Whitehaven Coal is believed to be circling the Olive Downs mining project that Denham Capital holds through its interests in Pembroke Resources.

A stake of between 25 per cent and 35 per cent is on the market through investment bank UBS, prompting various parties to eye the asset.

The project is believed to be worth more than $1bn and it remains unclear if Whitehaven is eager to buy a stake in Olive Downs or the project as a whole.

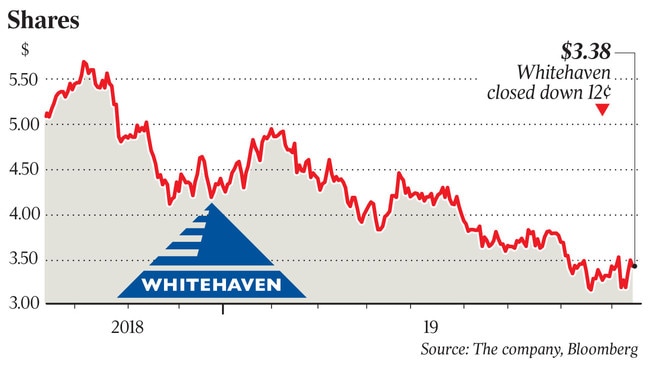

The $3.59bn listed Whitehaven is understood to have an appetite for acquiring quality assets. It was among the line-up of buyers for Rio Tinto’s coal mines that were up for sale last year through Credit Suisse.

At that time, JPMorgan and Deutsche Bank worked on the transaction.

The understanding is Pembroke’s preference is to offload the interest to one of its customers, likely to be from China or Korea, rather than a competitor. But time will tell how the sales process unfolds. It is understood to have been launched about one month ago.

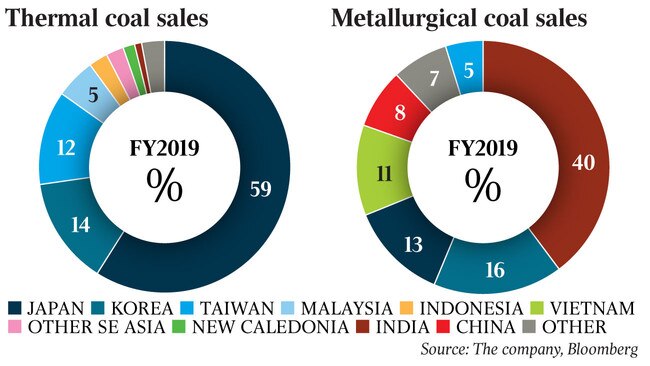

Olive Downs in Queensland’s Bowen Basin is a coking coal project being developed into a world class, large scale producer of metallurgical coal to sell to key markets including Japan, South Korea, China and India.

The first stage of the project needed $450m of investment and will produce 4.5 million tonnes per annum of steelmaking coal, which will be exported through the Dalrymple Bay Coal Terminal.

Thermal coal has recently rebounded after trending lower as the price of coking coal has remained steady.

Whitehaven counts hedge fund Farallon Capital as its largest investor with a 14 per cent interest, according to Bloomberg data. It also has AMCI billionaire founder Hans Mende as an 11 per cent shareholder. Its other founder, Fritz Kundrun, holds 12 per cent. For the 2019 financial year, Whitehaven posted a slight lift in its net profit to $527.9m.

The Olive Downs sale is happening ahead of an anticipated divestment by BHP Billiton of its Mount Arthur thermal coal mining operation in NSW and the 33 per cent interest in its long-life Colombian mine, Cerrejon.

Macquarie Capital is currently undertaking a scoping study for BHP while JPMorgan is understood to be working on a possible sale of the operations, which could be worth an estimated $4bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout