Under-fire agricultural landlord Rural Funds Group has called in Ernst & Young as independent investigator of claims made by short-selling outfit Bonitas Research that led to $335 million being stripped off the company on Tuesday morning.

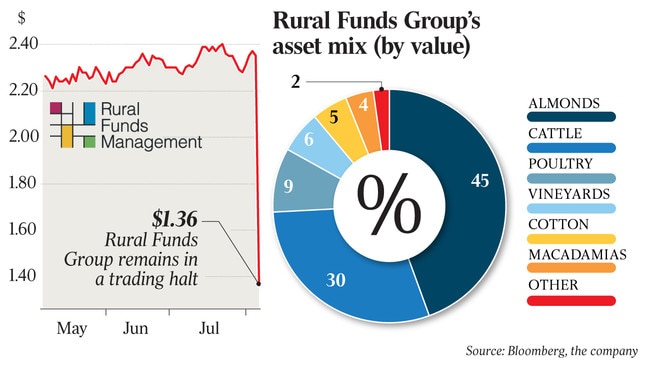

The listed group, which has a $920m agricultural property empire, had been a star performer, undertaking a series of capital raisings as it blazed a trail in getting listed property investors to back its operations.

But its stellar run came crashing down when a report authored by Bonitas claimed the listed orchard, farm and cattle station owner had inflated its profits and conducted “nefarious” transactions with its private manager, Rural Funds Management.

Rural Funds Group last night doubled down on its initial dismissal of the claims made by the US-based short-seller that prompted the 42 per cent plunge in the group’s share price after the short-seller’s 31-page document was released.

The report was launched by Glaucus Research co-founder Matt Wiechert, who has shifted to Bonitas. Glaucus is best known for bringing Blue Sky Alternative Investments to its knees but its new target is proving more hardy.

RFM said it rejected “entirely” what it termed the “unfounded” allegations of financial impropriety and irregularity contained in the report and said it was obtaining legal advice.

But it acknowledged the seriousness of the matters raised by Bonitas and the resultant adverse effect on Rural Funds Group’s share price, leading it to bring in Ernst & Young.

The group is expected to restart trading today and the manager provided a line by line rejection of the Bonitas claims ahead of this move, saying an allegation of $28m-plus of fabricated rental income paid to the listed group was “mistaken”.

The group also said claims it artificially inflated its reported financial performance were not correct as it rejected the Bonitas analysis that its dividend was afforded with cash from equity raises and bank borrowings.

Instead, it added, these were covered by free cash flow generated from rents after payment of expenses.

Bonitas has said the listed rural group’s net assets were overstated by 100 per cent and its true net assets figure was only $268m, putting in breach of a $400m loan covenant. But RFM said the accounts were “accurate, appropriate, supported by independent valuations and reviewed by its auditor, PricewaterhouseCoopers”.

Bonitas also called out an undisclosed dividend recapitalisation of RFM’s newly acquired cattle asset, J&F as the “largest nefarious transaction” it had identified.

However, RFM said the J&F deal was exactly as described to investors in an equity raising and in documents provided at an investor meeting last month.

RFM said that it did not benefit from a $30m special dividend as Bonitas had claimed.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout