Village Roadshow’s board is likely to be on tenterhooks until Tuesday evening when an exclusivity period it has with BGH Capital to buy the theme park and cinema chain operator expires.

BGH had earlier agreed to pay up to $468.5m for the company, or as much as $2.40 a share.

But playing out in the background has been a new deal struck by Universal with cinema chain AMC in which movies are released on big screens for 17 days instead of 75 days before they are offered to streaming services, with box-office hits the exception.

The new agreement is expected to flow on to similar deals internationally to reap sales from housebound consumers and with other major film studios.

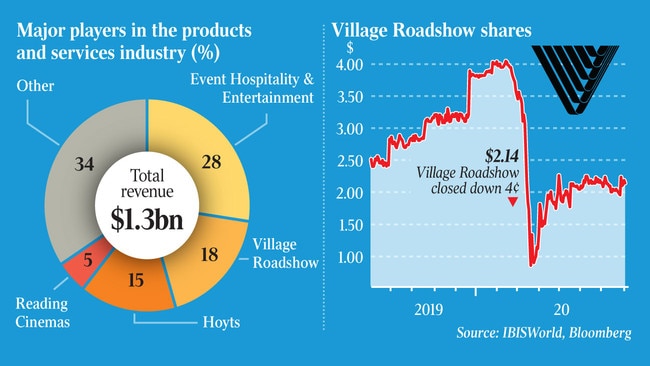

Village Roadshow is one of Australia’s largest cinema operators and, with joint venture partner Event Hospitality & Entertainment, has nearly 600 screens across 58 sites across all Australian states.

Some say last week the transaction was all but done, with BGH Capital awaiting only the finalisation of financing.

While the cinema operations appear challenging, facing COVID-19 trading restrictions and digital disruption, the thinking is that the real drawcard for BGH is Village Roadshow’s theme parks, including Sea World, Wet’n’Wild and Warner Bros Movie World, which generate large levels of cashflow in normal times.

Still, conditions for the cinema industry have been getting worse by the day, with few movies being released and box-office sales at about 15 per cent the level they were a year ago.

In a research note on Event Hospitality & Entertainment released by analysts at Citi, it said the risks from the new AMC deal to reduce the theatrical window were “too big to ignore”.

However, the analysts said cinemas typically generated 52 per cent to 72 per cent of box-office collections within the first three weekends of release.

As of last week, about 80 per cent of cinemas were open, but restrictions exist on entry levels and many people are staying away over health concerns.

Waiting in the wings should the BGH deal fall over is believed to be BGH’s rival Pacific Equity Partners, which earlier put forward a takeover proposal and still has some voting rights.

The understanding is that the backers of the 40 per cent shareholder Village Roadshow Corporation, Graham Burke and Robert Kirby, are eager for a deal to proceed.

But as reported by The Australian, Mittleman Brothers, with a holding of about 8.5 per cent, has expressed disapproval about the mooted price of the transaction.

The terms of BGH’s offer was that it could be sweetened from a base $2.20 a share, with another 20c a share paid if the theme parks and most cinemas have reopened three business days ahead of the deal being voted on.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout