Australian wheat in demand from Vietnam to Africa despite China snub

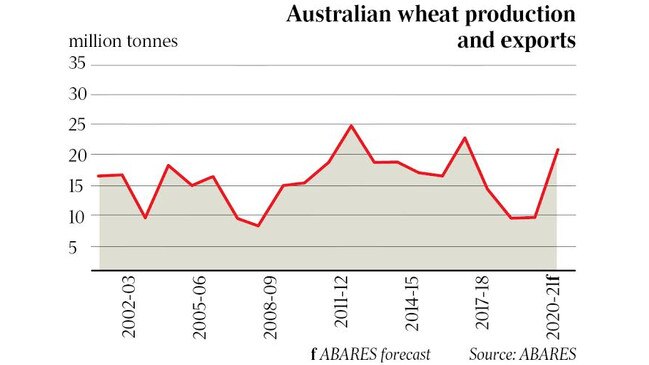

Australian wheat production is forecast to double, and despite China slashing imports there are still plenty of outlets for high quality Australian grain.

Exports of Australian wheat are at capacity, with shipments booked out until at least late February and in some ports as far out as May, despite China cutting purchases of Australian grain as part of Beijing’s $20bn trade war with Canberra.

Australian wheat production is forecast to double to about 30 million tonnes this season, and while shipments to China hit a decade low in November, other key markets, including Indonesia and Vietnam, as well as new ones in East Africa, are snapping up the bumper crop.

Emerald Grain, which operates the high throughput bulk grain terminal capable of loading vessels with up to 20,000 tonnes a day at the Port of Melbourne, said Australia was regaining market share in global wheat markets after several years of drought, with total international trade worth about $4.6bn.

“It’s going everywhere,” Emerald Grain chief executive David Johnson said.

“Australian wheat is priced very competitively and we’re seeing demand not only from south and north Asia but the Middle East and the east coast of Africa, which is a market we haven’t supplied for a number of years. With the size of our crop and our Australian wheat price we are competitive in a broad range of markets, so there is a broad range of interest.”

The blockbuster wheat crop and opening of new markets more than compensates for China scaling back on its purchases of grain — it buys about 1.1 million tonnes of Australian wheat worth an average $346m a year.

China imported 880 tonnes of Australian wheat in November — the lowest quantity since 2011 — as tensions between Beijing and Canberra show no signs of abating. Australia exports about $4.6bn worth of wheat a year, with China accounting for around 10 per cent of total international trade.

China’s communist regime has banned or imposed punitive tariffs on about $20bn worth of Australian exports from barley, beef, timber and coal to wine and lobster.

But the Chinese snub appears to be having little impact elsewhere across the Asia Pacific region.

Other Asian markets have been buying up Australian wheat in the lead up to lunar new year, with more than 30 per cent of Australian wheat exports used in Asian noodles thanks to its starch and protein quality. Other key Asian markets include Vietnam, which buys about $404m of Australian wheat a year, and Korea, which buys about $361m.

Mr Johnson said export orders were booked out at least two months in advance.

“The east coast is even probably booked out a little bit further because east coast grain has been the most competitively priced — I’d say April, maybe even to May.

“With the volume we have we are regaining the market share we lost during two years of drought.

“Everyone is trying to maximise the flow of grain through their assets, which is what we should be doing this year.”

The world wheat price is forecast to surge 11 per cent this financial year, to an average of $US245 ($320) a tonne, reflecting a fall in production in some major exporting countries in 2020–21 and a dry stretch during the 2021–22 winter crop planting window in the US, the European Union and Russia, the Australian Bureau of Agricultural and Resource Economics said in its December quarterly report.

Australian Grain Growers chairman Brett Hosking said that while China had tightened its purchase of Australian wheat to a decade low last month, he expected the Asian powerhouse to continue to buy the grain throughout January.

This is despite Beijing banning or imposing punitive tariffs on a suite of Australian farm commodities following Prime Minister Scott Morrison pushing for an inquiry into the origins of the coronavirus and instituting foreign interference legislation that angered the Chinese Communist Party.

“We have got orders, with many or the larger exporters Emerald Grain, Glencore, GrainCorp and CBH having wheat going to China over January, and even in December there were some shipments that left,” Mr Hosking said.

“I understand January will be a reasonably busy month for wheat going into China … just in terms of shipping slots that have been booked up by the exporters.

“That being said, the feeling we are getting from a lot of the exporters is that they are treating China as a little bit of a nervous market. They are still happy to trade there but they are not exposing themselves too much in terms of booking too much up in advance, and at the moment shipping slots are pretty full so there is no need to be booking more.”

Trade Minister Dan Tehan is committed to securing an Australia-India free-trade agreement as one of his top priorities as the government moves to diversify the nation’s export markets to counter increasing hostility from China.

“India is a great friend of Australia and further strengthening the trading relationship between us will be mutually beneficial,” Mr Tehan told The Australian.

“Re-engaging on a Comprehensive Economic Cooperation Agreement is in both countries’ national interest.”

With thousands of Chinese soldiers camped on Indian soil and negotiations to defuse the conflict deadlocked, the world’s two biggest militaries are squaring off against one another at altitudes above 5000m as temperatures plunge to -40C.

The dispute over the border has escalated this year after 20 Indian troops and an unknown number of Chinese were killed on the border. The stand-off has raised fears that a miscalculation by either side could tip the world’s two most populous nations — nuclear-armed powers with a joint population of more than 2.7 billion — into open conflict.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout