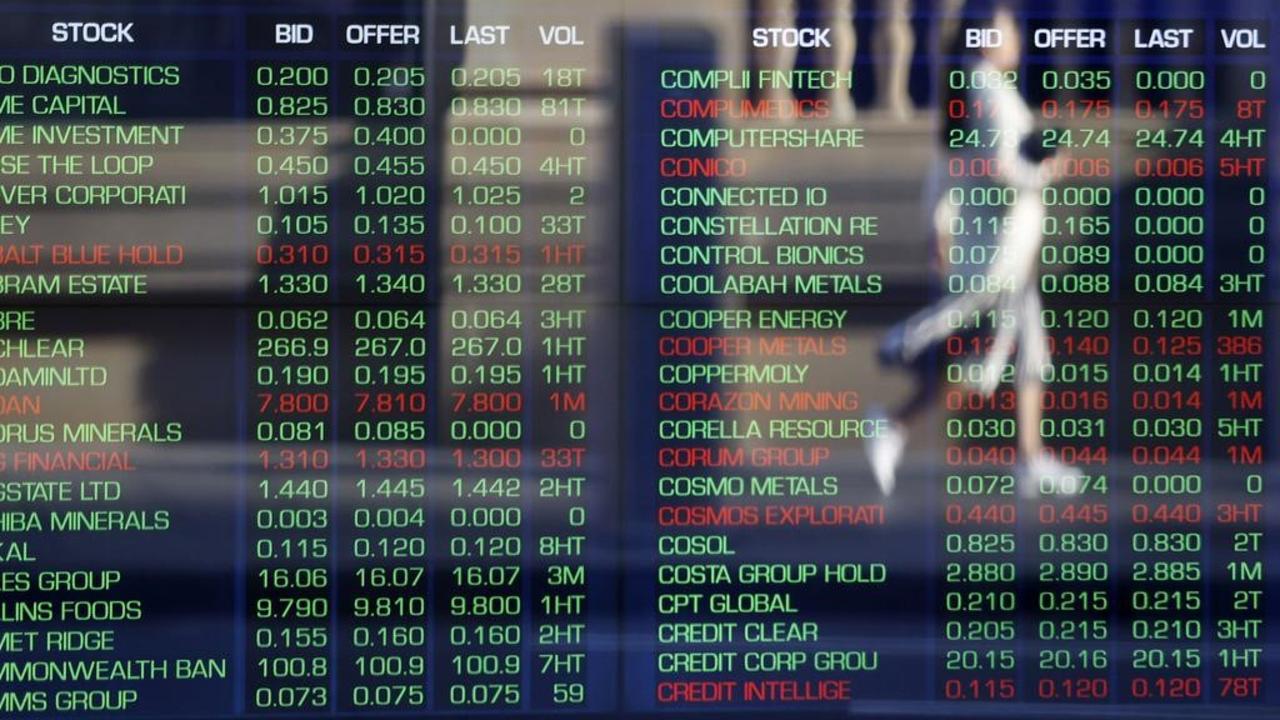

$274bn in bank loans frozen, APRA reveals

Ten per cent of all bank loans in Australia – worth about $274 billion – have now been temporarily frozen.

The dollar value of deferred loans continues to rise as more companies feel the impact of COVID-19, with the lockdown in Victoria likely to lead to more deferrals.

Figures released by the Australian Prudential Regulation Authority showed repayments were frozen on loans worth $274bn at the end of June, or 10 per cent of total loans worth $2.7 trillion.

While this was $8bn higher than the May figure of $266bn, the percentage figure was unchanged at 10 per cent.

Commonwealth Bank chief executive Matt Comyn said on Tuesday that CBA was committed to supporting its customers in their time of need, particularly Victorians who were facing additional challenges from the latest lockdown restrictions.

“We fully appreciate that the circumstances of individual customers can change very quickly, which is why we are focusing very closely on our customers in Victoria during the check-ins we are making at the moment to see what further help we can provide to them,” Mr Comyn said.

CBA, he said, had doubled the number of people in its financial assistance teams over the past few months.

Peter Strong, chief executive of the Council of Small Business Organisations, said APRA’s latest figures were deeply concerning, and urged Victorians to support the local businesses within a five kilometre radius from their homes.

“Even now, almost one in five small businesses have deferred their loans,” Mr Strong said.

“With stage 4 lockdowns in Victoria, this number is likely to climb even further.

“These figures show some small businesses will continue to need critical government support to get through this pandemic.”

Housing loans worth $195bn made up the majority of total loans granted repayment deferrals, although small business loans had a higher incidence of repayment deferral.

About 17 per cent of small business loans worth $55bn were subject to deferral, compared to 11 per cent of housing loans.

Overall, the composition of deferrals was relatively stable, with the most noticeable change being increased loans exiting from deferral, up from $2bn in May to $18bn in June.

The majority of these loans returned to performing status.

The housing risk profile showed that deferred loans were more likely to be extended to owner-occupier borrowers, subject to principal and interest repayments.

In a move aimed at helping households and businesses struggling through the coronavirus crisis, the banks initially allowed borrowers to pause their loan repayments for a period of six months from March, but that was extended by four months.

Last month, APRA deputy chair John Lonsdale urged the banks to engage with affected borrowers before the end of the deferral period, saying that lenders should be encouraging borrowers who can restart repayments to do so.

Reserve Bank governor Philip Lowe said on Tuesday that Australia’s economic recovery was likely to be bumpy, as the central bank left the official cash rate on hold at 0.25 per cent.

“The global economy is experiencing a severe contraction as countries seek to contain the coronavirus,” Dr Lowe said in a statement.

“Even though the worst of this contraction has now passed, the outlook remains highly uncertain.

“The recovery is expected to be only gradual and its shape is dependent on containment of the virus.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout