Listed tourism company SeaLink is set to unveil a major transformation on Tuesday, with the company buying Transit Systems for $635m and tapping the market for $150m in cash.

The $635m acquisition price that includes debt was revealed online by DataRoom on Monday, with the column also first reporting that Transit Systems chief executive Clint Feuerherdt would take the reins of SeaLink, marking the departure of current boss Jeff Ellison from the role.

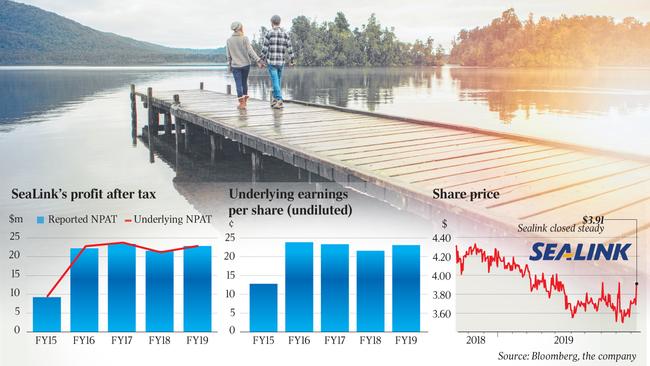

SeaLink plans to sell shares at $3.50 each through Macquarie Capital, Ord Minnett and Taylor Collison. It remained in a trading halt on Monday, with its shares last traded at $3.91 each.

The transaction also includes a $63m earn-out consideration and will see some Transit Systems owners become substantial shareholders of SeaLink, which operates travel and tourist services with a fleet of vessels.

The deal is happening amid buoyant conditions for domestic tourism operators, with the low Australian dollar luring both international and domestic travellers to the country’s top holiday destinations.

Transit Systems consists of Transit Systems Australia and Tower Transit Group.

It is a passenger transport group operating buses.

It is Australia’s largest private operator of metropolitan public bus services and is an established international bus operator in London and Singapore.

The Brisbane-based company, founded by Lance Francis, Graham Leishman and Neil Smith operates about 3129 buses and 32 depots across Australia, London and Singapore on behalf of local and regional governments and authorities.

It has 16 major contracts in Australia, 23 in London and 31 routes under one contract in Singapore.

The multiple for the transaction is about 8.2 times EBITDA on an enterprise value basis and includes net synergies of between $4m and $4.6m.

The deal comes after SeaLink purchased Transit Systems marine operations in 2015.

For the 2019 financial year, SeaLink generated a 20 per cent lift in revenue to $251.3m and a 5.9 per cent increase in net profit to $23.4m. It operates under the brands SeaLink and Captain Cook Cruises.

Separately, a number of initial public offerings appear to be ramping up in the market, with PropertyGuru on Monday releasing a prospectus for its float and Onsite Rentals releasing its IPO analyst research.

Analysts at Macquarie Capital and Bank of America Merrill Lynch estimate Onsite Rentals to be worth up to $700m, or between 4.5 and 7 times its estimated annual EBITDA for the 2020 financial year of $99.1m.

The equipment leasing company has been owned by Next Capital and is now controlled by US debt investors, with the business leveraged at one times its EBITDA compared to 2.3 times on average for the industry.

Meanwhile, PropertyGuru told the market it would raise between $345m and $380.2m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout