Dividends, buybacks likely as BHP, Rio Tinto, Comm Bank build up $66.4bn of franking credits

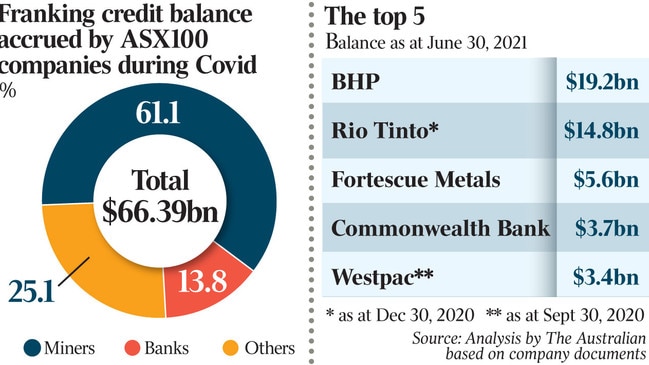

Two main factors have seen Australia’s biggest listed firms amass a staggering $66.4bn of franking credits to pass on to shareholders.

Australia’s biggest listed companies have built up a staggering $66.4bn war chest of franking credits, adding almost $27.2bn since the beginning of the pandemic in early 2020.

The figures come from an analysis by The Australian of financial reports issued by members of the S&P/ASX 100 index, and show Australia’s top listed companies are building up a massive bank of tax credits for shareholders.

It suggests shareholders in major mining and banking stocks are in pole position to cash in on an anticipated dividend and buyback bonanza over the next few years.

Designed to eliminate double-taxation of company dividends, franking credits are generated through the payment of corporate taxes and passed on to shareholders when dividends are paid, allowing them to reduce their own tax liabilities or, in the case of some self-funded retirees that pay little or no income tax, receive a cheque from the federal government to their value.

Those cheques were worth $5.9bn in 2015, according to treasury documents. Whether they should continue was the subject of heated debate during the 2019 federal election campaign as opposition leader Bill Shorten took a policy of ending franking refunds to the polls, arguing it would save the budget $55bn over the next decade.

Treasury documents released in October 2019 estimate the cost to the budget of franking refunds from the 2020-2021 financial year through to the end of the decade will be about $56.8bn – although the recent build up of credits could increase that total.

The incredible $27.2bn build-up over the last two years has been driven by soaring iron ore prices and restrictions put in place by the banking regulator on shareholder returns to shore up the sector’s financial stability through Covid uncertainty.

Australia’s major listed iron ore miners – Rio Tinto, BHP, Fortescue Metals and Mineral Resources – saw their franking credit balance lift by a combined $19.17bn since June 30 2019, representing more than 70 per cent of the net gain made by the entire ASX100.

The big four banks plus Macquarie added $5.53bn to their franking credit balance over the same period, meaning together the banks and miners accounted for more than 90 per cent of the net gain made by the ASX 100.

The miners and banks’ balance represents 75 per cent of the $66.4bn franking credit war chest.

Australia’s top companies added more than $29bn worth of franking credits over the last two years, with 44 of the S&ASX 100 companies adding to their franking credit balance.

And the full figure is likely to be far higher, given Westpac, ANZ and NAB last reported their franking credit balances with their 2020 annual results in November, and Rio’s $14.8bn balance was at December 30.

Only 25 members of the list have reduced their franking credit balance in the period, analysis shows, by a combined $1.9bn.

The surge of additional corporate tax payments that has underpinned the build up of franking credits over the last two years has undoubtedly put a smile on the face of Treasurer Josh Frydenberg, helping offset some the more than $311bn cost of JobKeeper and other Covid-relief measures.

But the franking account balance also sits on the other side of the federal government’s balance sheet, as the cash returns to shareholders with lower tax rates grows.

The treasury refunded about $1.9bn in franking credits in 2006, with the figure more than tripling to $5.9bn in 2015.

While Labor has ditched its franking credit policy under the leadership of Anthony Albanese, tax policy experts say the system still needs reform.

Robert Breunig, director of the Tax and Transfer Policy Institute at the Crawford School of Public Policy at ANU, said the impact on the government’s bottom line would come down to the percentage of shareholders who are taxed at a lower rate than the company rate and are entitled to a refund on the difference.

“The recipients will pay the difference between the corporate tax and their personal tax rate. Some people’s personal tax rate will be below the corporate case, in which case they’ll get a refund,” he said.

He said companies with fat franking credit balances could choose to launch share buybacks to shed their balances.

If they are off-market buybacks, they are often taken up by super and pension funds with lower rates of tax, resulting in higher amounts of franking credit refunds.

“And so for the taxpayer, they end up getting an after-tax return that’s above what they would have gotten had they sold their shares on the market,” he said.

Fund managers expect the franking credit balance at major companies to unwind quickly as the economy opens up after vaccination rates bring about the end of lockdowns.

Michael Price, equity income portfolio manager at Ausbil, said he listed companies were unlikely to sit on their higher franking credit balances.

“We’re pretty bullish on economic recovery and we think growth over the next 12 months will be slightly stronger than people expect, there’s a huge amount of pent up demand,” he said.

“So we think there‘s good growth in dividends, maybe even better than the market’s expecting.”

Mr Price said the banks were keen to return franking credits to shareholders after being constrained by APRA regulations last year, with CBA recently announcing a $6bn off market buyback, and Westpac expected to follow.

However, he said although iron ore miners were doing their best to return franking credits to shareholders through record dividends, they might peel off slightly as the iron ore price declines.

Mr Breunig said the government should move away from the franking credit system and levy a separate flat tax on investment income.

“One reason why other countries have moved away from franking credit systems is that it basically is a tariff on foreign investment, it creates differential treatment between foreign investors and domestic investors.

“The second reason is that if people’s marginal income tax rates are not a good reflection of their true wealth, then maybe giving them a zero tax rate isn’t such a good idea.

“There’s a lot of people who have a zero marginal tax rate but who are multi-millionaires who have lots of wealth, have lots of property, they get lots of income, it’s just all tax free. I think that’s a fundamental problem.”

Franked share dividends are the backbone of income-focused investment portfolios, often underpinned by blue chip shares such as banks or supermarket stocks.

Shareholders use franking credits to reduce their tax liabilities. For retirees, if the value of their credits exceed their tax liabilities the excess amount can be claimed as a cash refund.

Advisers estimate that for a self-funded retiree with a share portfolio worth about $200,000, the cash payment from franking credits might run to between $4000 and $5000 a year.