ASX companies expect windfall from US tax cuts

Some of the biggest companies in the Australian sharemarket will get a financial windfall from US corporate tax cuts.

Some of the biggest companies in the Australian sharemarket will receive a financial windfall from US corporate tax cuts due to be signed into law by Donald Trump next month.

In the most sweeping overhaul of US tax rules in more than 30 years, the US corporate tax rate will fall to 21 per cent, from 35 per cent.

Significantly, the changes mean US-based companies will also be able to expense 100 per cent of their capital expenditure in the first year after buying an asset, about twice as much as is allowable under the current legislation.

Analysts have calculated the US changes should boost profits across dozens of S&P/ASX 200 companies by $620 million.

The passage of the tax bill through US congress triggered a wave of earnings updates among local corporations, including BlueScope Steel and Computershare, while dozens of other companies were assessing the impact on their operations.

It also prompted calls for Australia to embark on its own round of corporate tax reforms.

The Business Council of Australia said the US tax changes meant Australia could no longer leave its top company tax rate “frozen in time” at 30 per cent.

Indeed, as of next year Australia will have the third-highest corporate tax rate in the OECD behind France and Belgium.

BCA chief executive Jennifer Westacott said: “The decision by the United States to slash its federal company tax rate from 35 to 21 per cent underlines the urgency for Australia to boost competitiveness to continue to attract new jobs and investment and power a growing economy”.

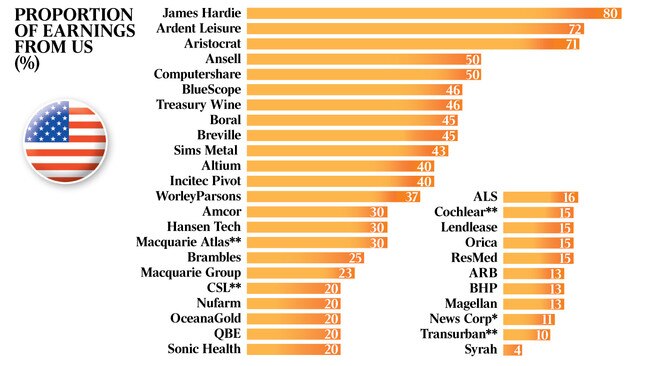

BlueScope Steel, which has major operations in the US, said the US tax cuts would benefit its US earnings. It expects a 7 per cent decrease in the federal tax rate on its US earnings in the current financial year and 11 per cent in subsequent years.

BlueScope shares surged as much as 8.5 per cent to a record high of $15.73 yesterday after the manufacturer issued a profit upgrade, helped by higher steel prices and increased sales in Australia.

Computershare, which generates 50 per cent of its earnings from the US, said it expected the proposed tax changes to result in a one-time benefit to net profit after tax this financial year.

Shares in Computershare hit an 18-year high of $16.99.

CLSA analyst Andrew Johnson expects building materials group James Hardie to benefit the most, given 80 per cent of its earnings are paid in the US. This is followed by Reliance Worldwide and Sims Metals Management.

Elsewhere, healthcare manufacturer Ansell yesterday said it was set to enjoy a windfall of up to $US27m ($35m).

The rubber products and safety equipment manufacturer said the US tax changes would lift its profit after tax by $US3m-$US5m a year by 2019, primarily as a result of lower direct tax expense.

Ansell also said the restatement of previously recorded net deferred tax balances was estimated to provide a one-off tax expense benefit in the range of $18m-$22m in the 2018 financial year.

Ansell said it now anticipated its effective tax rate to remain at the current 24-25 per cent level through to the 2020 financial year, as opposed to a previous forecast of 24-27 per cent.

Similarly, financial services group Navigator said it expected to “benefit significantly from a lower US corporate tax rate” once it rolled off its current round of tax losses.

The holding company for US-based hedge fund manager Lighthouse Investment Partners said it would have to write down a $US106m deferred tax asset to reflect its reduced value under the 21 per cent corporate tax rate.

It will book non-cash expense in its results.

Minerals Council of Australia chief executive David Byers said the passage of “significant and immediate” corporate tax cuts in the US “sends a clear message to Australia’s politicians to get on with urgent company tax reductions if we are to retain and attract investment and jobs”.

Mr Byers said while Australia’s corporate tax rate had been frozen since 2000, 19 countries had reduced their tax rates since 2010, and more, in addition to the US, would do so in the near future.

“It is unsustainable for Australia to continue to impose such a high tax burden on new investment on our manufacturing, services and mining industries,” he said.

“For example, Australia’s tax burden on iron ore is more than double that of our major competitor Brazil.”

Telstra chairman John Mullen said he agreed with the need to cut business and personal tax rates, but that it did not need to be the top priority for the country.

“I certainly subscribe to the view that lower tax encourages more investment, more growth and more employment,” Mr Mullen said.

“But I am pretty sceptical about how quickly that happens and how you attribute that with so many other things going on in an economy. Absolutely I would do it, and I would cut personal tax rates as well.”

Mr Mullen said there were more interesting tax issues that needed to be addressed, such as ways to capture the business model used by big tech companies such as Amazon and other large private groups that reinvested all of their profits rather than paying dividends.

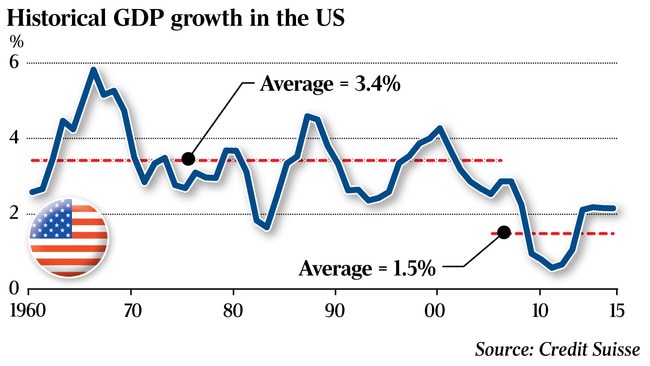

Scott Morrison said Treasury estimated that Australia’s gross domestic product over the next decade would be 1 per cent lower than it would be if Australia were to match the US tax cut.