Troubled retailer Pas is almost certainly heading for a break-up, after those in control of Seafolly on Monday announced they had purchased its swimwear brand JETS.

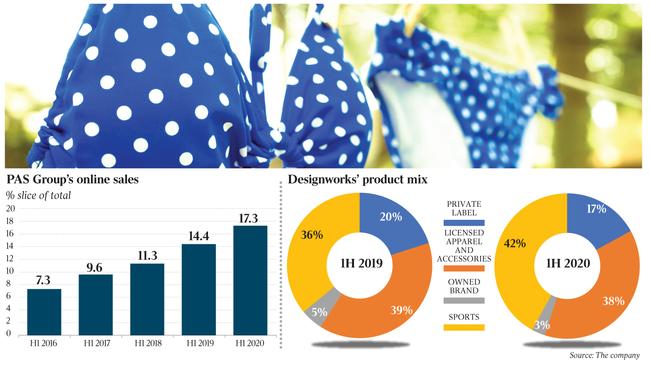

The understanding is that the voluntary administrators of the listed Pas at PwC are finalising a deal to sell the business, but its wholesale arm, which includes its Designworks business which makes clothes for department stores such as Big W, Myer and Target, will be sold to a separate buyer from the fashion brands such as Review Clothing and Black Pepper.

Allegro Funds Management, Sussan, which owns Sportsgirl, and South Africa’s Foschini could be bidders.

Its original shareholder, Coliseum Capital, and Mosaic Brands backer Alceon are not expected to be in the final mix.

Both Pas and Seafolly are in voluntary administration, and market analysts say they struggle to remember a time when one collapsed company bought a business off another in the same position.

It is thought that Seafolly’s voluntary administrators paid between $1m and $6m for the JETS business and the transaction was bankrolled by the original owner, L. Catteron, which is now in the final stages of buying the business back after it was named as the preferred bidder in a sale process.

JETS’ inventory has a book value of between $4m and $6m and most suspect that any buyer would be unlikely to offer full value at a time that consumers are restricted from going on holidays because of travel restrictions.

Pas was placed in voluntary administration on May 29 and is now under the control of PwC.

Seafolly was placed in voluntary administration on June 29. Administrators include KordaMentha’s Scott Langdon and Rahul Goyal.

The thinking is that of the buyers interested in buying the bulk of Pas, most were happy to sidestep JETS.

While Pas is being offloaded at a tough time for the retail industry, the Designworks business had its second-highest month of sales ever for July.

The logic for the Seafolly deal is that both serve two different segments of the swimwear market and the JETS business would be mainly a wholesale and e-commerce offering.

Mr Langdon said the acquisition was logical for Seafolly.

“The combination presents clear and material synergies around design, wholesale and supply chain,” he said.

It comes after Seafolly creditors voted to accept a Deed of Company Arrangement (DOCA) that would see the business return to normal trading.

Elsewhere, listed homewares company Adairs enjoyed a strong rally on the back of some pleasing full-year results, with strong online sales causing its earnings before interest and tax for the 2020 financial year to soar by almost 40 per cent.

However, some believe that the rally may have been overblown because much of the sales were pulled forward and trading could be softer in the months ahead, with unemployment expected to spike as the government’s JobKeeper subsidy ends.

While some groups have capitalised on strong share prices by raising equity, there is not expected to be any move by Adairs to tap the market or make acquisitions.

It purchased the online business Mocka last year and does not have any other acquisition prospects on the agenda.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout