Orica may have been in the spotlight on Thursday for its full-year earnings result, but behind the scenes some are wondering whether mergers and acquisitions could be on the agenda.

The obvious takeover target is mining services provider Imdex, say sources, a market darling due to its sophisticated intellectual property that is considered more a software as a service business.

Orica’s market value is $6.25bn, while Imdex is worth $1.1bn. It would be a big bite for Orica, and some consider Imdex – a drilling product and sensor developer – to be currently expensive.

But the explosives equipment provider has looked at the business before and many believe a tie-up makes sense. Imdex already partners with Orica on its Blast Dog technology and has made moves to become more integrated into the mining cycle.

Imdex has traditionally been mainly focused on exploration drilling, but is becoming more focused on production drilling, which brings it closer to being useful to integrate with Orica explosives technology.

Orica is also in a position where it needs to find new avenues of growth, and investing in technology is consistent with that theme.

Imdex is considered to be the most obvious target on the Australian Securities Exchange, especially given that Orica wants to become a more hi-tech business rather than one that focuses on heavy maintenance.

As earlier reported, it is selling its commercial explosives and blasting systems business Minova through JPMorgan.

Adding weight to the theory that Imdex could be a target is that chief executive Sanjeev Gandhi was only appointed in April and many believe that corporate is activity is one way for him to make his mark.

Investors are understood to be keen for Orica, which has a 34.6 per cent debt level, to become more dynamic and better positioned for growth following a long period with limited change.

Apparently, late last year Orica investigated a possible acquisition of Imdex as part of a broader exercise to test what opportunities were currently in the market.

Weighing against the theory that it could be a target is not just Imdex’s current share price, but that a major part of its business is involved with selling drilling fluids, which could be unappealing to Orica.

Currently, only a small part of Orica’s operations cross over into the same space as Imdex, and some believe that Epirock or Sandvik make more sense as buyers.

On Thursday, Orica’s results coincided with a sell down of a 3.3 per cent stake worth $200m by one of its investors.

The trade through Barrenjoey Capital Partners at $14.50 per share came as Orica shares on Thursday closed at $14.72 compared to $15.35 in the previous trading session.

Among Orica’s largest investors are AustralianSuper with a 14 per cent holding, Harris Associates and Cooper Investors.

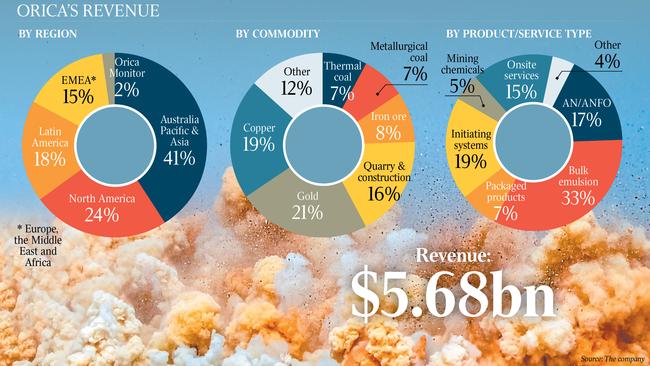

On Thursday, it posted a $173.8m loss in what was said to be a challenging year due to unfavourable foreign exchange movements, trade tensions with China disrupting thermal coal trade, and rising freight and input costs.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout