed to the COVID-19 restrictions that were put in place during the month.

“We remain confident that this trend of growth will continue in an environment where business operating conditions continue to normalise.’’

The increase in electric vehicle sales comes as the debate continues about whether to introduce a new tax regime for EVs.

South Australia was the first state to float the idea in its Budget late last year, but has since pushed those plans back a year while it waits to see what other states do.

The Victorian Government has proposed a per/km levy for electric and hybrid vehicles, with the cost coming in at 2.5c/km and 2c/km respectively. The charge is intended to be implemented from July 1 this year.

Mr Weber has said that governments should instead be encouraging the uptake of new technologies.

“It does not make sense to apply the charge to zero emission vehicles right now as these technologies are still in their infancy and account for a relatively small portion of vehicle sales across Australia,’’ he said.

“Right now, governments should be encouraging the uptake of these technologies with positive policy initiatives particularly around emissions targets, infrastructure development and appropriate incentives for fleets and private consumers rather than introducing charges that potentially reduce the incentive for these customers to buy these vehicles.”

A consistent approach across the nation was also needed, Mr Weber said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout