Southern Cross Media may be finally launching an official sales process for its regional television business, hiring investment bank Grant Samuel to advise the business on its options.

It comes after approaches from media entrepreneur Antony Catalano to buy the broadcasting operation late last year, while other bidders are likely to include the CBS-owned Network Ten and opportunistic private equity firms such as Allegro Funds, Anchorage Capital Partners and Platinum Equity.

The Kerry and Ryan Stokes-controlled Seven West Media has also taken a look at the television assets of Southern Cross Media in the past, but has since agreed to buy the assets of another regional broadcaster, Prime Media.

Both Seven and Mr Catalano had earlier walked away from a deal to buy the assets due to a disagreement on price, sources say.

The talk in the market has been that Southern Cross chief executive Grant Blackley would want about $105m for the division, equating to about three times its earnings, although some in the market say that offers may be around the $30m-$50m mark.

Grant Samuel was hired in recent months after the media company ran a process to find a new adviser.

A source close to Southern Cross said Grant Samuel would explore a range of options for the audio business and radio and television broadcaster.

Southern Cross’s television assets have had a two-year deal for an affiliation with free-to-air broadcaster Ten, after previous partner Nine Entertainment opted instead to join forces with Bruce Gordon’s WIN television network.

Some question Ten’s level of interest in the television assets, given it makes about $38m from the affiliation deal it has with Southern Cross.

Mr Blackleyis known to have been open to a possible sale of its television arm, leaving it as a radio broadcaster and audio company, and there has been suggestions in the market that the assets have been unofficially on offer at the right price, as first reported by DataRoom.

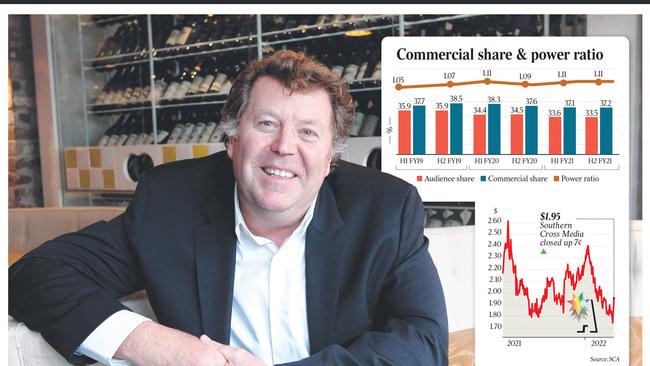

For the year to June, Southern Cross saw its earnings before interest, tax, depreciation and amortisation soar for its regional television unit by 59.7 per cent to $38.1m.

Free-to-air television broadcasters have seen their market values in decline in recent years as they lose viewers to streamed content and advertisers to other forms of media. Yet the pandemic has led to soaring audience numbers.

In New Zealand, listed pay-TV group Sky Television Network last year launched a strategic review and has hired Jarden for a potential sale after receiving approaches from parties, at least one of which was out of Australia.

Some market experts believe that the time may now be right for a sale of the television unit by Southern Cross if Network Ten pursues more sports sponsorship deals, which would not necessarily suit a regional audience.

Digital on-demand services of groups like Ten also could be a drain on audience numbers for regional operators.

The potential sale of Southern Cross assets comes as Mr Catalano and his backer, Alex Waislitz, pursue a move to back their investment vehicle IMP into the shell of regional broadcaster Prime Media, the company that has agreed to sell all its assets to Seven West Media, leaving only about $10m in franking credits.

Held in IMP is real estate venture realestateview.com.au, of which IMP owns 32 per cent and plans to increase to 72 per cent subject to a vote on Thursday.

The payment for the additional stake involves $75m worth of media sales and marketing services.

Other assets held in that vehicle include a 30 per cent of the Tomorrow Agency/Media Plus advertising business, 25 per cent of The Today Business, an advertising services provider for residential real estate and developers and a 20 per cent interest in Beevo, a connection business for small to medium enterprises.

The backdoor listing deal with Prime makes sense for the media entrepreneur, who founded the Nine Entertainment-owned online real estate business Domain Group, because it saves him listing costs.

Mr Catalano’s publishing business, Australian Community Media, which owns regional publications such as The Newcastle Herald and The Canberra Times, will remain privately held for now.

This is because in the public market, media companies sometimes weigh on the valuation metrics of digital assets, to which investors ascribe a higher multiple.

Seven launched a bid for Prime in 2019, but the deal was thwarted when Mr Catalano amassed a blocking stake of about 14 per cent that increased to about 23 per cent after he bought shares from Mr Gordon.

At that time, he had plans to turn Prime into a multimedia company by combining his digital assets and publisher ACM.

Mr Catalano is also involved with Apartment Developments, a website run by his son, Jordan, and Tom Hywood, the son of former Fairfax Media boss Greg Hywood.

The Melbourne-group is expected to be rolled up into one entity and potentially part of the back door Prime listing.

Mr Catalano also holds a 30 per cent stake in real-estate tech start up Propic.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout