Australian women’s fashion label Blue Illusion is believed to have been placed on the market, with better industry conditions thought to be also fuelling sale plans for its competitors.

It is understood that working on the divestment is boutique advisory firm CDI Global.

Prospective buyers have already been approached and are understood to be in the process of signing nondisclosure agreements before receiving an information memorandum.

The business, owned and run by Donna Guest, who founded the operation in Melbourne in 1998 with her late husband Danny, has more than 100 stores throughout Australia and New Zealand.

It describes itself as “a French-inspired brand dedicated to the modern woman’s pursuit of curated personal style”.

French actress Juliette Binoche, who has starred in films such as Chocolat and The English Patient, was the brand ambassador for Blue Illusion during 2014 and 2015.

Market analysts expect the business to sell for tens of millions of dollars.

The understanding is that it was set to hit the market early last year but the sale plans were paused after the market was hit by the pandemic.

It comes amid talk in the market that other apparel retailers are now testing the market for interest, while QBD Books, which has a dominant presence in the Queensland market, is also for sale.

The book retailer describes itself as Australia’s largest Australian owned and operated book retailer with 76 stores.

There is persistent chatter about whether Marshall Investments will sell its Apparel Group, which owns brands Saba, Sportscraft and Jag.

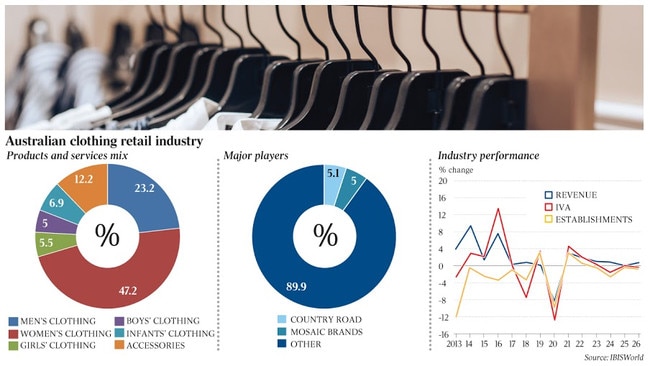

Reporting season has shown apparel retailers appear to have turned the corner after a tough time during the pandemic with Mosaic Brands reporting a lift in its half-year profit on Wednesday, along with Athlete’s Foot owner Accent Group and City Chic Collective.

It may bode well for apparel retailer Best & Less which has been embarking on an initial public offering through Macquarie Capital.

One of the major talking points in the apparel market right now, though, centres on the plans for industry heavyweight, fast-fashion retailer Cotton On.

There have been suggestions in the market that the company’s owners have been holding discussions with advisers, with industry insiders predicting that they will likely look to take some money off the table in the next few years.

A signal that a sale or float could be on the agenda for the massive retailer is that it appears to have paused its global expansion and is now consolidating.

Cotton On, founded by Geelong billionaire Nigel Austin, has also started releasing more detail about its financial performance and has recently been raising its profile by entering retail awards globally.

Following the scaling back of its major global rival H&M in the Australian market recently, some believe that the fast-fashion market in which it operates may have seen its best days.

For the year to June 24, it generated earnings before interest, tax, depreciation and amortisation of about $295m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout