Westpac is understood to be selling its $600m equipment finance book in a move that is likely to further fuel buying activity by private equity firms in the Australian finance space.

The book of loans was bought by Westpac from former HBOS subsidiary Bankwest at the same time that it acquired its car finance and auto loans business.

Westpac’s auto and equipment loan book and car loans were supposed to be for sale last year when it was earmarked for an initial public offering.

It was expected to amount to a $4.9bn business with $15bn of assets, including $7bn of car loans provided through the consumer bank and separately categorised equipment and auto loans worth $8bn. But now it is understood Westpac has opted to sell the equipment finance book separately and retain the car and auto loans business, probably through Morgan Stanley, which was last year working on the IPO.

The logic for the bank to offload the assets is thought to be that the loan book is too small and capital-intensive for Westpac and cannot be supported in terms of the bank’s IT systems. The loans are also mainly introduced to the bank through brokers.

Private-equity firms are tipped as the most likely buyer, including Affinity Equity Partners, which last year bought Australian-listed equipment financier Scottish Pacific.

Eclipx could have been a suitor before its share price crashed on the back of profit downgrades, prompting the group to embark on asset sales.

Pepper Group, owned by Kohlberg Kravis Roberts, may be interested, and Cerberus Capital Management, which recently bought equipment financier Axsesstoday, may be a contender.

Another possible buyer is Next Capital — Scottish Pacific’s former owner — which is trying to buy kitchen equipment financing business Silver Chef.

Next Capital this week sweetened a recent proposal that was set to be blocked by shareholders.

Private equity is circling the space at a time when a number of equipment loan books are on offer due to small lenders striking challenges from rapid growth, and the hope is to swallow the assets at opportunistic prices.

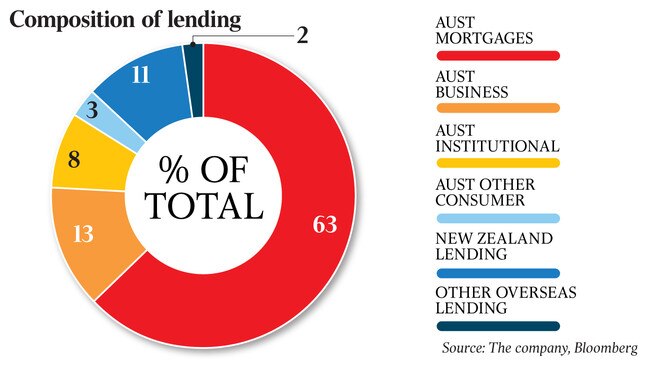

Australia’s top-four banks are likely to sell more non-core assets as they move to streamline their operations and narrow their focus more towards mortgages on the back of more regulation expected due to the royal commission, which may offer buyout funds more opportunities.

ANZ is thought to remain eager to sell its UDC equipment finance business in New Zealand, although new capital requirements being introduced by the Royal Bank of New Zealand could be more onerous on UDC and, by reducing its return on equity, it could make the division a tougher sell.

Meanwhile, the sale of Westpac’s auto loans last year was held up by the need to put the business onto a separate IT platform and that now is expected to be delayed. This is due to new laws coming into force in June in which it will be illegal for dealership staff to offer car loans without a licence, following the royal commission into the financial industry.

Earlier this year, Westpac CEO Brian Hartzer told The Australian he wanted to maintain a dominant position in car dealership finance, but would be keeping the door slightly ajar for exiting should mooted regulatory changes up-end the industry.

Westpac and other lenders came under fire during the royal commission for charging higher interest rates to borrowers who often could not meet repayments.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout