As NAB closes in on Citi’s $2bn Australia and New Zealand banking business, some are wondering what it will mean for rival ANZ.

Analysts says NAB and ANZ need to build scale in their residential mortgage businesses to compete with Westpac and CBA, which both gained market share through acquisitions during the GFC. Westpac purchased St George in 2008 for $18.6bn, while CBA bought Bankwest for $2.1bn.

Both deals gained clearance from the competition regulator because of concern about the health of banks during the global credit crunch.

But now some think that if NAB buys Citi and other banks bulk up, the ACCC’s patience may wear out and it may object to further industry concentration. This puts pressure on ANZ to do a major deal sooner rather than later.

While ANZ is said to have looked at ME Bank, which was sold to Bank of Queensland, and AMP’s bank in the past year, the latest to come into focus is Suncorp, with some wondering whether ANZ is rekindling its interest in the banking division of the Queensland lender.

ANZ could partner with Allianz or Zurich to take on the insurance arm while it buys the banking division.

The challenge is that Suncorp boss Steve Johnston is unlikely to be a seller, leaving the success of an agreed deal largely dependent on chairman Christine McLoughlin.

Some Suncorp shareholders earlier lobbied for a sale of the bank in an effort to see the group trade on a more lucrative multiple, in line with other insurers.

Apparently ANZ made an opportunistic offer for Suncorp’s bank about two years ago, when it was chaired by David Gonski, at about 0.6 times book value.

Interestingly, Gonski chairs recently formed investment bank Barrenjoey Capital Partners, which now advises Suncorp.

ANZ was also interested in buying Suncorp’s bank in 2009 when the then boss of the Queensland bank, Patrick Snowball, was quoted as saying his “polite message to those who seek to target us is: ‘get your tanks off our lawn’.’’

Various hurdles would exist for ANZ to buy the business, one being legislation that requires the headquarters of Suncorp’s bank to be in Queensland, not to mention regulatory challenges.

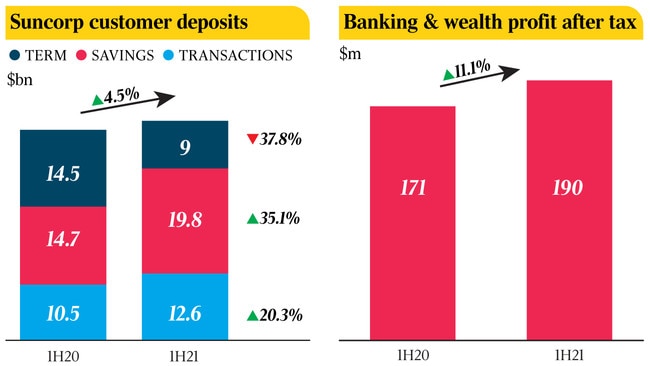

Suncorp reports its results this week, so it will be interesting to see if merger and acquisition activity remains a focus.

Buying Suncorp would solve a problem for ANZ, which has a low proportion of its mortgage business in Queensland.

AMP’s bank also cannot be ruled out as a target.

ANZ’s former CFO Michelle Jablko was previously AMP’s defence adviser while working in investment banking, and former ANZ deputy CEO Alexis George has now been hired to run AMP.

But the Suncorp option would be more attractive. ANZ also has a AAA credit rating compared to Suncorp’s A rating, so it can offer a cheaper cost of capital.

A deal could also reduce ANZ’s exposure to New Zealand.