Stocks to win from budget capex measures

Companies in the waste management, infrastructure, retail, utilities and potentially the telecom sectors are set to benefit from the budget’s capital expenditure measures, according to analysts at Macquarie.

In this month’s federal budget, the government introduced numerous capex measures for the next two financial years, such as the full expensing of capital assets acquired from October 6 and installed before June 2022, a tax loss carry-back scheme, and other incentives.

In a note, analysts at Macquarie said the companies that will benefit the most for these measures are the ones that are capital intensive, have a high share of domestic assets, have longer duration assets, a strong balance sheet and recently paid cash taxes that could be “returned if full expensing causes a tax loss in FY21 or FY22.

Given this criteria, the analysts believe the largest beneficiaries are likely to be listed infrastructure companies such as AusNet Services, Spark Infrastructure Group, APA Group and Aurizon Holdings.

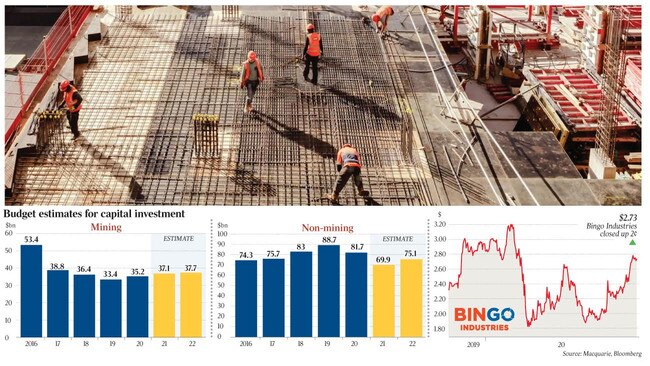

They also believe that some waste management companies like Bingo and Cleanaway to reap the benefits, as well as some specific stocks like Mineral Resources, Adbri and Sealink Travel Group.

“As flagged at the FY20 result, SLK’s (Sealink Travel Group) FY21 capex guidance for Australia was $41m, with $28m for 72 buses and $13m for 3 vessels,” the analysts wrote.

“To the extent eligible, SLK is a natural candidate to potentially utilise the Budget’s capex incentives by bringing some capex forward for both Tourism & Marine and Australian bus.”

On a more micro level, the capex the measures will inspire in smaller businesses will flow-on to retailers of computers, cars, tools and office equipment.

The analysts fingered Wesfarmers, JB-Hi-F, Harvey Norman, Eagers Automotive and ARB Corp as listed companies that would benefit from a small business capex bonanza.

The analysts also said that as capex measures only apply to companies with annual revenue under $5bn, telecom and utility players like Telstra, TPG and AGL Energy would miss out unless the cap was removed.

ABS Capital expenditure data for the next two quarters is set to be released on November 26 and then February 26.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout