Special situation funds Oaktree Capital Management, Anchorage Capital Group, The Carlyle Group and Apollo Global Management are believed to be in TerraCom’s data room for a potential refinancing of the Australian-listed coal miner.

The resources company chaired by Wal King — the former boss of Leighton Holdings (now called CIMIC) — has operating assets in Australia and South Africa and is looking to refinance debt worth $220m ahead of its repayment deadline next June.

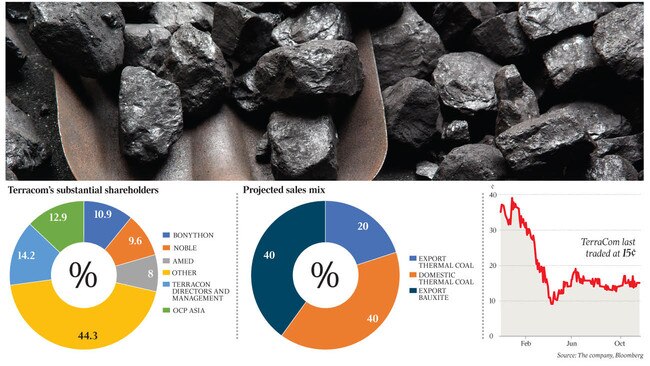

Current lenders include OCP Asia and Hong Kong-based commodity trader Noble Group Holdings.

It is understood that OCP is prepared to remain a lender, committing $80m towards the debt refinance, but Noble has challenges elsewhere.

Noble has been buying back debt on some of its investments, according to market sources.

The company was embroiled in an accounting fraud case in 2015 that eventually led to a restructuring.

TerraCom’s main Australian asset is the Blair Athol Coal Mine in central Queensland, which is considered a strong performer in the sector, given that the mine has the lowest production costs in the country.

The mine produces 2.7 million tonnes per annum of high quality thermal coal that is exported to markets including Japan and Korea.

TerraCom also purchased Universal Coal in South Africa in the past year, which holds a portfolio of producing, development and exploration assets across South Africa’s major coal fields.

Special situation funds are closing in on lending opportunities in the coal space as traditional banks shy away from the sector due to environmental concerns surrounding coal.

However, some believe that the coal price will stage an uplift in 2021.

Oaktree has recently purchased debt for 71c in the dollar in the Western Australia-based Bluewaters Power Station after its lending syndicate offloaded loans in the coal-fired asset.

The Los Angeles-based fund is also considering a recapitalisation of the food and milk product producer Freedom Foods, along with Anchorage Capital Group and Sixth Street Partners — the fund that until recently was part of the US-based private equity firm TPG Capital.

TPG continues to hold a small investment in the business.

Advising TerraCom is a former lead portfolio manager for UBS Asset Management, Christian Baylis, who has recently launched the boutique fund manager Fortlake Asset Management, backed by wealthy investor Alex Waislitz.

The fund manager is seeded by $150m worth of funds and is embarking on a fundraising exercise as it targets fixed income and real returns investments for wholesale and retail clients.

Sub advisers to TerraCom include Skye Capital Advisory and KPMG.

It is understood that TerraCom has aspirations to expand into the nickel market once its refinancing is finalised – likely by the end of this month.

It is also looking at a bauxite mine in Guinea.

At the end of June 30, TerraCom had a $97m market value with $US163.6m of debt and $US41.6m of cash.

It generated $4.1m of net profit for the 2020 financial year, as the thermal coal price came under pressure.