CVC and its private equity backer are understood to have walked away from a deal to buy Prime Media for now, but sources close to the situation have not ruled out the possibility they may return to the negotiating table.

It is understood a plan to buy the business was at an advanced stage but thwarted by the surprise decision by Seven West Media to recruit James Warburton as its new chief executive.

Mr Warburton was understood to have been the person who spearheaded the Prime Media takeover plan with CVC and private equity, but can no longer be involved.

Now the question is whether Seven would buy the regional free-to-air broadcaster, although most believe the chances of a deal are slim.

The thinking is that digital or technology assets are a more likely acquisition by Seven West.

But the constant question is whether the chairman Kerry Stokes would be prepared to invest any more money in the business at a time when it is widely believed the Stokes family — major investors through their Seven Group interests — are eager to make an exit.

It also has high net debt of $564.4 million.

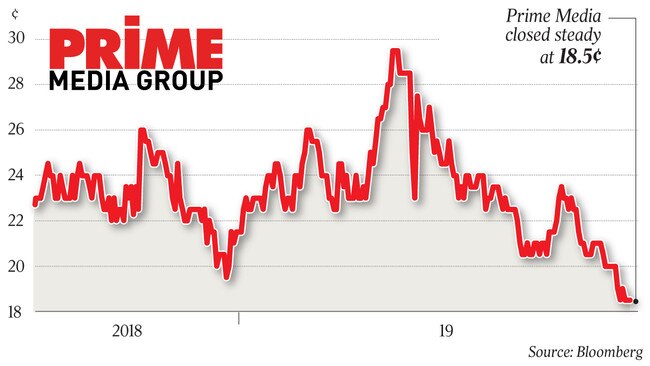

Given Seven West trades on only about three times its earnings, most other acquisition targets would be dilutive, but the exception would be Prime, which trades on less.

Prime Media posted a $7.3 million net profit for the year to June, as its earnings before interest, tax, depreciation and amortisation fell 14.8 per cent to $38.5m.

Elsewhere, GrowthOps — a management consulting, technology and services company listed on the Australian Securities Exchange — could soon be subject to corporate activity, with investment bank Macquarie Capital said to be close at hand.

It is understood the investment bank has been working with the business at a time sources believe it is on the market or subject to a takeover bid.

GrowthOps declined to comment. The group has a market value of about $53m and was previously called Trimantium GrowthOps.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout