The chief executive and chairman of the Australian and New Zealand listed Spark have been spotted on this side of the Tasman in recent days, prompting questions about the future of the Kiwi telecommunications company.

With the share price of the $5bn company falling from $5 highs in recent months to less than $3, some believe investors are growing weary about over-leveraged telcos, with Spark being no exception.

Some comparisons can be drawn with the Australian-listed TPG Telecom.

TPG’s share price fell more than 4 per cent on Monday, even after announcing what should be good news in that it had sold its fibre network infrastructure assets for $5.25bn to the Macquarie Asset Management-backed Vocus Group.

The understanding with the deal is it was in fact TPG that had approached Vocus to revive talks earlier in the year after the pair could not reach an agreement over negotiations in 2023.

TPG has $4.2bn of gross bank debt, more than $2bn of which is due to be refinanced in the 2026 financial year, so it came from a position of weakness in terms of negotiating terms.

Both Spark and TPG Telecom have already sold off their mobile phone towers, and received plenty of cash for the assets.

Spark divested 70 per cent of its telecommunication towers to the Ontario Teachers Pension Plan Board for $NZ900m ($814m) in 2022 while Canada’s OMERs bought TPG’s towers for $950m in the same year.

However, they now have a new set of lease liabilities to those owners.

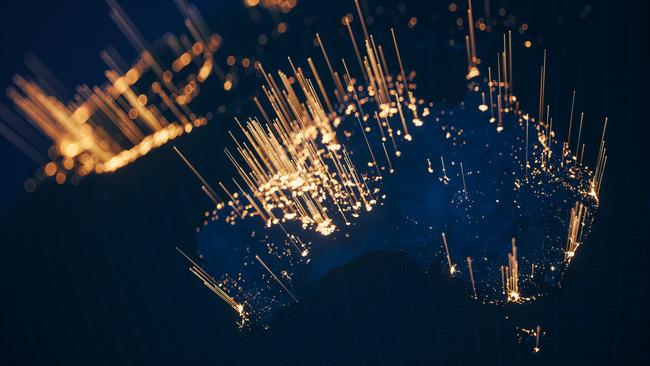

Spark’s net debt at June 30 was $NZ1.6bn. With that, there’s chatter that Spark – the equivalent to Telstra in New Zealand as the country’s biggest telco – could be next to sell down fibre assets to raise funds, because it will need the cash.

Spark, run by Jolie Hodson and chaired by Justine Smyth, is thought to be close to UBS and Macquarie, while Jarden and Forsyth Barr advised on its last asset sale.

Meanwhile, as part of the TPG Telecom asset sale, Vocus, owned by Macquarie and Aware Super, will buy TPG’s fibre network infrastructure assets and Enterprise, Government and Wholesale fixed business, including its Vision Network business, which connects new homes to the internet.

Working for Vocus was Macquarie and UBS, while TPG was advised by Bank of America.

TPG will retain its mobile infrastructure and business, along with its consumer and small office home fixed retail business including its fixed wireless assets.

TPG will lease back the fixed network services from Vocus.

One view is that the deal was recut at a lower price, but there’s an argument it’s difficult to assess due to the higher interest rates since the first negotiations last year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout