Takeover talks between Vocus Group and EQT Infrastructure are understood to have collapsed because the private equity firm wanted to lower the price from the $3.3 billion it initially offered for the listed telco.

It is believed that just days into EQT’s due diligence on Vocus, the private equity firm wanted to revise its offer down to around $5 per share.

This is said to be the reason the deal collapsed, rather than due to any problem identified in the Vocus business.

EQT was granted due diligence on the basis that it was planning to pay $5.25 per share for Vocus, reflecting a market value of about $3.3bn.

Many in the market questioned how EQT could justify a bid as high as $5.25 in the first place, but they believed it was real given that the Swedish private equity firm now counts Ken Wong in its ranks.

Mr Wong previously worked for Affinity Equity Partners when it bid for Vocus a few years ago then walked away from the target. It means he would be familiar with the business.

On that basis some in the market say it is a surprise that EQT Infrastructure would change its pricing on the Vocus bid.

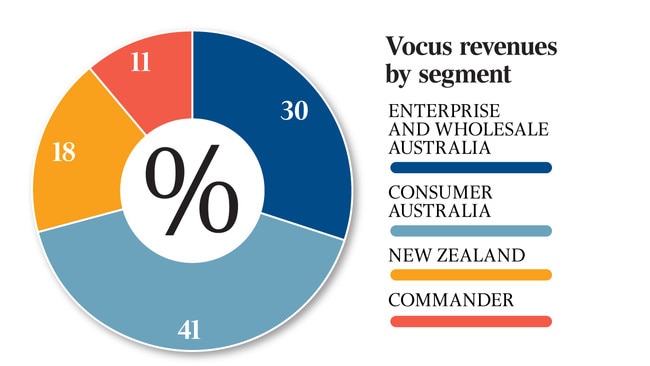

The plan by EQT was to pay for the Vocus acquisition by selling off its consumer assets. Yet there have been doubts in the market that strong buyer interest would exist for the consumer business, so perhaps the private equity firm revised its pricing lower on the realisation that a buyer would be hard to come by.

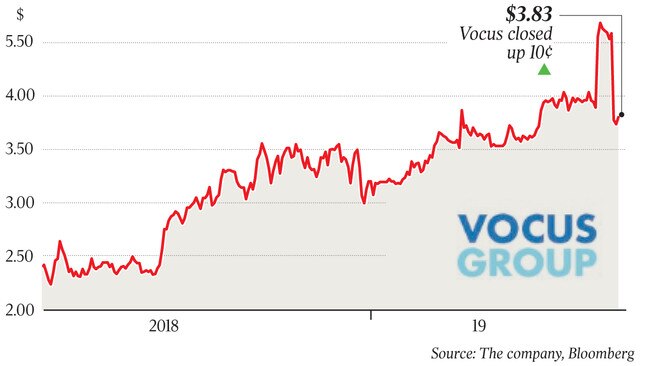

Shares in Vocus on Friday closed at $3.81 and, apparently, the company’s view is that the stock price will likely hit $4 in the near term, particularly after the transformation of the consumer division undertaken by new chief executive Kevin Russell is completed.

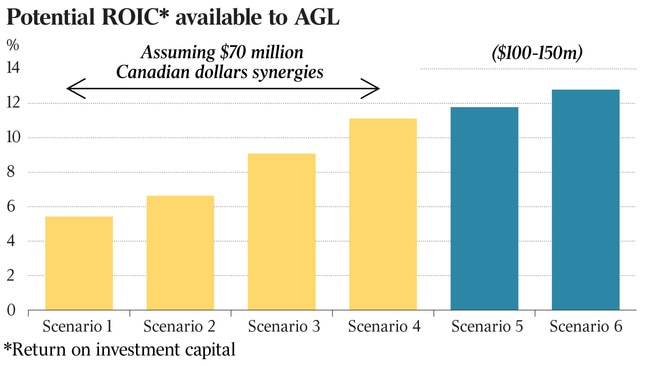

Now all eyes are on AGL Energy, which had earlier offered around $4.80 per share for Vocus.

Should the listed energy retailer return to the negotiating table, the understanding is that it would be unable to pay a price higher than $4.80.

One of its terms is also said to be that it is granted exclusive due diligence.

Yet it would likely be eager to return with another bid, given the synergies between the companies are said to be material.

Other parties that were thought to be circling Vocus include Affinity Equity Partners and Kohlberg Kravis Roberts, which both bid $2.2bn for the business in 2017 when it faced challenges integrating its operations.

However, both are understood to be no longer interested.

Shareholders are upbeat about the company’s prospects and so are not expected to place pressure on Vocus management to accept an offer for the group at any price.

Should shares hit $4, the thinking is that a bid of about $5 would be needed to see any deal proceed.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout