Southern Cross Media is understood to have rebuffed private equity funds making approaches to recapitalise the business, as its earnings outlook as a broadcaster remains uncertain amid disruptions linked to COVID-19.

Now the expectation is that the regional radio and television business will tap the market for a small amount of equity and lobby its lenders for a reprieve from paying its loans back until normal trading conditions resume.

Various other companies in distress, including Webjet and oOh!media are understood to have received opportunistic private equity approaches, but have rebuffed the offers after finding support from their investors that are providing the funds they need to weather the current financial storm.

Flight Centre is also understood to be weighing a couple of proposals before deciding whether to approach the equities market for cash in a few days.

Part of the problem with embarking on debt-for-equity swaps or other similar structures in the current environment is that pricing a company in the current market seems a near impossible feat, with the huge level of market volatility and no clarity as to when strict government measures in place to restrict movement to stem the spread of the coronavirus will be lifted.

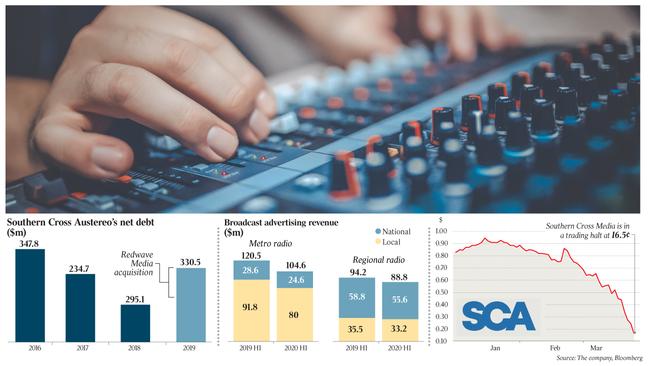

Southern Cross has been among the listed media groups hardest hit by investors, with its market value last worth about $127m, down from its 2020 high of about $726.7m.

Some believe the regional radio and television broadcaster, which delivered a half-year net profit of $20.4m and earnings before interest, tax, depreciation and amortisation of $67.5m, has been oversold.

The radio division in Southern Cross is the company’s strongest performer and some had earlier suggested that the group could be willing to sell its television operations for the right price.

However, finding a buyer for free-to-air television broadcasters at a time when they are being hard hit by digital disruption is thought to be challenging.

Perhaps other asset sales are on the agenda, although the thinking is that there are few assets to offload other than television.

Working for Southern Cross, which has $330.5m of net debt, is Luminis Partners.

The irony is that regional and national broadcasters are enjoying some of their largest audiences to date, as consumers tune into the news and absorb media content while forced to stay home.

NewsCorp, publisher of The Australian, this week announced it would suspend printing community titles amid the coronavirus crisis, producing digital-only versions of the publications.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout