APRA to shelve controls on interest-only lending as housing market stalls

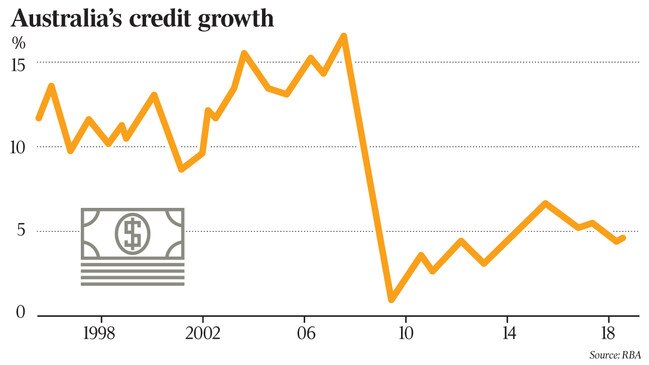

As the housing downturn accelerates, regulators have scrapped limits that have led to a sharp drop in mortgage lending.

The nation’s banking regulator has declared it will scrap limits on banks being able to write interest-only mortgages, as the housing market cools and it looks to avert any threat of a credit crunch.

The lending limits, put in place as a temporary measure in March 2017 as the housing boom was accelerating, have since seen the amount of new interest-only lending stall.

The decision to end the limits was communicated to banks in a letter sent by Australian Prudential Regulation Authority chairman Wayne Byres.

In the letter, made public today, he said: “Since the introduction of the benchmark, the proportion of new interest-only lending has halved, and interest-only lending at high loan-to-valuation ratios (LVR) has also declined markedly.

“In summary, as with the benchmark on investor loan growth, this measure has served its purpose.”

Mr Byres added that the interest-only caps had strengthened the “resilience of individual ADIs (authorised deposit taking institutions) and overall financial system stability”, but also helped to reduce risks that came with high levels of household indebtedness.

Among the four major banks, Westpac has the highest proportion of interest only loans, reporting a figure of 34.8 per cent in its 2018 full-year results. Commonwealth Bank reported 30 per cent of its loans were interest only, with NAB reporting 24.5 per cent and ANZ 22 per cent.

The APRA move comes, however, against the backdrop of falls in house prices of almost 10 per cent in Sydney and steep declines in Melbourne, on the back of a clampdown on lending and the exit of investors from housing market.

“The abandonment of the interest only loan cap is an acknowledgment the housing market is weakening and may threaten the broader economy,” EY managing partner Andrew Price said. “Some would argue that over-regulation was stifling the proper functioning of the housing market, while reducing consumer choice. Investors have vacated the housing market, placing some new developments at considerable risk.”

The UBS economics team led by George Tharenou believed APRA’s move to do away with the 30 per cent cap would not bring the flood of new lending that some may have believed. Well known for being bearish on Australian housing, UBS said the focus on responsible lending brought on by the Hayne royal commission would continue to hold credit in check

“The removal of the interest only cap is unlikely to result in a re-acceleration of housing credit growth in our view,” a note to clients says. “The major banks should continue to tighten underwriting standards as they move towards complying with responsible lending laws (ie verifying customer income and expenses) in response to the royal commission and will result in further reductions to customer maximum borrowing capacity.”

Rates on interest only loans are also unlikely to attract customers, UBS believes.

“The major banks have repriced interest only loans to the extent that they are no longer attractive to customers and have been lending well below the 30 per cent interest only cap since September 2017,” the note says.

At the same time regulators have raised concern that major banks are curtailing their lending too much, which can add downward pressure on house prices if borrowers are knocked back or it takes them longer to secure finance.

In its December board minutes released yesterday, the Reserve Bank of Australia again made public its sentiments about the housing market, including that tighter credit conditions were impeding the supply of mortgages and loans to small business.

The Australian Banking Association said today’s move by APRA would allow banks to offer “more choice” for customers and boost competition among lenders.

“Increased competition across the industry will mean customers have more ability to shop around for the best deal for them when looking at an interest-only home loan,” said association CEO Anna Bligh.

According to comparison site Mozo, there has been a 37 basis point average increase in interest rates on investor, interest-only loans since March 2017. On average they were now 76 basis points above owner-occupied, principal and interest rates.

APRA said the decision to scrap lending limits restricting interest-only loans to 30 per cent of new residential mortgages would take effect from January 1.

The move comes after APRA axed its 10 per cent speed limit on bank lending to property investors in April. At the time APRA said the cap had served its purpose and improved credit standards.

Bank shares rallied this morning in response to the changes. At 10.30am (AEDT) shares in Commonwealth Bank, the nation’s biggest mortgage lender, had jumped 1.9 per cent to $69.92.

Interest-only loans, often used by housing investors, are often regarded as higher risk loans for banks.

When the lending restrictions were first put in place banks sharply raised interest rates on investor and interest-only loans.

APRA said it planned to remove the supervisory benchmark on investor loan growth subject to banks providing certain assurances as to the strength of their lending standards.

“Most (banks) have now provided those assurances,” APRA said today.

“(Banks) that are no longer subject to the investor loan growth benchmark will also no longer be subject to the benchmark on interest-only lending from January 1, 2019.

Mr Byres said: “APRA’s lending benchmarks on investor and interest-only lending were always intended to be temporary.

“Both have now served their purpose of moderating higher risk lending and supporting a gradual strengthening of lending standards across the industry over a number of years.”

Figures released by CoreLogic show housing prices to the end of November fell 8.1 per cent in Sydney and suffered a 5.8 per cent fall in Melbourne.

By the end of the year, CoreLogic expects its national housing index for be 5 per cent below the recent peak.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout