Hospitality finance company Silver Chef has shelved plans for its sale to Next Capital after major shareholder flagged plans to vote down the deal.

The company will now enter negotiations with its banks over the next month.

If banks call in the loans, the hospitality lender says it is uncertain it would be able to continue as a going concern.

A major Silver Chef shareholder Silver Chef last week said it would block the proposal, claiming that the private equity offer undervalues the business.

Fund manager The Blue Stamp Company owns 19.99 per cent of Silver Chef and said it would vote on the Next Capital scheme of arrangement proposal with other shareholders that was scheduled for September 6.

But the vote has now been cancelled.

Next Capital was offering 70c per share for the business, despite its net asset value being $2.02.

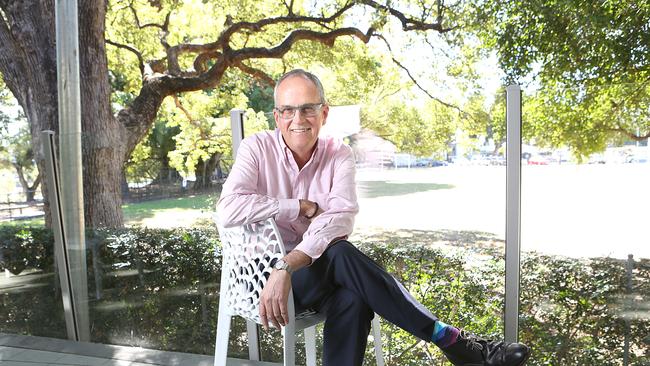

Silver Chef founder and chairman Allan English owns 23 per cent of the financier and was backing the deal, in which he will roll his equity into the business.

His shares are subject to a separate vote, which means BSC had enough of a holding to block the deal.

BSC said it was “violently opposed” to the scheme and was asking instead that the company embark on a $50 million capital raising at 31c per share to repay $35m in debt.

It is also calling for new directors to be appointed.

BSC is run by Luke Trickett, husband of former Olympic swimming gold medallist Libby Trickett.

It is backed by a large US University Endowment Fund and Australian high net worth investors.

The independent expert for the Next Capital takeover proposal said the underlying value for Silver Chef was in the range of 90c to $1.13 and that the Next Capital offer was not fair but reasonable.

Silver Chef was founded by Brisbane entrepreneur Mr English in 1986 and was floated in 2005.

Silver Chef shares initially were trading around the $1.50 mark. By October 2016 they had risen more than ten-fold to $11.74.

Before the bid, it had been embarking on a turnaround program to return the business to one that focuses solely on its reliable hospitality-only business model and exit its Go Getta equipment service provider operation.

It has been in debt default since June last year, when it owed more than $300 million to its lenders.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout