The Australian operations of the dessert company Sara Lee have recently been doing the rounds among prospective buyers, and it is understood that one of the companies that has been targeted as a possible acquirer has been iconic Australian fruit and vegetable processor SPC.

SPC was purchased from Coca-Cola Amatil last year by Sydney-based private equity firms Perpetuity Capital, run by Hussein Fifai, and The Eights, under by Nithan Thiru.

It is understood that SPC has been sounded out as a potential buyer of the business. However, while it may be officially in the contest, the recent purchase by its owner of the controlling stake in prepared foods company Kuisine Group means they are unlikely buyers right now as they bed down that acquisition.

However, if the business is still available in the months ahead, then SPC is expected to return to the negotiating table with Sara Lee’s owner McCain Foods, given that the company would be such a strong strategic fit.

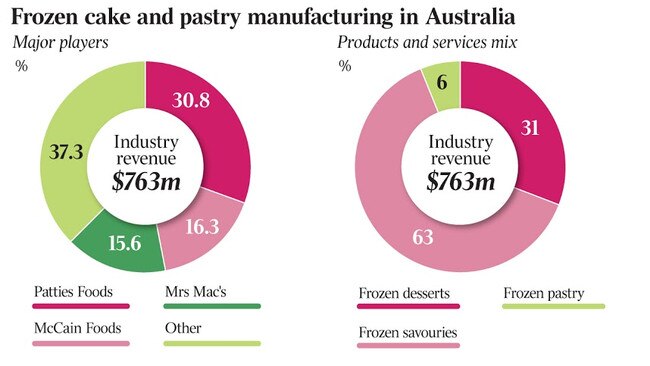

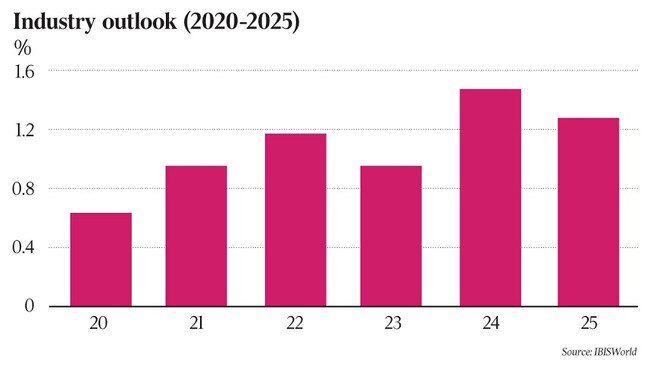

As reported by The Australian last month, SPC had been eager to move into the frozen food space. Sara Lee, which makes most of its revenue from desserts and some from the sale of premium ice cream, has been on the market through Rothschild after it tried to find a buyer a few years ago through KPMG.

Its products include pies and crumbles, cheesecakes and Bavarians, puddings and brownies, ice cream and Danishes, cakes and bakery products.

The business, owned by Canadian multinational McCain Foods, was believed to be forecasting strong earnings this financial year after generating about $15m of earnings before interest, tax, depreciation and amortisation for fiscal 2020.

It is understood that information memorandums are in the market, and that some buyers are only interested in the ice cream brands — but the business will not be broken up.

Perpetuity Capital has previously invested in retailers, rubber recyclers, systems integrators and financial services companies and outlaid $40m for SPC last year in a joint deal with The Eights.

SPC owns food brands including SPC, Ardmona, Goulburn Valley and ProVital.

It recently raised $100m from wealthy and institutional investors, valuing the Shepparton-based company at almost $260m, as it looks to a potential IPO in the future.

About $20m has been invested in information technology and systems for the business, and it has brought in new management.

Under its new ownership, SPC has turned around from losses to report annual earnings before depreciation and amortisation of $45.6m with revenue of $284.1m.

Other investments by SPC have included The Gluten Free Meal Company and The Good Meal Company. It has also purchased the Helping Humans healthy beverage business and added dates, jackfruit and pomegranates to the SPC product portfolio over the past 12 months.

Coca-Cola Amatil purchased SPC in 2005. The Australian-listed drinks company cut its value by $146m to zero in the months before it was placed on the market. The business had suffered from strong market competition.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout