Salmon farmer Tassal ready to dive into the prawn market

Tasmanian Atlantic salmon producer Tassal is believed to be on the cusp of announcing an acquisition in north Queensland as part of an entry into the prawn market.

While the deal is only said to be worth about $40 million, it is important, offering the listed company a path into what is expected to become an increasingly lucrative market in the months ahead, sources have said.

The challenge for Tassal is that gaining a new lease to operate is seen as nearly impossible, so an acquisition is the only way in.

A structure like the Costa avocado venture could be contemplated, where a group like Macquarie could purchase the lease and Tassal act as operator.

While the company has not made a comment on the move, it shows that acquisitions to fuel future growth remain on its agenda, although it says it has no binding agreements.

There are 15 major prawn fisheries around Australia and the expectation is that the industry is ripe for consolidation, given that many are family businesses, predominantly in Queensland.

On average, 25,000 tonnes of Australian prawns are produced annually, with 21,000 tonnes wild and about 4000 produced by Australia’s prawn farms.

However, Australia’s largest feed company, Ridley Corporation, has introduced a new type of feed that enables prawns to grow bigger, a development that could fuel higher earnings.

Tassal’s last big acquisition was its purchase of De Costi Seafoods in 2015 for $50m cash, five times the group’s earnings.

It was a move the group said at the time made sense strategically, given it was one of the largest businesses in Australia’s seafood industry and complementary to its own operations.

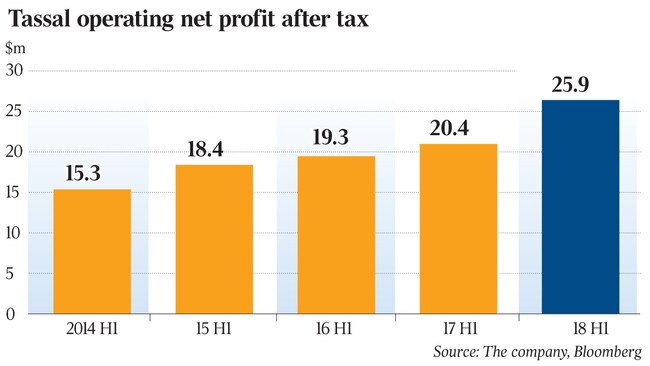

For the six months to December, Tassal reported a 2.5 per cent increase in its net profit to $28.4m.

Managing director Mark Ryan at the time said the salmon business continued to thrive, supported by better than forecast growth in local demand and increasing domestic returns for high quality salmon.

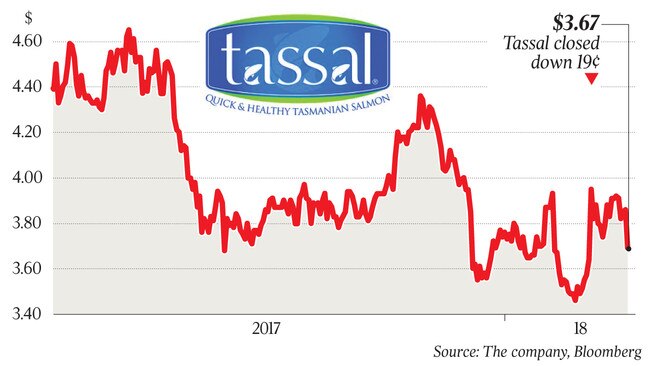

The $640m group has also recently driven down debt following a capital raising to 13 per cent from 34.6 per cent, so it is now well placed for deals.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout