Westpac is believed to be weighing a move to sell up to $50bn worth of superannuation assets separately to its BT wealth management platform in a deal expected to reap hundreds of millions of dollars in proceeds for the bank.

Private equity sources say Westpac has been sounding out buyer interest for commercial and retail superannuation assets worth between $30bn and $50bn as it remains in talks with investment bankers about asset sale options.

However, sources close to Westpac say a decision is yet to be made as to whether the bank would fire the starting gun on a sale that was separate from its BT wealth management business, with one option still being that it could be part of the same offering.

The understanding is that private equity groups are being targeted as buyers for the super assets and a separate sale is under consideration.

Westpac manages several superannuation fund assets under brands Asguard and BT.

They sit within Westpac’s recently formed Specialist Businesses unit overseen by Jason Yetton.

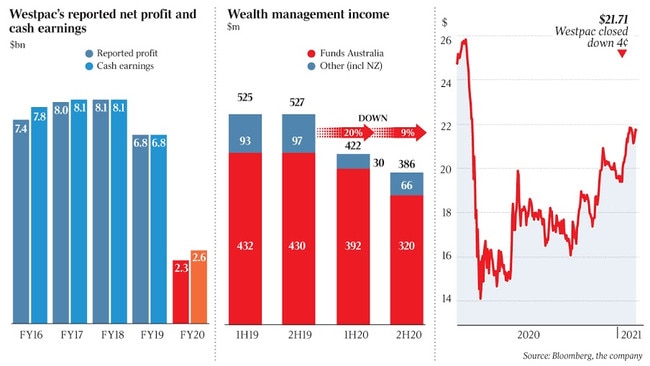

Westpac last year started moving forward on plans to sell more than $4bn worth of non-core wealth assets, as the bank focuses on mainstream banking and returns funds to its core operations amid the challenging COVID-19 environment.

Operations identified as non-core for the bank are its dealer finance and auto loans portfolio and its BT Panorama wealth management operation, which is expected to shortly be placed up for sale, estimated to be worth between $700m and $1bn.

Westpac, with its Panorama wealth management platform, is the largest platform provider in Australia.

It has a 19 per cent market share and started a price war in 2018 by lowering its platform pricing.

Also included was its Pacific Bank, which was sold to Kina Securities for $420m, and its general insurance division was offloaded late last year to Allianz for $725m.

It also offloaded its vendor finance business last year to Cerberus Capital Management.

The talk about Westpac’s wealth assets comes as a sale process for its auto loans portfolio is said to be imminent.

On offer is understood to be about $11bn worth of auto loans.

The business writes about $5bn annually, with about 90 per cent of the loans for new car sales, while some are wholesale loans for dealers.

The thinking is that only global groups of significant size would be in a position to buy the portfolio, which is considered too large for Australian lenders such as Bank of Queensland, with about $1.5bn of capital probably needed to fund an acquisition.