Energy giant Santos is thought to be moving further down the track towards a selldown of about $5bn worth of infrastructure assets attached to its oil and gas projects, with at least one investment bank said to be in pole position to land an official mandate.

Chief executive Kevin Gallagher has made no secret of his aspirations to weigh a spin-off of the infrastructure.

Sources say investment bankers at UBS have been busy for the $16bn Australian-listed oil and gas producer and it is the infrastructure spin-off that has their attention.

UBS advised Santos when it bought Quadrant Energy from shareholders including Macquarie Group and Brookfield for $2.9bn in 2018.

Market experts estimate the infrastructure assets for the Santos oil and gas business could be worth about $5bn collectively.

This includes infrastructure assets from its Quadrant Energy business in Western Australia, which some suspect is worth about $2bn, its Barossa project in the Northern Territory, worth about $1bn, and its 30 per cent stake in the Gladstone LNG project in Queensland, about $2bn.

It comes at a time infrastructure funds are awash with cash amid a low interest rate environment and in search of low-risk spending opportunities.

Lately, much attention has been turned towards the renewable energy space, with Banpu Energy confirmed as the $288m buyer of New Energy Solar’s Australian assets on Monday, as first tipped by DataRoom.

However, strong demand is still expected to exist for the Santos assets.

Last year, Global Infrastructure Partners agreed to spend $US2.5bn for a 26.25 per cent stake of the infrastructure in Shell’s QCLNG project.

The understanding is Santos would be eager to retain about 20 per cent of the infrastructure and operating control of the assets.

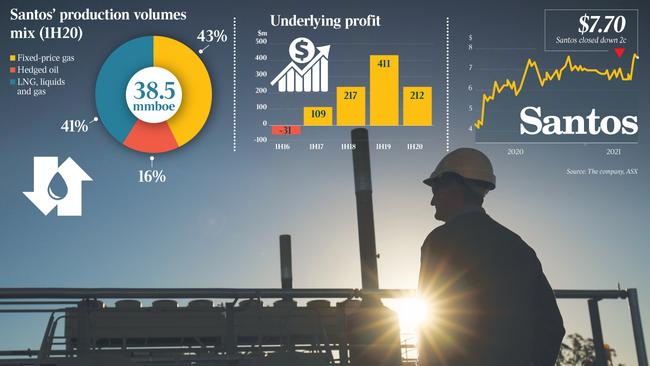

At its investor day in December, Mr Gallagher outlined plans to separate the infrastructure from its oil and gas assets in its accounts and attribute about $400m worth of annual revenue to those assets.

He told investors Santos would not rush into any sale of assets, but the preparations would offer the company the option further down the track.

The value of assets depends on the tolling agreement Santos strikes with any buyer.

At that time, the company was said to be in preparation mode for packaging up the assets, with a sale about 12-24 months away.

Santos is also looking to sell down a minority stake in its Dorado project in Western Australia, with Goldman Sachs on board for that process.

Goldman’s is understood to have received indicative bids in the past two weeks from a select group of buyers, thought to be most likely out of Asia.

Also on offer is the opportunity to buy into its WA-based Van Gogh and Pyrenees projects. A deal could see a suitor invest about $1bn in Dorado

No doubt, the activities of Santos and other major oil and gas players will be widely discussed when the industry meets in Perth next week for the annual conference run by the Australian Petroleum Production & Exploration Association.

The other company being closely watched for a potential demerger or sale of assets is Origin Energy, with sources suggesting UBS could also be working with that company for a possible break-up plan.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout