Pacific Equity Partners is understood to have put forward a proposal in the form of a financial lifeline to Village Roadshow ahead of the latest $400m-plus takeover play by rival BGH Capital.

It is understood that PEP, which last year bought the right to secure 19 per cent of the company held by the Kirby family and Graham Burke’s Village Roadshow Corporation, was understood to have offered liquidity in some form in recent weeks.

This was either through equity or debt.

But PEP is thought not to have made a revised takeover proposal following its pre-COVID-19 indicative bid launched in December that valued the theme park and cinema owner at about $761m on an equity value basis and was subject to due diligence.

No doubt, the latest offer by PEP was one that would have enabled the private equity firm to have gained an even stronger hold on the company so it could have made a revised proposal should conditions have improved.

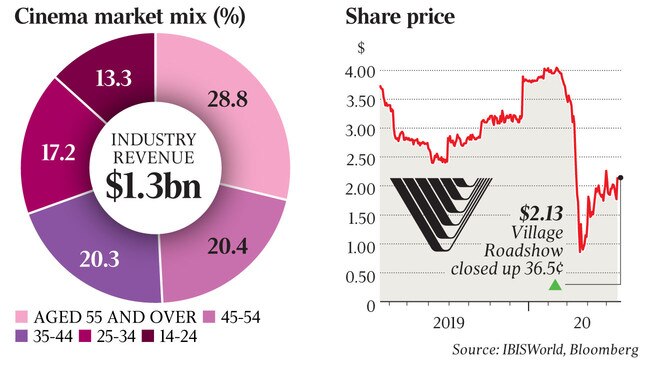

On Monday, Village Roadshow announced it was in exclusive talks with BGH Capital, which had been granted four weeks of due diligence on the cinema and theme park operator for a takeover worth between $409.5m and $468m on an equity value basis.

Some see it as a brave move by the Australian buyout fund, which is headed by former TPG Capital Australia boss Ben Gray and former Macquarie Capital boss Robin Bishop and is offering between $2.10 and $2.40 per share for the business.

This year, before the onset of the COVID-19 pandemic, BGH had put forward a rival bid to the PEP offer, valuing the business at $780m, or $4 per share.

However, the price has now been dramatically slashed on the back of the COVID-19 concerns.

It is thought that PEP was more reserved on its COVID-19 recovery assumptions than BGH and Village Roadshow’s ability to withstand the tough conditions, which is why the private equity firm shied away from putting forward another revised takeover bid.

BGH has said it would offer shareholders $2.20 per share for the company and would add an additional 12c per share if its theme parks, Warner Bros World, Sea World and Movie World on the Gold Coast had already opened three days before shareholders met and voted on the transaction. It would add an additional 8c per share if the cinemas open up in the same time frame.

Shareholders have the option of choosing two structures for the deal – one where the privately held Village Roadshow Corporation, which owns about 40 per cent of the company, is bought out before a takeover is launched for the whole of the listed Village Roadshow via a scheme of arrangement.

The other option is one where shareholders vote on a scheme of arrangement and have the option of taking cash or scrip.

In this offer, the base price would start at $2.10 per share.

A break fee of $4.29m exists should a deal not proceed.

The majority family shareholders, John and Robert Kirby, and Graham Burke are keen to go along for the ride once Village Roadshow becomes a private company.

Clark Kirby would hope to remain as the chief executive and Robert Kirby as chairman once the company is privatised.

The offer is subject to due diligence, funding and no deterioration in the market conditions or outlook.

The company, said to be severely cash strapped, with its cinemas and theme parks closed, has net debt of $284m and cash of $5m.

It expects net debt to be $315m by the end of next month and is in advanced talks to increase debt with lenders.

Village Cinemas is one of Australia’s largest cinema operators, and combined with joint venture partner Event Hospitality & Entertainment Limited has nearly 600 screens across 58 sites across all Australian states.

The big challenge for cinema chains right now is that they need Hollywood film studios to release content globally, and they will not release content for Australia alone.

They also require enough people allowed in their complexes to make them profitable.

BGH Capital is working with JPMorgan and Goldman Sachs.

UBS and Stratford Advisory Group are acting as financial advisers and MinterEllison as legal adviser to Village.

PEP had been working with Highbury Partnership.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout