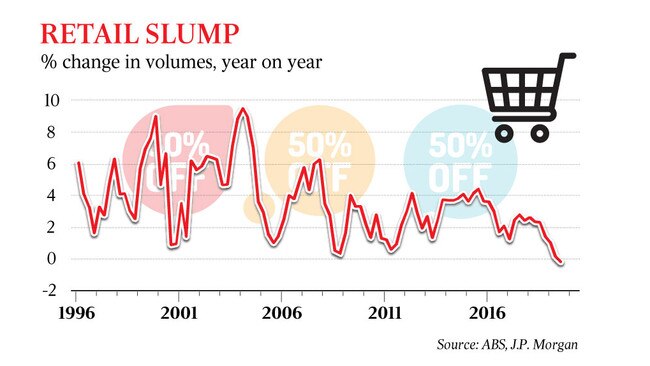

Annual retail turnover falls for first time since 1990s

Official data has confirmed the first annual fall in retail turnover since the early 1990s recession.

The Australian economy received a blow on Monday after official data confirmed the first annual fall in retail turnover since the early 1990s recession.

The 0.1 per cent contraction in real, or after inflation, retail sales over the September quarter brought the annual growth figure to -0.2 per cent — the first annual contraction since 1991, according to seasonally adjusted figures released by the Australian Bureau of Statistics.

The monthly retail sales number, released concurrently by the ABS, also disappointed.

Retail spending growth on a seasonally adjusted basis slowed to 0.2 per cent in September from 0.4 per cent in August and was well below the 0.4 per cent consensus economists forecast.

The figures are likely to reignite debate on whether the economy, and the household sector in particular, requires further help in the form of fiscal or monetary support.

The monthly data confirms that retail spending “shows no real sign of a response to policy stimulus” including the Reserve Bank’s rate cuts in June, July and October, as well as tax relief to some households via the Low and Middle Income Tax Offset, Westpac economist Matthew Hassan said. Mr Hassan calculates that the combined impact of these fiscal and monetary measures amounts to about $3bn a month but said “it looks as if very little is going through” in terms of additional retail spending.

Josh Frydenberg has fended off calls for more stimulus, saying government will “stay the course” on achieving budget surplus.

RBA governor Philip Lowe has said there are signs the economy might have reached a “gentle turning point”, a term he first gave an airing in parliamentary testimony in August.

ANZ head of Australian economics David Plank described the numbers as “really disappointing”.

“We are seeing a turn in the housing market in terms of prices and evidence that building approvals are bottoming, but the retail data suggests the consumer hasn’t joined the turn,” Mr Plank said.

Economists noted that Monday’s retail trade data suggested that consumer spending more widely remained very weak and was likely to weigh on overall economic growth through the quarter.

By segment, a 1 per cent fall in retail volume for cafes, restaurants and takeaway services was the largest drag over the three months to September.

Department store volumes dropped 0.1 per cent.

Household goods retailing growth, however, rebounded to 0.9 per cent, and clothing and footwear increased 0.3 per cent.

Despite Monday’s underwhelming result, the Reserve Bank on Tuesday is widely expected to keep its cash rate target steady at an all-time low of 0.75 per cent.

Financial markets in recent months have slashed the chances of further and deeper easing.

Futures traders price in a 24 per cent probability of a cut by the end of the year.

“We always thought that the RBA would have to do more, and this strengthens that case,” Mr Plank said.

Mr Hassan said there was “clearly a case for more policy stimulus in Australia — the growth backdrop is still weak”.