South32 has tapped UBS, Bank of America and Mizuho Bank for its acquisition of a 45 per cent interest in the Sierra Gorda copper mine in Chile for $US1.55bn ($2.10bn)

Sources say that South32 won the auction for the stake in the mine owned by Japan’s Sumitomo after putting forward a price that was far higher than its competitors.

The three banks are understood to have provided a $US1bn bridging loan to fund the acquisition should South32 need to draw on that facility in addition to using cash.

Working as the adviser to South32 on the transaction was UBS, while the seller of the stake, Sumitomo, worked with Royal Bank of Canada.

South32 paid 3.3 times the mine’s earnings before interest, tax, depreciation and amortisation.

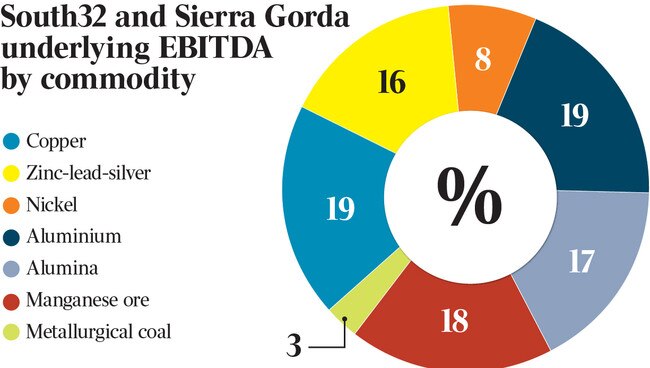

The stake’s underlying annual EBITDA is $US510m.

While some believe that South32 paid a big price for the mine, it is said to be at least 30 per cent comparatively less than what Sandfire Resources agreed to pay to secure Minas De Aguas Teñidas (MATSA) in recent weeks.

Sandfire outlaid $2.6bn in a contest for the Spanish copper development MATSA in which South32 was also understood to be a contender early on.

Sierra Gorda is a lower cost and longer life mine than MATSA.

The understanding is that Sierra Gorda has not been a strong performer for the former owners, but the thinking is that South32, with its expertise, could change that.

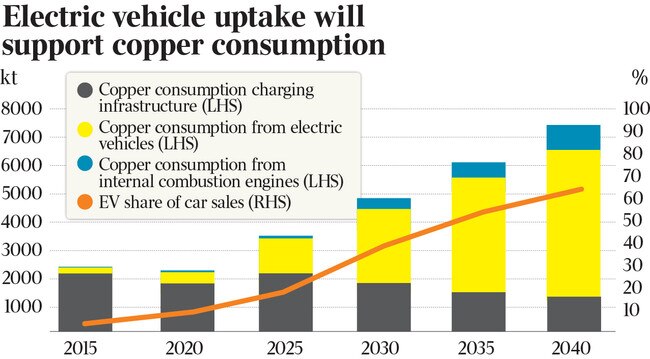

South32 is known to have been looking at opportunities to expand its copper portfolio for some time as the price of the commodity commonly used for electrics and piping escalates.

Copper is a bet on the growing trend towards cleaner fuel transport, namely electric cars.

The acquisition was announced on Thursday by South32, which said it had $US660m of cash at the end of September.

Sierra Gorda is a conventional open pit mine with more than 1 billion tonnes of copper reserves and a mine life of more than 20 years.

Owners KGHM from Poland and Sumitomo have invested about $US5bn over time.

South32’s participation in the process was first reported by DataRoom in May after Sumitomo made moves to sell its stake in the second half of last year.

As part of the deal, South32 has agreed to paid Sumitomo an additional sum should the copper price – currently trading at about $US4.10 per pound – exceed certain forecasts over the next four years.

Expectations are that in a worst-case scenario, South32 may be required to top up the deal by no more than $US500m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout