Analysts have thrown their support behind Aristocrat Leisure’s $3.9bn buyout of British-based gambling software and content supplier Playtech, which offers an opportunity to capitalise on the lucrative online market.

Aristocrat, founded by Australian billionaire Len Ainsworth and one of the world‘s largest gambling machine companies, has signalled to the market for some time it planned to embark on a major acquisition, so the deal was no big surprise to the market on Monday.

It is its largest acquisition, with deals to buy businesses earlier including Big Fish in 2018 for $US990m, Plarium for $US550m the year before, VGT for $US1.3bn in 2014 and Product Madness in 2012 for $US22m.

The gambling market is currently booming amid the global pandemic and Aristocrat is capitalising on its soaring share price by funding the deal partly through a $1.3bn entitlement offer handled by advisers Goldman Sachs and UBS.

Aristocrat has a lot of poker machine content and Playtech, which offers services not just business-to-business but business-to-consumer, will offer distribution channels.

The Australian listed Aristocrat, with a $29bn market value, has only a small position in the so-called “ilottery” market.

It is the third time this year that Aristocrat has looked at the business, which offered some comfort to analysts on Monday on the price it is paying.

Shares on Monday were being sold in its entitlement offer at $41.85 each after the stock closed on Friday at $45.79.

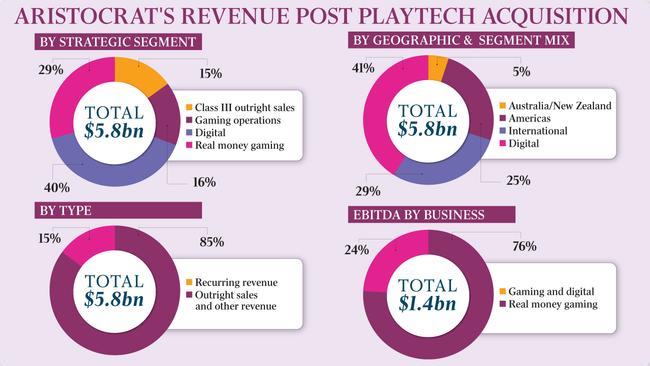

The deal comes as Aristocrat says it expects net profit after tax and amortisation to be $864m for 2021.

Including debt, the price being paid is $5bn.

The price is a 58 per cent premium to Playtech’s last closing price on the London Stock Exchange at 11.4 times adjusted earnings before interest, tax, depreciation and amortisation for the year to June.

Playtech’s board has recommended the offer and Aristocrat has undertakings from shareholders holding 20.7 per cent of the stock to vote in favour of the transaction.

Aristocrat will also use debt from the Term Loan B market to fund the buyout.

Playtech is one of the world’s largest online software gambling suppliers developing platforms and content for the gambling industry operating from 24 countries.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout