Australian exports at risk in any US-China deal

Business leaders fear Australian exports to China could be affected by a trade deal between the US and China.

Business leaders have welcomed a thawing in US-China trade tension that could bring to an end more than a year of global economic uncertainty, but some fear Australian exports to China could be caught by the specifics of any final deal between the superpowers.

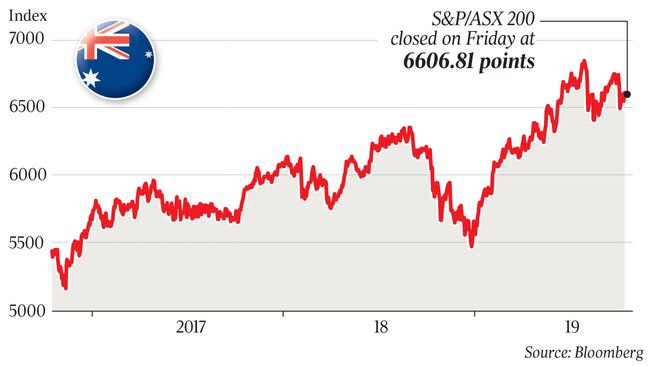

A weekend breakthrough on trade talks between Washington and Beijing has triggered hopes across global markets that the two countries can work out their differences on more divisive issues that have hampered talks and led to a broader dispute that has weighed on the global economy.

US President Donald Trump at the weekend said the US would call off planned tariff increases on $US250bn worth of Chinese goods this week, while Beijing would buy $US40bn-$US50bn worth of American agricultural products — a move China has not publicly confirmed. If correct, that would be more than double the level of agriculture goods the US sold to China in 2017 before the trade war erupted.

Mr Trump touted the mooted Chinese agricultural purchases in a tweet on Saturday.

“The deal I just made with China is, by far, the greatest and biggest deal ever made for our Great Patriot Farmers in the history of our Country,” he said. “In fact, there is a question as to whether or not this much product can be produced? Our farmers will figure it out. Thank you China!”

Much of the details of the weekend “first phase” deal on trade are yet to be ironed out but are expected to be finalised by next month’s APEC summit in Chile.

Mark Allison, the chief executive of Australian beef export major Elders, said Australian agricultural exports to China should escape being hit by any specific US-China trade deal because the two countries operated in different agricultural sectors. The US is a major exporter of soy beans and pork to China.

Mr Allison believed Australia’s $3bn a year meat trade with China could also be protected by any deal, as most US beef was treated with growth hormones that were not allowed in the Chinese market.

“The benefits of stability (from a US-China trade deal) will offset any other downside,” he said in an interview in Beijing, where he has been attending an Australia-China business meeting.

“A trade deal should not have any major impact on the meat trade.”

But US beef exporters had been planning to step up their sales to China before the outbreak of the trade war in mid-2018 and any purchase agreement with China under a trade deal could still see more US beef exports.

An email by the Reserve Bank’s China representative, Adam Cagliarini, sent in August this year and released following a Freedom of Information request, warned that a US-China trade deal could have “longer term downside risks” for Australia in areas such as agriculture, goods and services and LNG, if the deal involved agreements by China to step up purchases of goods from the US.

But he said it was unlikely that any deal would hit Australia’s sales of coal and iron ore to China.

Australia has been the world’s biggest winner from the trade wars as China has sought to counter a slowdown by bringing forward investment spending, which has seen coal and iron ore prices surge, according to a new report from Deloitte Access Economics.

“Despite a global slowdown driven by the US-China trade war, the world has been giving Australia a pay rise via higher iron ore and coal prices,” Deloitte partner Chris Richardson said.

Deloitte Access Economics, in its latest Business Outlook report released on Monday, is forecasting global growth of 2.9 per cent in 2019 and 2.7 per cent in 2020.

While Australia has been a big winner from the global slowdown, the end of the housing boom and a prolonged drought challenged the local economy. Despite cuts to taxes and interest rates, as well as a lower dollar and signs of a housing recovery, there was little chance of wages accelerating or unemployment falling in the coming year, Mr Richardson said.

While President Trump’s on Friday spoke of the first stage of a trade deal, potentially to be signed by the two leaders at the APEC meeting in Chile in November, Australian officials in Washington and Beijing are now studying reports of the negotiations to see how a deal could affect Australian interests.

Seven Group Holdings director and the chairman of the Australia-China Council, Warwick Smith, welcomed the news of proposed deal between China and the US.

But he said it was too early to tell what impact it would have on any Australian exports to China.

“We think the escalation process of the tit-for-tat tariffs between China and the US might well have come to a pause,” he said. “A cessation of the escalation of the tariffs is a very positive issue.”

Mr Smith said he felt the situation had got to the point where “both sides see it is not constructive to keep ratcheting things up”.

“We are in a situation where the rest of the world is starting to see pressures on growth and we also have the uncertainties of Brexit and the Middle East,” he said. “There is starting to be a real fear that global geopolitical risk factors have become higher than normal.”

Mr Smith said at the moment there was just an “expression of intent” to do a deal following the talks between US and Chinese negotiators in Washington last Thursday and Friday. He said there would be more confidence “once (the deal) is committed to paper” and if the US didn’t go ahead with proposed increases in tariffs on Chinese goods planned for this week.

Mr Smith said discussions in Beijing over the weekend between business and government representatives from China and Australia had not identified any “catastrophic negative impacts” on Australian exports from the proposed deal.

But the email from the Reserve Bank’s China representative, sent in August to the RBA’s Sydney head office, was more frank in warning that there could be downsides for Australia in any deal.

“If they do strike a deal that involves purchase agreements, that could be detrimental to Australia,” he said in the email.

“It won’t just be ag (agriculture) either. These purchase agreements are likely to extend to LNG and other goods and services.”

While he said it was unlikely iron ore and coal exports from Australia would be hit by any deal, he told his superiors in Sydney that “I wouldn’t get too comfortable.”

Additional reporting: Cliona O’Dowd

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout