Could Chilean conglomerate Sigdo Koppers be back in talks with Downer boss Grant Fenn about a sale of the company’s mining services division?

Apparently, there is one bidder for the business currently in deep due diligence on the operation, and it is not thought to be private equity firm Oaktree, which had negotiated to buy the business in the past before walking away.

That leaves Sigdo Koppers.

The South American company made inquiries about buying Downer Miner last year, but nothing ever eventuated at the time, and many believe when it comes to an acquirer securing the business, that name made the most sense.

Sigdo Koppers owns mining services business Magotteaux and has operations in construction, transportation and logistics.

It is known to the Australian market after it invested $70m in the previously listed miner Bradken, which is now owned by Japan’s Hitachi.

Last year, investment bank Deutsche was working with Downer on a sale of its mining division to Oaktree, while the company publicly denied it was on the market.

This time the move to sell the division is official, with Macquarie Capital tasked with running the process.

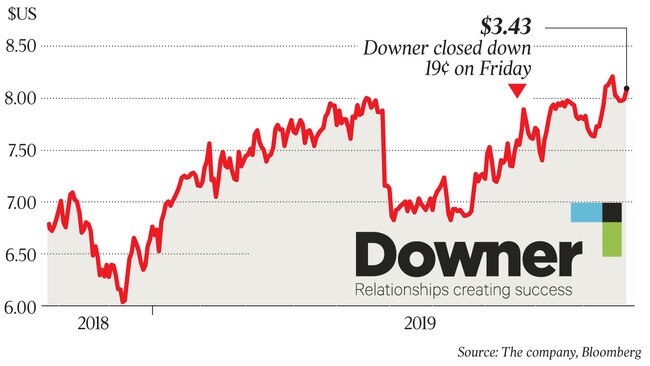

Downer says it will likely update the market during its November 7 annual general meeting.

The price tag is supposedly $700m, but some think a $550m valuation is more realistic.

The mining services industry is awash with companies for sale, but private equity firms have been coy about investing in the sector.

One Indian party, AvidSys, which has a presence in the resources space, is also known to Macquarie Capital, which is also selling BGC Contracting on behalf of the family of the late billionaire Len Buckeridge.

An Indian group has been tipped to be eager to buy the bulk of the BGC building materials empire, and some say AvidSys is the party.

Emeco, which was first tipped by DataRoom to be a likely acquirer of BGC Contracting on July 1, was thought to be on the fringes in the early stages and NRW was thought to be the frontrunner.

However, the understanding was that NRW bowed out of the process, although the thinking is that both NRW and Emeco have re-engaged with Macquarie for the company’s division.

With respect to Downer Mining, former Downer Mining boss Geoff Knox and Citi had been advising on a potential acquisition by Oaktree, which was said to have been spooked by possible contract losses with a key customer that could have been triggered by a sale and a management buyout was touted.

The private equity firm and Downer were unable to agree on price.

DataRoom first revealed in April last year that parties around the market were being tested for their appetite for a potential acquisition of the Downer Mining division.

Downer denied it was contemplating a sale and it also denied it was in talks with Sigdo Koppers, despite sources saying it had made inquiries about an acquisition with its investment bank Deutsche.

Downer, which bought catering and cleaning company Spotless in 2017 for $1.2bn, counts Rio Tinto, Glencore and BHP Billiton Mitsubishi Alliance as key customers for its mining arm.

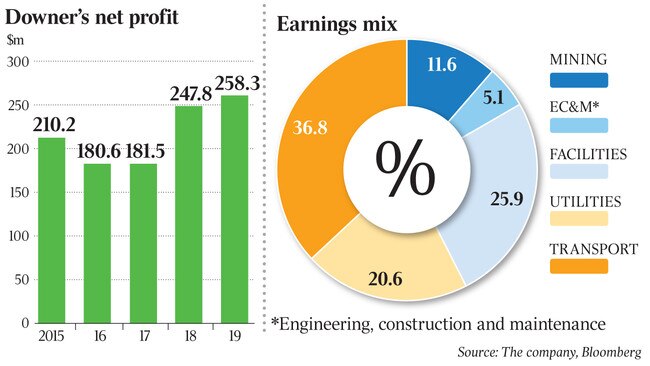

Without the mining arm, it is likely Downer would be treated by investors as an engineering or infrastructure services provider.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout