Real estate bankers at UBS are believed to be testing interest in the property market about a sale or spin-off of the Sydney-based Moorebank Logistics Park.

Some are suggesting it could soon be subject to a sale or private trust worth up to $1.5 billion.

While some say that a listed spin-off could also be considered, sources close to the company have played down the likelihood of that plan.

Others in the market say that a private sale is the most likely outcome, although a capital partner could be sought, while debt funding may also be an option.

The move comes at a time that property trusts are in soaring demand amid a low interest rate environment.

The yet-to-be-completed Moorebank Intermodal facility is valued at up to $2 billion and is the largest in the country, covering 243ha.

Moorebank Logistics Park is being developed on a precinct comprising of land owned by the Commonwealth of Australia and adjacent land owned by Qube.

The precinct has the capacity to transport up to 1.05 million twenty foot equivalent units a year of Import–Export freight and another 0.5 million Twenty-Foot Equivalent Units of interstate freight a year.

Moorebank Logistics Park will have 850,000sq m of high specification warehousing, as well as auxiliary services including retail and service offerings.

A rail connection to the Southern Sydney Freight Line is being constructed which has direct access to the site, while the M5 and M7 arterial roads are only minutes away, providing a complete supply chain solution driving savings in time and costs for onsite tenants.

Among the listed property groups that have been active in the market are parties such as Dexus Property Group and Charter Hall while buyout funds such as Brookfield and Blackstone are major Australian retail investors as well as global and local pension funds and sovereign wealth funds.

Qube describes itself as Australia’s largest integrated provider of import and export logistic services, with more than 6500 employees at 130 locations across Australia.

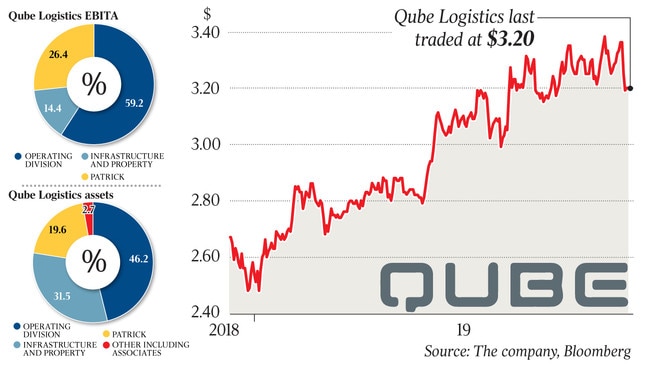

It owns half of Patrick Terminals, Australia’s leading container terminal operator.

Last year, it purchased the logistics company Chalmers for about $60m.

It has a market value of $5.2bn and for the 2019 financial year, it posted a 15.4 per cent lift in underlying net profit to $123.2m.

Qube is not the only listed corporate to capitalise on the current soaring demand for real estate.

Caltex is planning to embark on a $1bn property float made up of a half-stake in 250 of its retail sites.

However, the company is currently subject to a takeover bid by Couche-Tard that is based on the condition that the initial public offering does not proceed.